Not even one of these strategies requires any knowledge of "technical analysis" it can help, but it's not required. These make money whether the market goes up or down. These are strategies you can manage based on "the numbers". One important thing I should mention: There are ways to make money that are NOT obvious. For example, when you buy a stock you understand that when it goes down you lose money and when it goes up you make money. Right? But did you know you there are ways to make money even when the stock goes down and I'm not talking about a little money. When good stocks move down the strategy I describe in Strategy #1 makes more money than if they go up! How can that be? It's something I have been studying for years, and it works every time and cannot fail to work.

Explosive Strategy #1: Amazing profit/loss ratio. And it doesn't matter if the stock goes up or down but does require an longer time frame- 6 to 8 months is not uncommon for these trades but they are worth it.

Explosive Strategy #2: Another method I call "Flipping Stocks" let's me buy stocks cheaper than anyone else and if I the market does not cooperate with my plan - I get paid lots of money for waiting until it does! This is for bigger players with more capital.

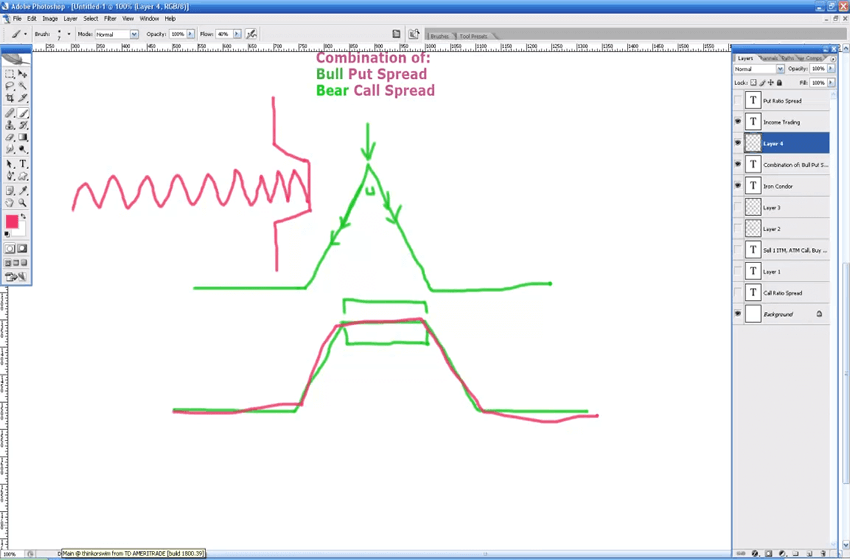

Explosive Strategy #3: This new strategy that has large upside or downside potential with minimal risk? This strategy is extremely powerful and one of the biggest real "secrets" that no one has ever discussed that I know of. Think there's no free-lunch on Wall Street? This isn't one either but it's as close as it gets to one! So think again. This is the perfect strategy for playing earnings reports, takeover news stocks and any stock you think will move big in any direction with little risk.

Explosive Strategy #4: If you want to be more active in stocks but hate the risk, you'll love this. Day trade without the risk normally associated with day trading. Can be setup to be an "semi-automated" trading system. Very powerful and again another strategy for more active participants.

