The Double Calendar Spread!

Examples below of how to trade DCS in Practice

| B/S | Strike | Type | Price |

|---|---|---|---|

| Sell Front Month | $300 | Put | ($6) |

| Sell Front Month | $320 | Call | ($5.65) |

| Buy Back Month | $300 | Put | $8.50 |

| Buy Back Month | $320 | Call | $8.55 |

| Net Debit | $5.40 | ||

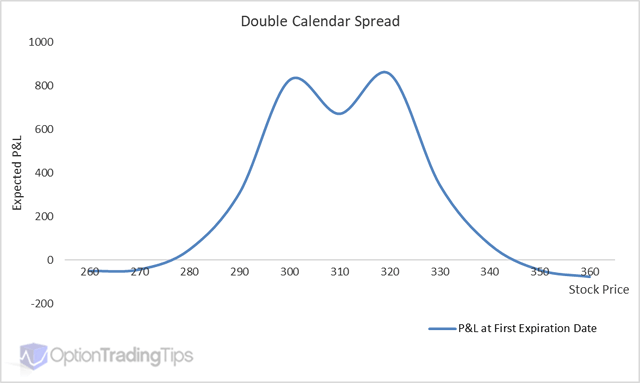

Double Calendar spreads are a short vol play and are typically used around earnings to take advantage of a "vol crush".

The usual setup is to sell the front month options and buy the back month. This should result in a debit.

The ideal setup is when the implied volatility in the front month options is significantly higher than the options in the back month; thereby selling higher volatility and buying lower volatility.

Ideally, once earnings have been released, vol will drop and the front month options can be purchased back for a lower price. Subsequently the back month options will need to be sold. Back month options will also lose money though, but the expectation is that the net difference is a profit.

The idea is great, but here are some struggles I've had in practice with Double Calendars.

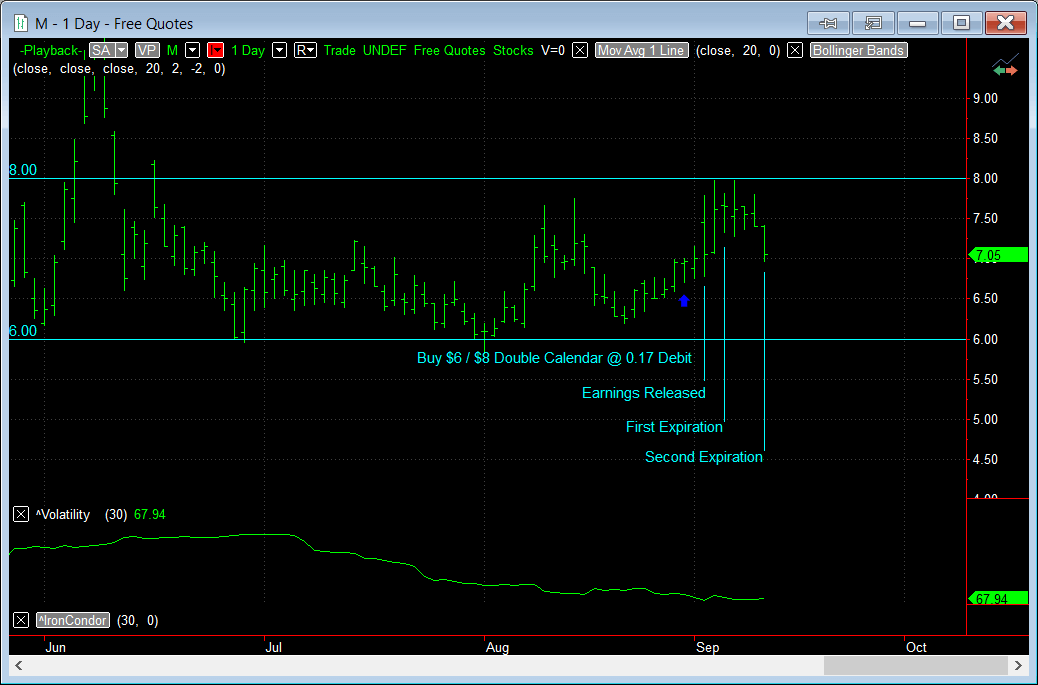

Losing Trade on Macy's

Be careful when exiting. I made the mistake of only exiting the short legs leaving the back month strangle. The stock was close to the strike and I was bias towards the stock moving favorably, thinking I would make a big gain over the next week. But of course it didn't and the stock hovered inside the strikes and I lost all premium on the back month, which was the max loss anyway.

In this example, I bought 5 x $6 / $8 Double Calendars on the 31st August:

Sold 4th September expiry $6 puts and $8 calls

Bought 11th September expiry $6 puts and $8 calls

Earnings were released on the 2nd Sep before market open. After an initial small jump the stock closed pretty much where it ended the previous session. I should have exited the spread then.

