Put Spread Trade - Avon Products Inc. (AVP)

14th January, 2015

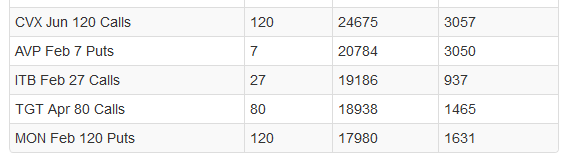

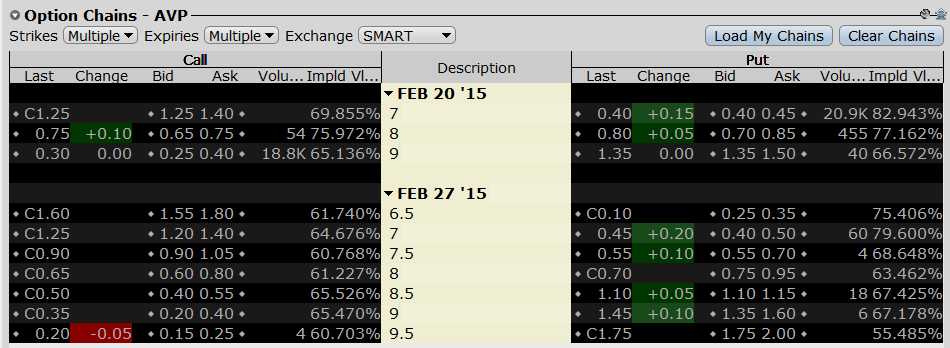

Volume Spikes for the close of business 13th Jan showed AVP, Feb 20th Puts trading 20k over 3k of open interest. Earnings are out on February 12th.

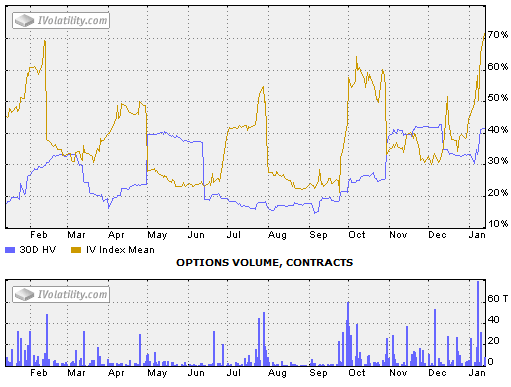

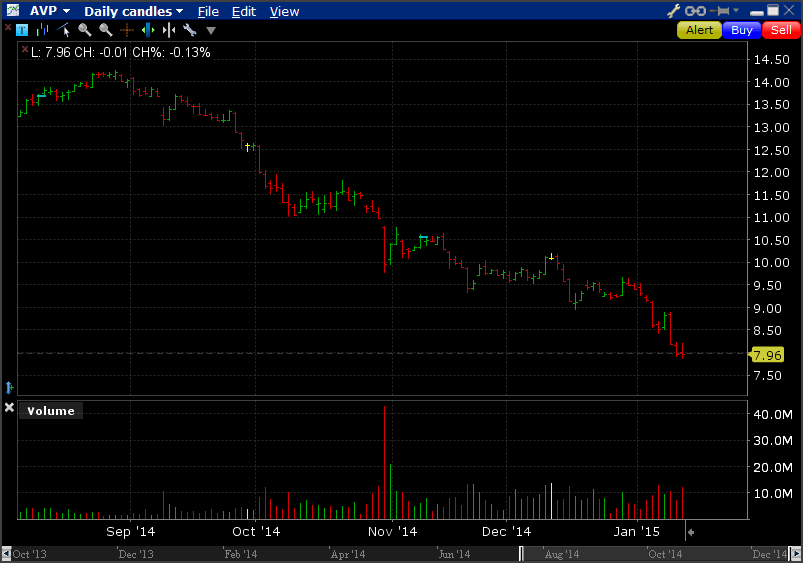

Buying puts is interesting as the stock is currently in a strong downtrend - perhaps information is leaking about pending announcement? Looking at the prices of the puts, however, I can see that they seem expensive. The implied volatility confirms this; IV is high and rising - 71.65% vs 35.87% a month ago. Historical volatility of the stock is moderate but also rising - 41.24% vs 34.85% a month ago.