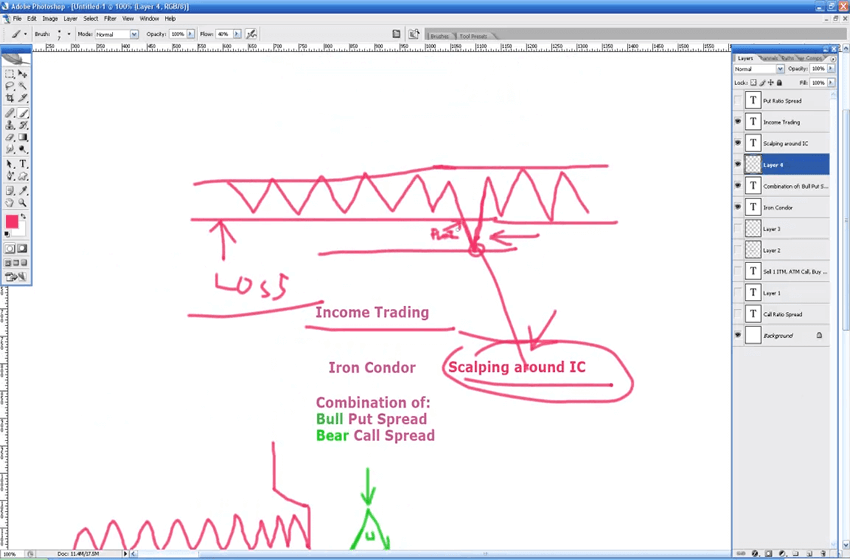

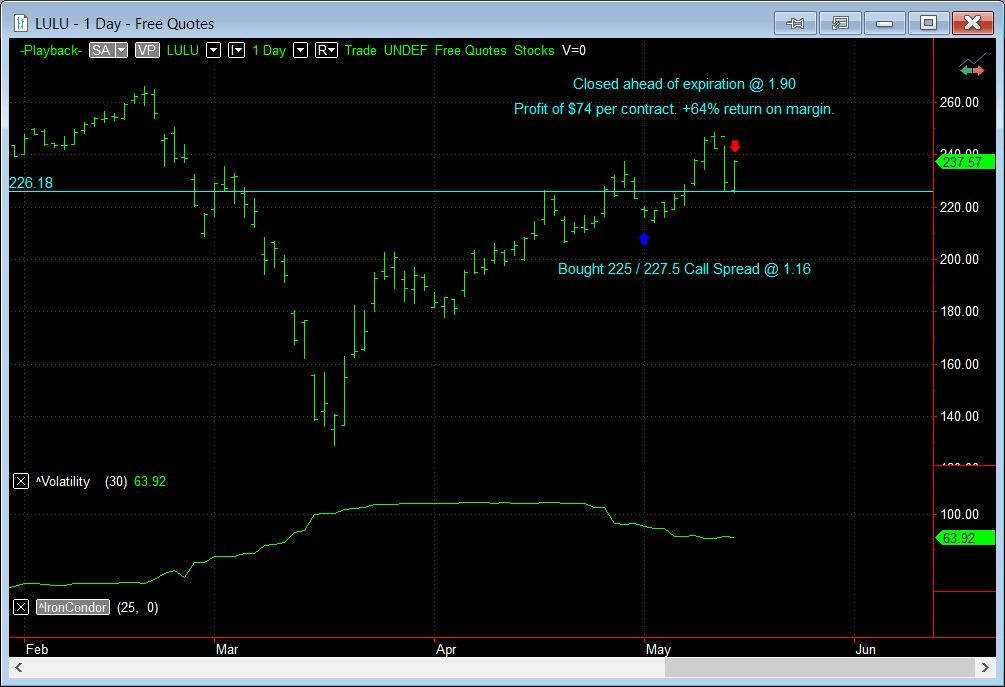

Explosive Strategy #5: If you liked the idea of the monthly income trades but was wondering how to "turbo charge" them to make more money, then you will love THIS. This last strategy is the "icing" on the cake - the peak moment in all your hard study and will be worth a lot more than what you paid for this course. Why didn't I reveal this before? Simple: You would not be able to use this strategy without a good foundation that was laid out in Module 0 to 10. Everything we have learned thus far has been leading up to Explosive Strategy #4 and this one.

This module contains 14 videos. (8hrs 55mins)

