Short Iron Condor (COH)

25th January

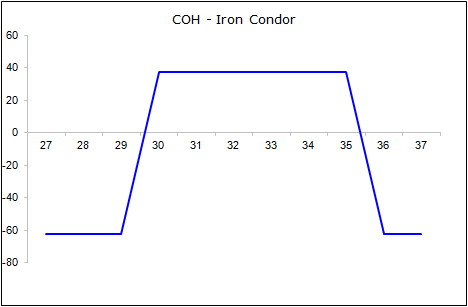

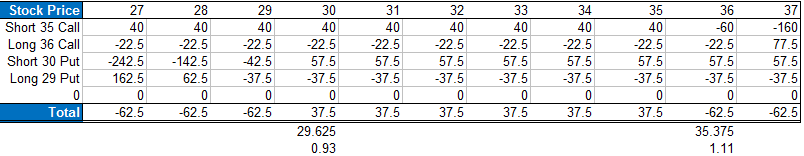

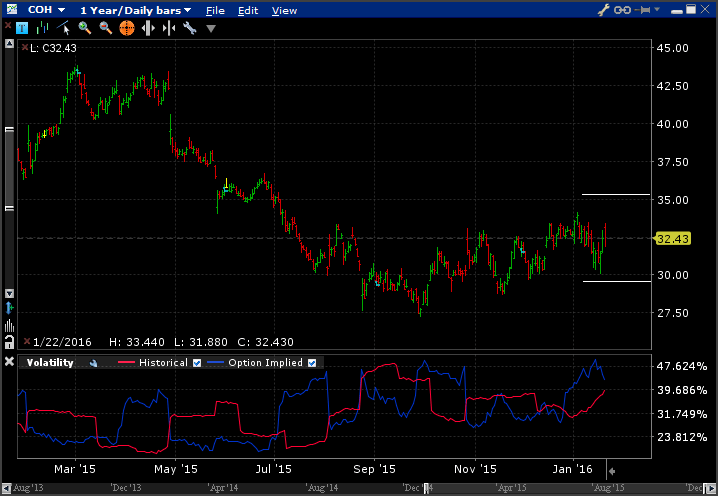

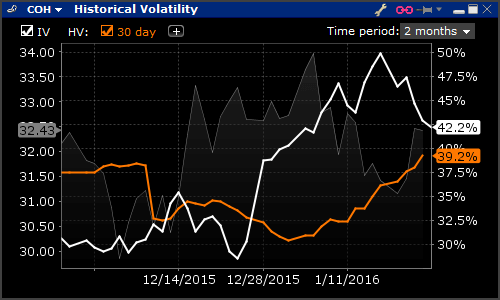

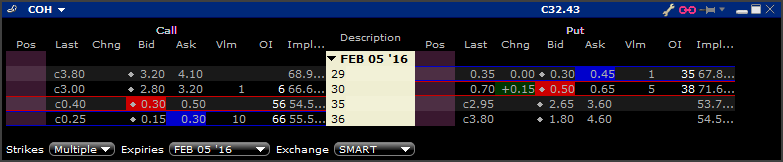

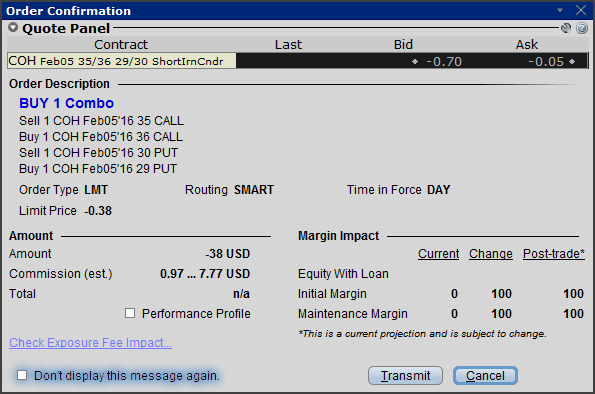

COH had earnings out after market 25th Jan and I took a short Iron Condor expecting the market to be range bound post the release and for the next two weeks. Recent price action was range bound and implied volatility was high. When I priced it up, the payoff graph looked ok:

From this I had 17% range for COH to trade between. Here's the graph with the breakeven points plotted:

And the volatility chart:

And here are the options screen and my combination order confirmation:

Update After Market Close

COH has dropped 6% in the afternoon - no doubt due to nervousness about the earnings release. The spread is making a small loss of $5.90 - perhaps the stock will bouce after the numbers come out.

