IPHI Calls Trade 241 Times the Puts

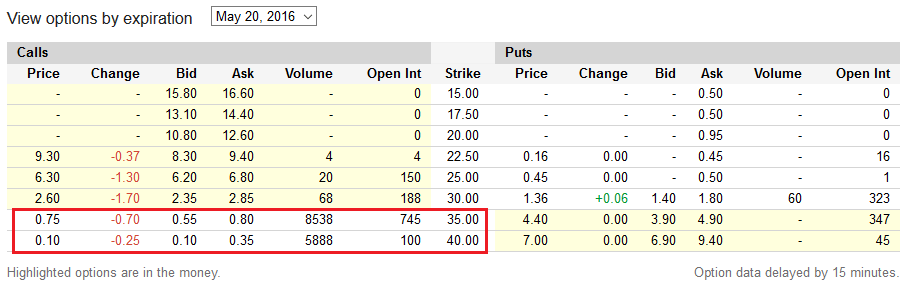

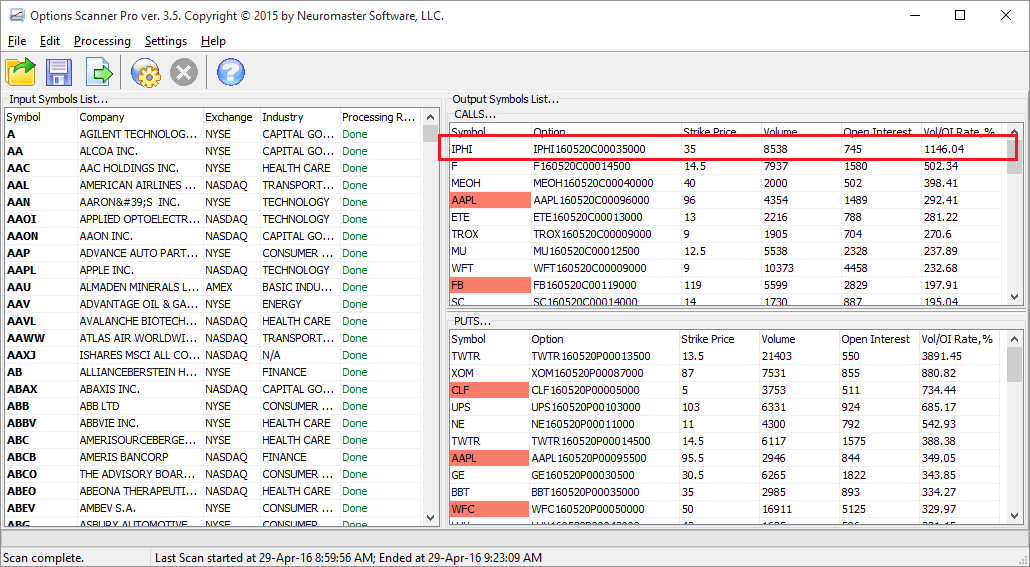

28th April option scans showed huge volumes trade through the $35 May'20 calls for IPHI. When I looked at the option page, I see the $40 strike also had a similar number of contracts trade.

Now, look at the puts. Only 60 contracts traded all day compared to 14,516 in the calls!

This happened today, right before the company was set to announce their earnings numbers after market close.

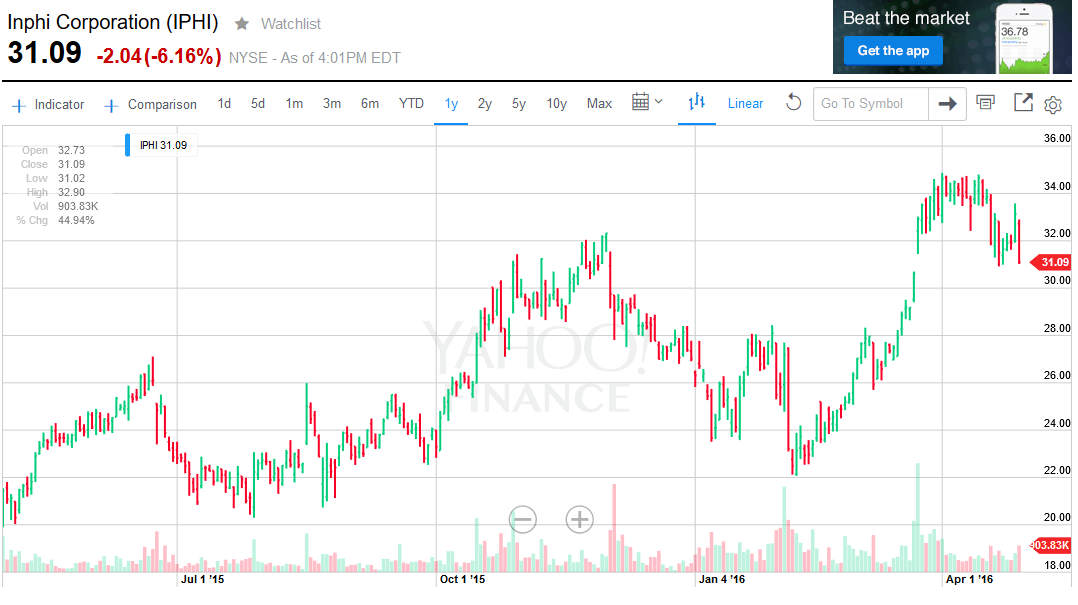

The stock dropped all day prior to the release:

After market close, surprisingly you might think, the company announces a better than expected Q1 income.

The results exceeded Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of 26 cents per share.

The market is closed now, so it is too late to buy those same call options at those prices. Let's see how the market opens tomorrow though. Might be worth paying a little more to ride on the back of this one.

I found this opportunity using the Option Scanner.

Questions or comments? Feel free to leave below.

There are zero comments

Add a Comment