PeterApril 19th, 2021 at 2:53am

Hi Jay,

1. Correct; it is only the training.

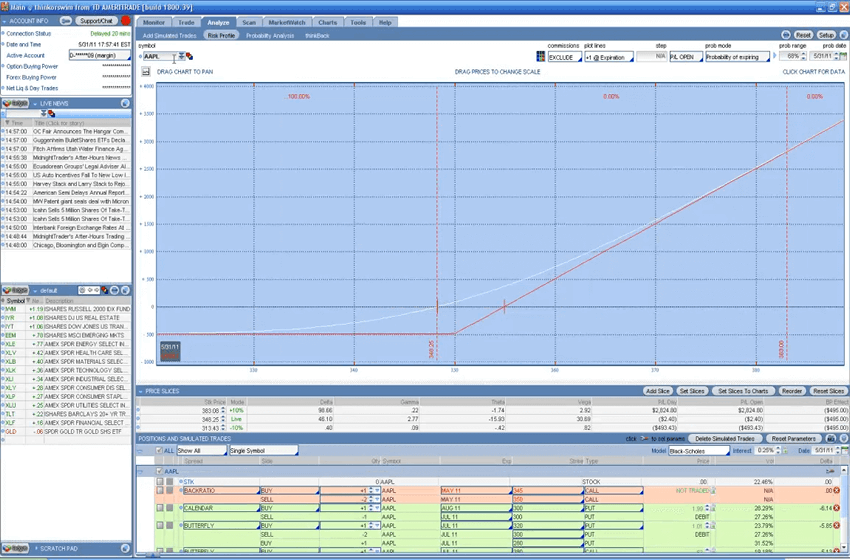

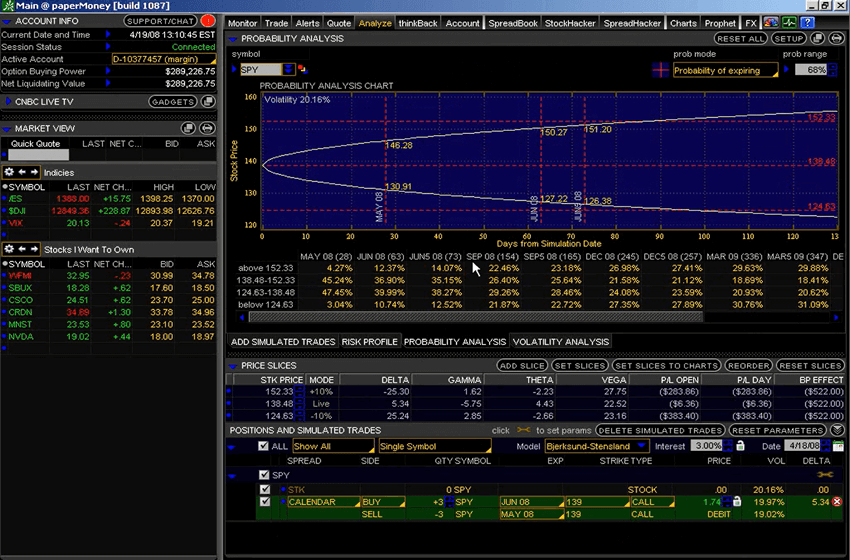

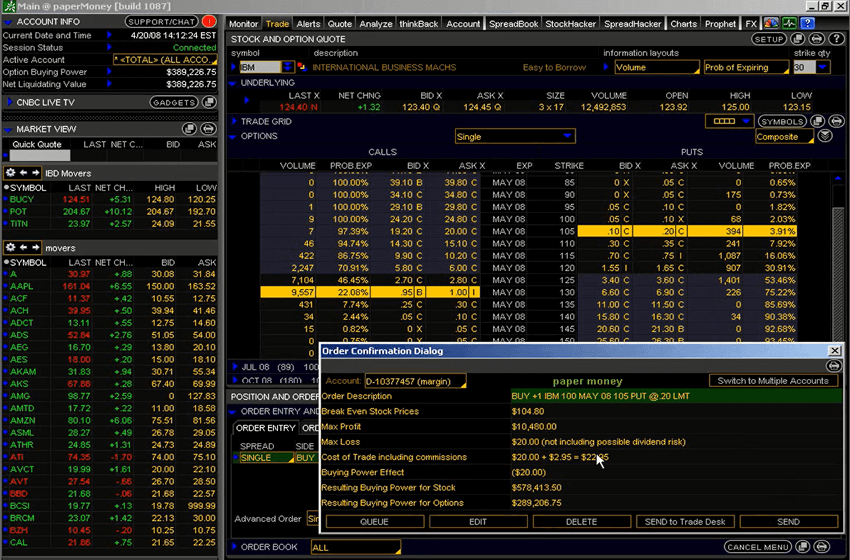

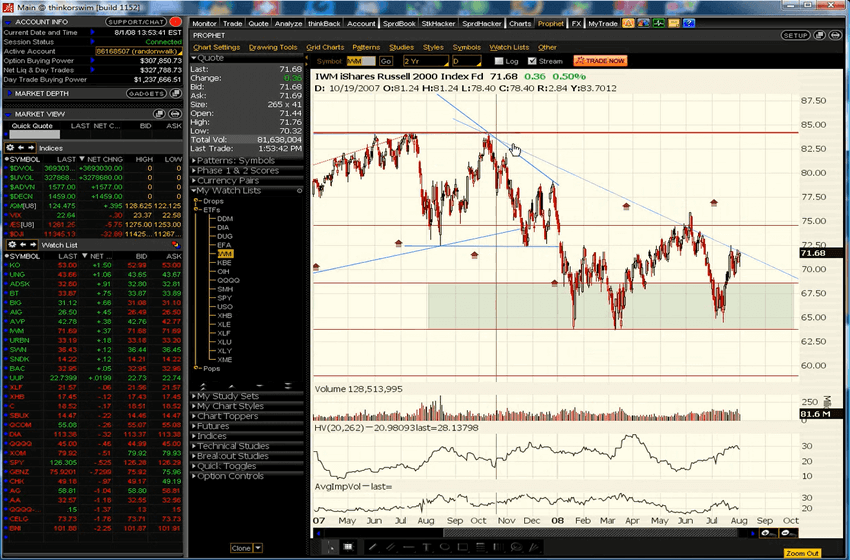

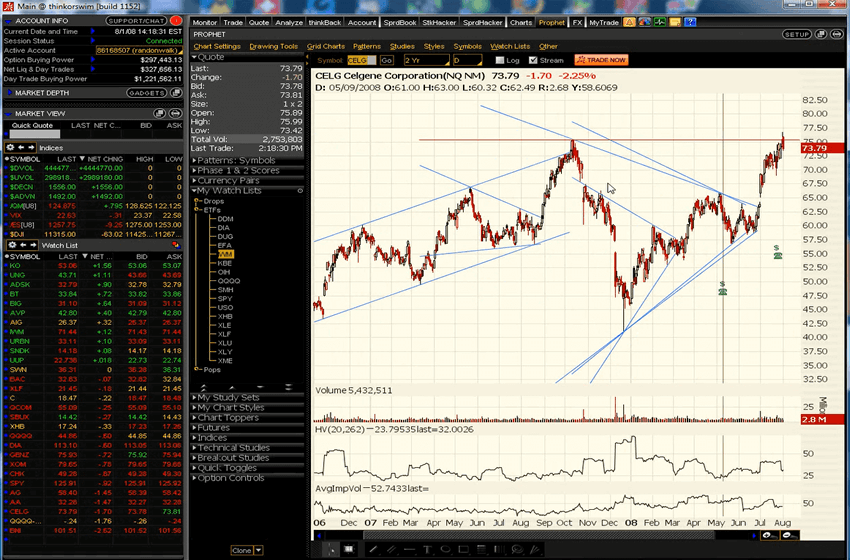