I like the idea of shorting the stock before earnings as the trend is down, but seeing as the vol is fairly high I am reluctant to go straight for a long put. I would like to limit my risk a little here as the premiums are expensive.

So I think a Bear Put Spread is a good trade idea here. However, the Feb 20th expiry doesn't have any strikes lower than $7 so I'm looking at the next expiry; Feb 27th.

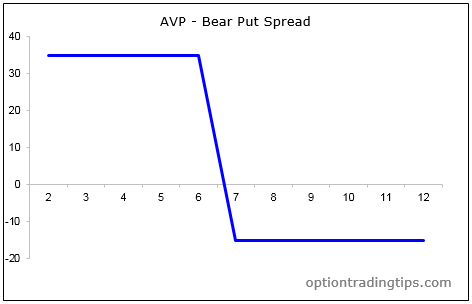

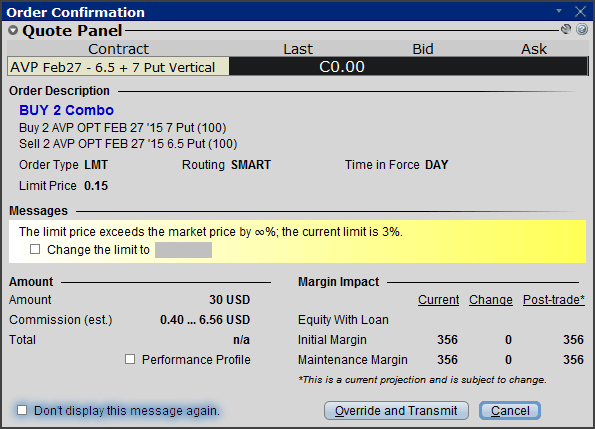

My order is to buy the $7 put and sell the $6.5 put for a net debit of $15 per contract. Buying the put outright would cost $45 per contract. The lower risk achieved is at the expense of lower gains if the stock does tank; capped at $35 per spread with the put spread and uncapped (limit stock trading at zero) with a long put. Risking $15 to make $35 on a down-trending stock post earnings announcement.

Order Status Update

My spread order was filled @ 0.15; 0.50 for the $7 and 0.35 for the $6.50 strikes.

PeterJanuary 15th, 2015 at 6:10pm

Nice, thanks Jason!

JasonJanuary 15th, 2015 at 10:09am

Here's a PL chart of the entire trade.

AVP Bear Put Spread

[Admin: removed PL Chart link as the graph was out of date and no longer populated the correct values]

Good luck.

PeterJanuary 13th, 2015 at 10:41pm

Hi John,

Yep, definitely a tough market right now! A fair amount of uncertainty around. I'm certainly no pro and always learning myself, but, yes, I do tend to look for more selling options on high IV and buying options on low IV - not always though. It's only that when I saw the graph for AVP I was tempted to short but thought may as well sell another to offset the cost. You've raised a fair point though. Let's see - I've only place the order today, see if it gets filled. If not, might change it.

Nice job on $EMES! You pretty much captured that whole up move!

JohnJanuary 13th, 2015 at 8:55pm

Not a pro by far but high iv don't u usually go credit spreads. Please correct me I like learning. This see-saw market has got me all turned around. With no floor on oil, I think u can still do well with that whole sector. Fracking sand co. all down. Except $EMES it moves quite a bit. I rode last month mid 40's to mid 60's closed at $57 today I think. Apple killed go pro with there new patent. $slb fell below 80 it should bounce off its previous low. I lost more than a few dollars on that one. I look forward to your post on avon.

Add a Comment