The following day, the stock rallied and closed 8% higher. The front month expiration was the following day, so I exited the short call only, thinking the stock would continue higher and left the back month strangle open.

The stock traded back down and ended the expiry @ 7.05, losing the premiums on the back month to realize the net loss of 0.17 per spread.

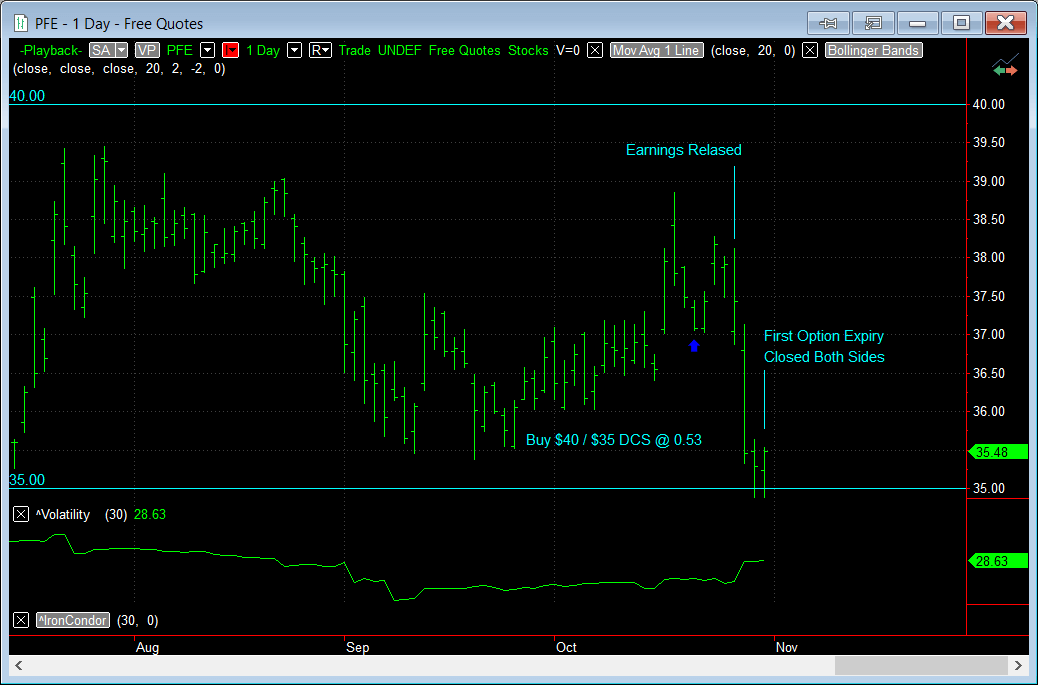

Losing Trade on PFE, even though earnings were low

What's hard about DCS is that sometimes, even when earnings disappoint and vol does crush down, the trade can still be a loser. Take this example on PFE.

On 21st October I bought 2 x $35 / $40 Double Calendar:

Sold 30th October expiry $40 calls and $35 puts @ 0.45 credit

Bought 6th November expiry $40 calls and $35 puts @ 0.98 debit

Total debit 0.53

Earnings came out on the 27th before market open. The market was underwhelmed by the release and I exited both sides on the close of the 27th.

I bought the front month strangle back @ 0.08 and sold the back month @ 0.54. Total loss of 0.12 per contract after fees (-23% of max loss).

Even though the market stayed stable I still exited the PFE double calendar for a small loss. In this scenario I would have done better if I had sold an Iron Condor instead.

Profitable Trades

It's not all bad though. Here are two profitable DCS examples.