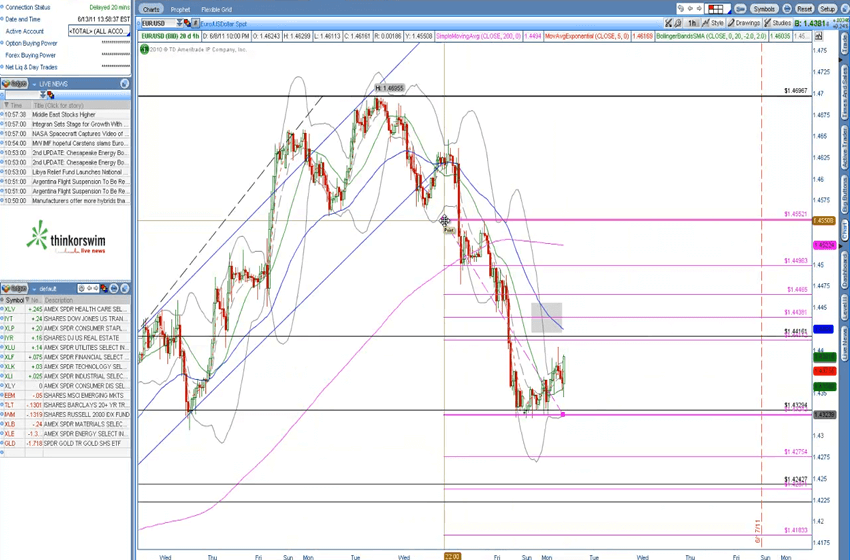

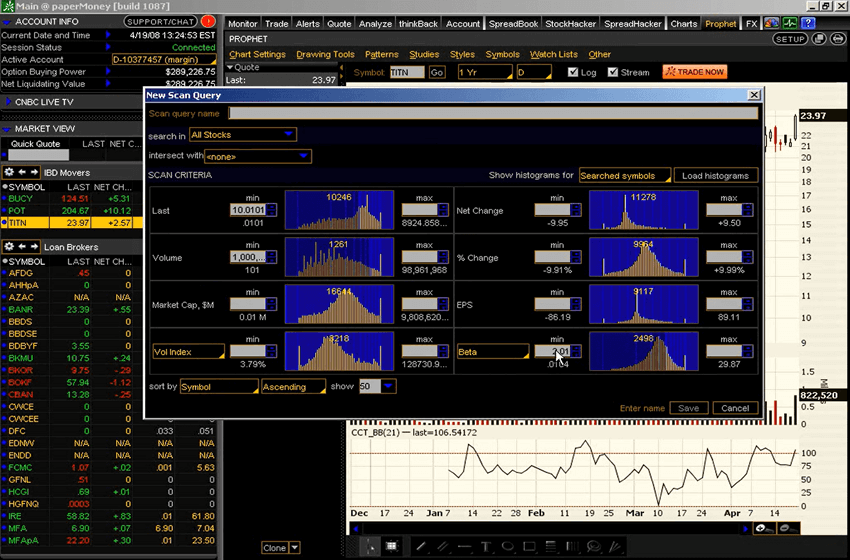

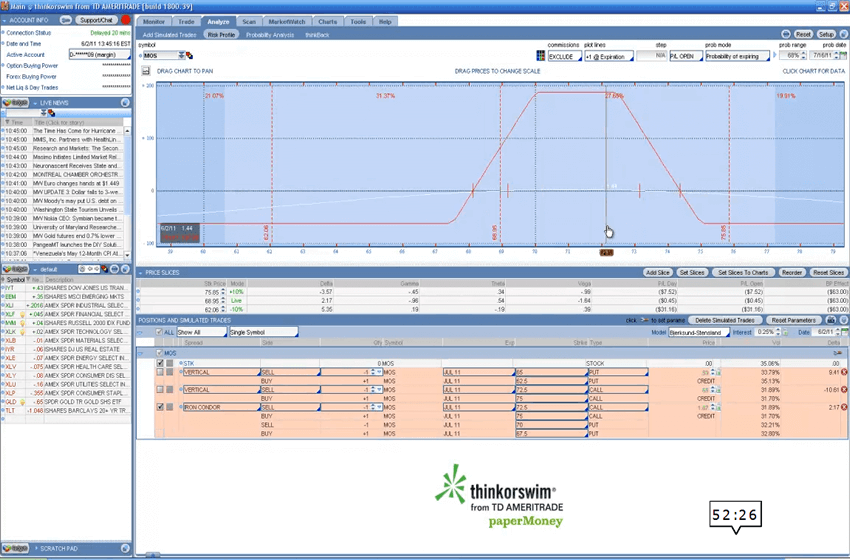

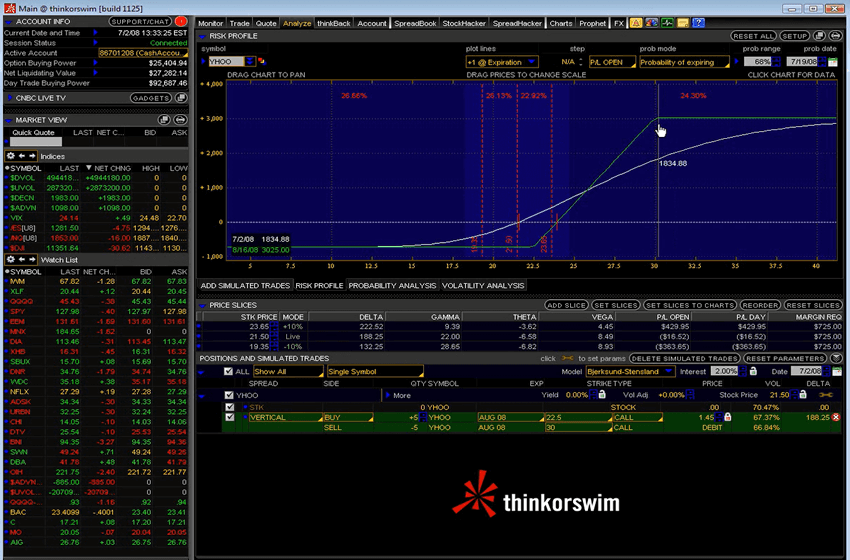

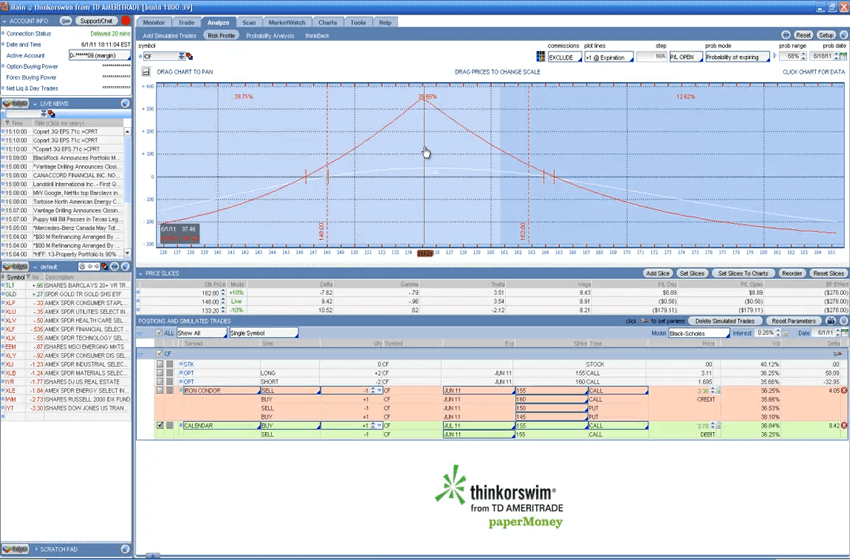

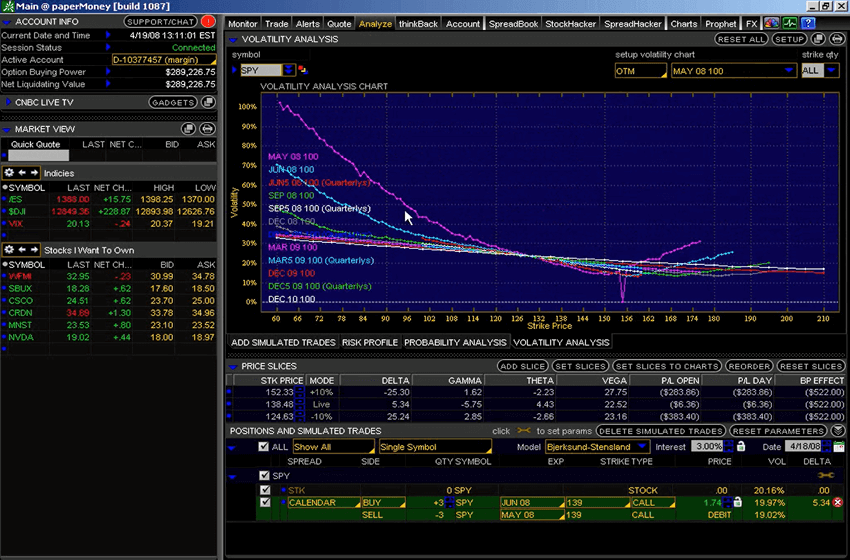

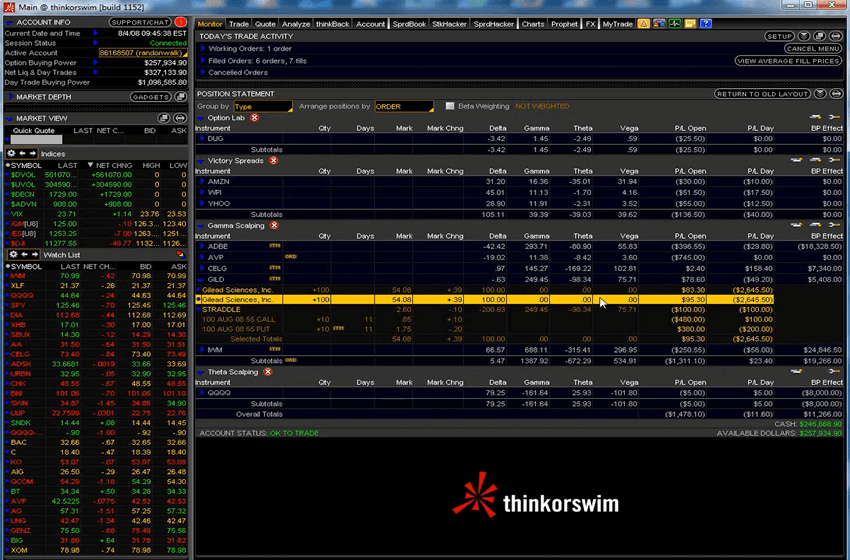

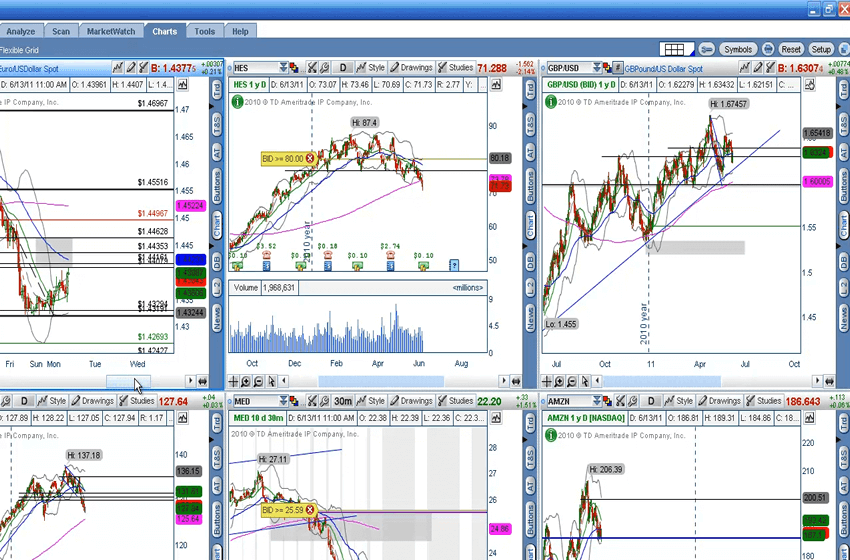

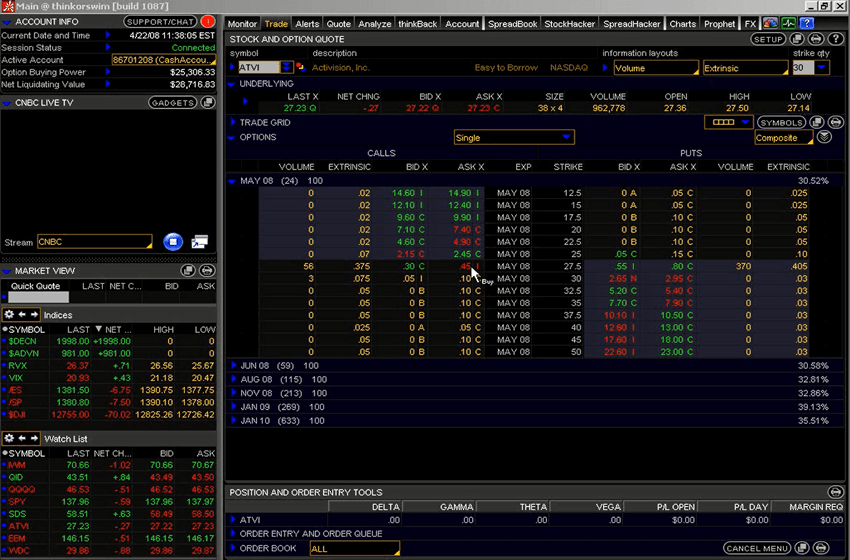

2. I use Interactive Brokers but both sets of videos have been created using Think or Swim.

JayApril 18th, 2021 at 12:27pm

Hi - Couple questions to clarify:

1. This is just training and not a "scanner" to be able to scan set ups is that correct?

2. Assuming answer is yes to 1 above, which platform / broker do you use and you have your training videos for? I understand that theoretically training / knowledge / set ups can be implemented on any platform / broker but in practice platform is crucial and could take time to learn / getting used to get the set ups etc.