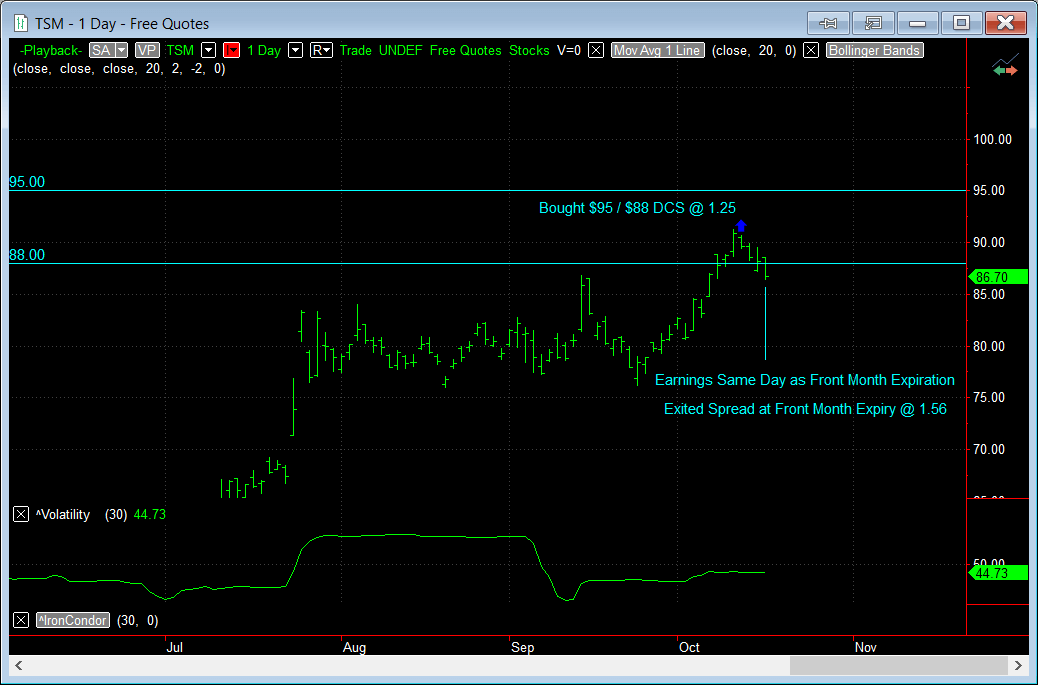

TSM

On the 13th October I bought TSM $95 / $88 DCS 16th October / 23rd October for 1.25 debit:

Sold 16th October expiry $95 calls and $88 puts @ 1.71 credit

Bought 23rd October expiry $95 calls and $88 puts @ 2.96 debit

Total debit 1.25

Earnings were released on the 15th before market open. I bought back the $88 put front month @ 0.61 and allowed the $95 call to expire worthless. Sold the back month strangle @ 2.24. Net profit of 0.31 per contract after fees (+18.79%).

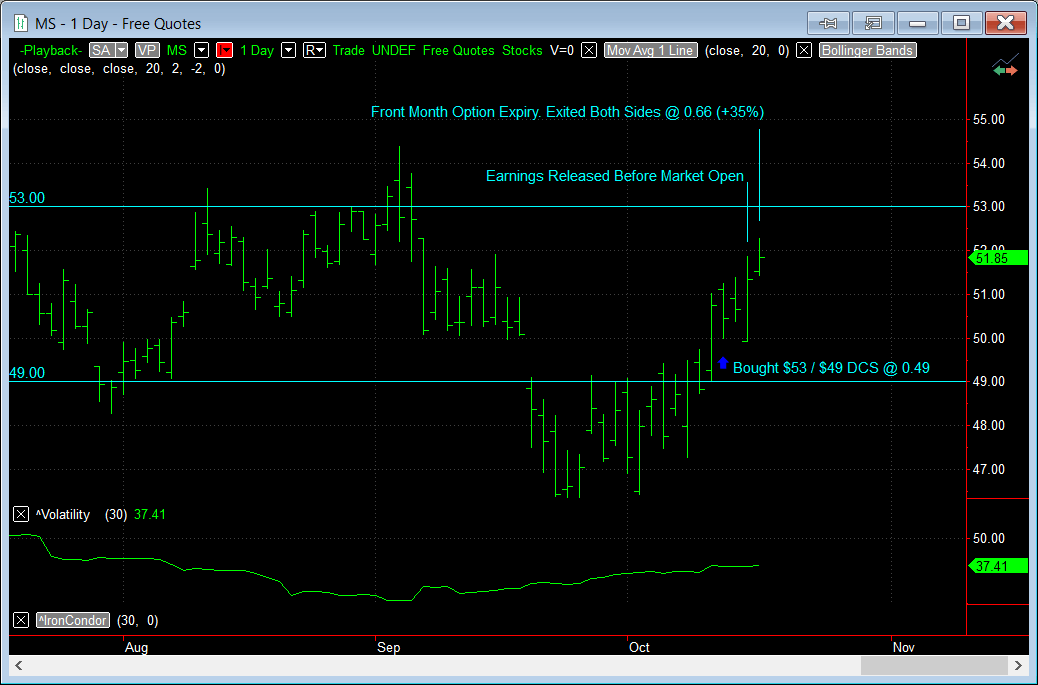

MS Double Calendar

Entered DCS 13th October:

Sold 16th October expiry $53 calls and $49 puts @ 0.68 credit

Bought 23rd October expiry $53 calls and $49 puts @ 1.17 debit

Total debit 0.49

Earnings released 15th October BMO. Let the short spread expire worthless and sold back the long spread on the close of the first expiration @ 0.66 (0.62 net of fees). +26% net profit on max debit spent.

Learn how to effectively trade Double Calendars with my instructional video series; what strikes, expiration's and vol spreads work best.

There are zero comments

Add a Comment