Thank you,

Jay

[email removed]

PeterSeptember 30th, 2020 at 7:18pm

Hi Robert,

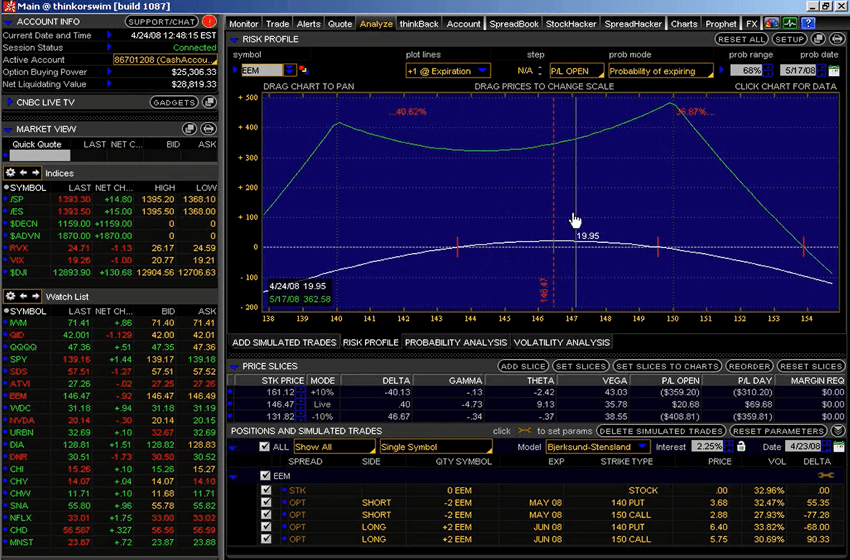

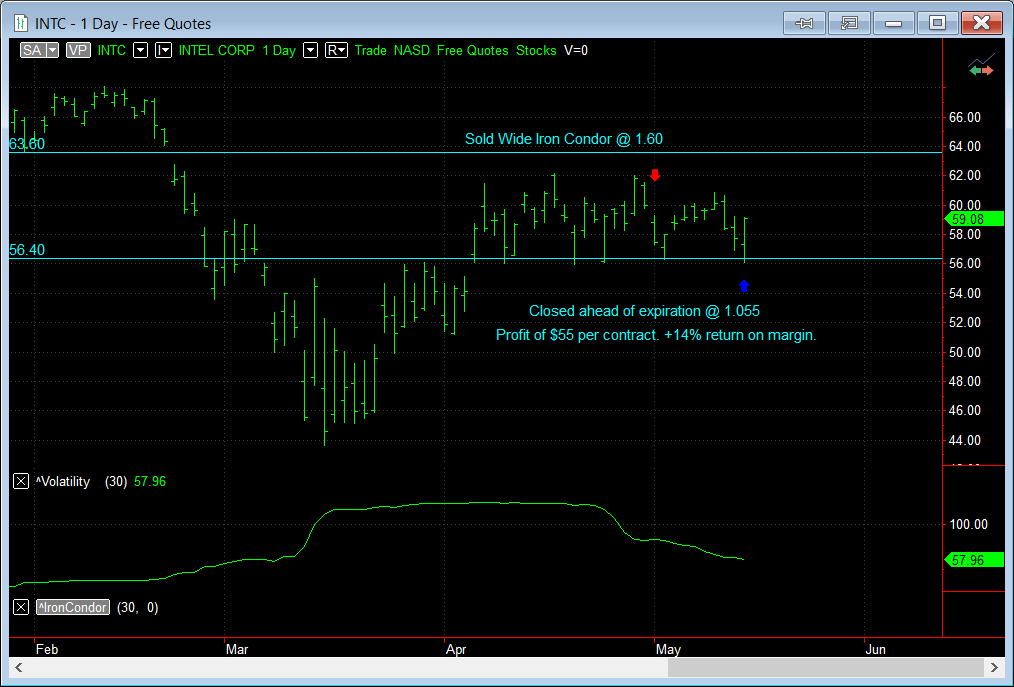

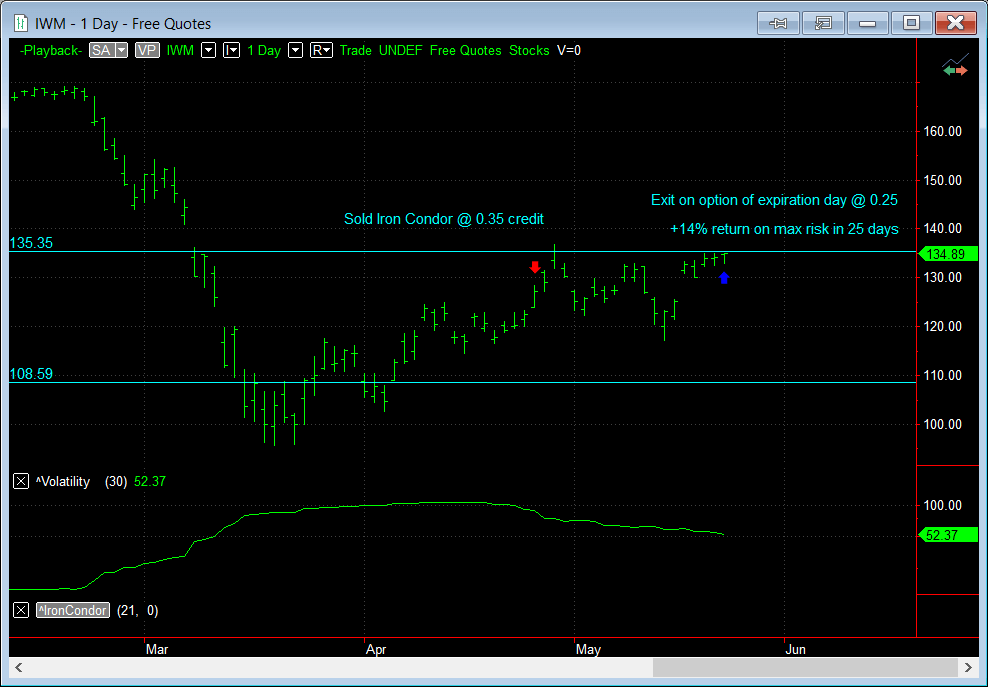

Yes, strike selection is covered and discussed as trades are established, often using the strike's delta as the guide, e.g for Iron Condors. Although condors are directional neutral spreads, there are also examples of directional strategies. And yes, there are modules on trade adjustments too.

RobertSeptember 30th, 2020 at 6:38pm

Hi Peter, does the training go in-depth on proper strike selection, strategy's to use if a stock has a certain direction, defensive strategy's if a spread goes against you, etc?

Thanks

PeterSeptember 28th, 2020 at 7:25pm

Hi Robert, yes, all the training is on video and I'm also available anytime for any questions you have. Feel free to reach out and I'll do my best to assist.

Peter.

RobertSeptember 28th, 2020 at 4:42pm

Hi, once I purchase the course is there a person I can contact about questions?

Are all the trainings on video?

Thanks, Robert

PeterApril 28th, 2020 at 3:45pm

I used to think that too; that if something is old, it must be "out of date". But let me tell you, principles never die and option trading has NEVER been more popular than it is right now.

In the US, options trading has been growing year on year and 2020 will certainly be a record year. See the numbers for yourself at The OCC.

LouisApril 28th, 2020 at 12:35pm

Is the content still relevant in today's markets?

PeterFebruary 12th, 2020 at 12:11pm

It's not! Trading as a Business is the original "how to trade options" video course. It was made before selling courses was "cool" and it remains the classic. All these other courses like the Option Income System, Trading Pro System etc are just remakes of the first Trading as a Business course.

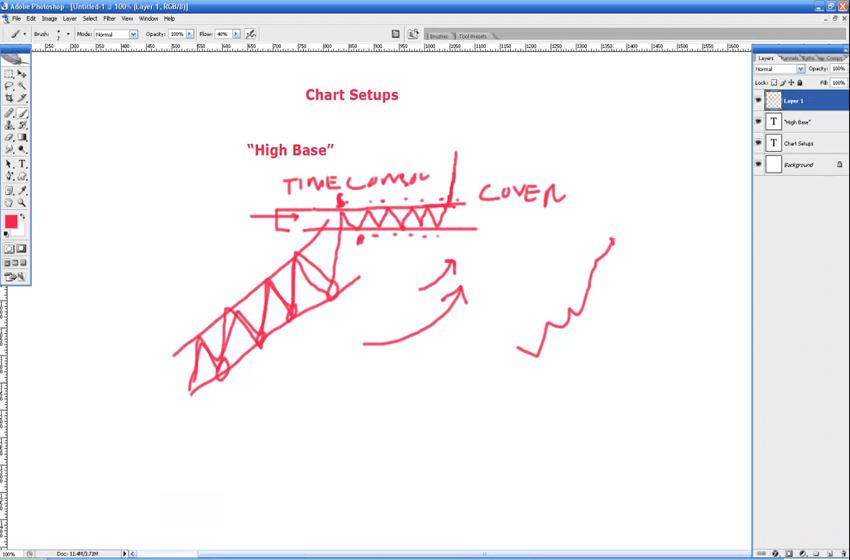

Plus, not only will you receive LIFETIME access to the original version, but you will also receive the Option Boost material too. Another live trading, practical course on making money with options. In this series, Derek has his own take on credit spreads but also unique setups for debit spreads and technical analysis setups that you can create on auto-pilot.

You cannot get this two course package anywhere else! And I am currently offering both courses for a $197 one-time fee. I don't know if I will always provided it at this low price as I think a yearly membership fee is probably better for me, but for now it is a lifetime deal.

JonFebruary 12th, 2020 at 10:01am

I've heard "income generating" strategies before. How is this different?

PeterJanuary 17th, 2020 at 3:35am

I'm happy to discuss refunds but can't guarantee it due to the fact that the product is a digital download.

If the videos are faulty or not possible to download and we cannot arrange delivery between us then of course we can work on that. If you don't get the product at all then yes I can provide a refund.

I just wanted to avoid the situation of opening it up and guaranteeing money back after all the content had been used. It's only for that reason that I don't offer it straight up as part of the sale.

AndyJanuary 16th, 2020 at 2:25am

Why no money back guarantee?

PeterJanuary 6th, 2020 at 8:15am

Unfortunately, I can't open up access to the entire vault for free but I'll show you another video of what's inside.

Please send me an email and I will shoot you a link to Expiration Week - Part 2.

This 5 minute video is part of Module 6: Portfolio Management (Greeks and Adjustments) and will run you through a few of the adjustment techniques under consideration for a small portfolio of option positions as the expiration date nears.

RajJanuary 5th, 2020 at 9:30am

Can I get a free trial?

Add a Comment