If not, I will most likely double up by placing another Iron Condor around the current stock price in the next expiration.

Update January 27th

Coach (COH) Iron Condor position down slightly from yesterday...down from $23.10 to $14.90. COH stock was up 2.58% and now up another 1.3% in after hours activity trading at $34.64. The stock is now only 2.12% under the upper breakeven point for the combination. If it continues to rally I will look to perhaps layer another condor trader in the next expiration or even a call credit spread with volume in the current expiry.

Update January 28th

Coach (COH) Iron Condor position down again after another strong day for the stock. It continues to rally since establishing the position; the exacy opposite of what I wanted. However, it provides a good opportunity to manage the trade now. Perhaps I will double up with a short call spread above where it is trading? I'll check out the prices and update if that happens.

Update January 29th

Coach (COH) continues to rally on positive expectations of a profitable 2016. Earnings numbers were in-line with expectations but comments from the company are fueling optimising about the future of the stock. The stock price has now crossed over the upper breakeven level for the condor and if the stock continues here I will realise a loss on the trade. I didn't layer the position as I said on Friday as I am still holding onto the idea that the stock will turnaround...perhaps that will be my demise?

February 1st

Coach (COH) Up 0.40% to $37.20. Still trading above the upper break point, which isn't good. I need some quick pullback here in the next couple of days for this spread to profit. I will review after tomorrow's trading and make a decision tomorrow.

February 2nd

Coach (COH) down a touch by -0.16% to $37.15. Still above the upper level, so not good for the position. So I've put in a trade adjustment to sell a $37.50/$38 call spread for 3 lots.

February 3rd

Coach (COH) down 2%! I entered an adjustment trade, shorting the $37.5/$38 call spread for $20. I did it for 3 lots, so 3 times the initial Iron Condor position. Now I am still down on the Iron Condor (-$45.90) but profitable on the Call Spread (+$48) to show a small total gain of $2.10. The stock is down another 1% in after hours trading, so hopefully it continues to tank.

February 4th

Coach (COH) ended Thursday down 0.91% trading at $36.09. Now, it is above the upper level of the Iron Condor but below the upper level of the Short Call Spread. Of course I'd prefer it to be lower but it is still a good result for the trade overall. I have so far limited my losses for the Iron Condor and leaves more room for profit if the stock tanks. The risk of losses remains above the $37.7 level, which is 4.5% away. Given implied volatility is showing 35% it is not impossible for it to reach it during Friday's session, which is the last trading day. At 35% volatility I can expect the stock to move up or down 2% per day with 66% confidence.

Closed Position Summary, February 5th

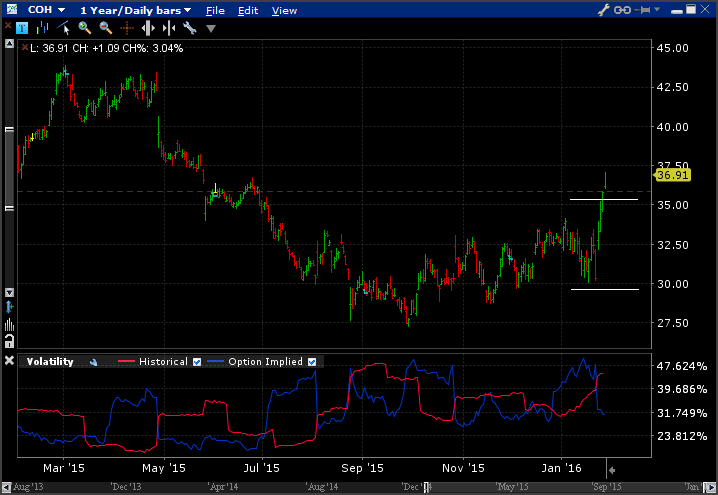

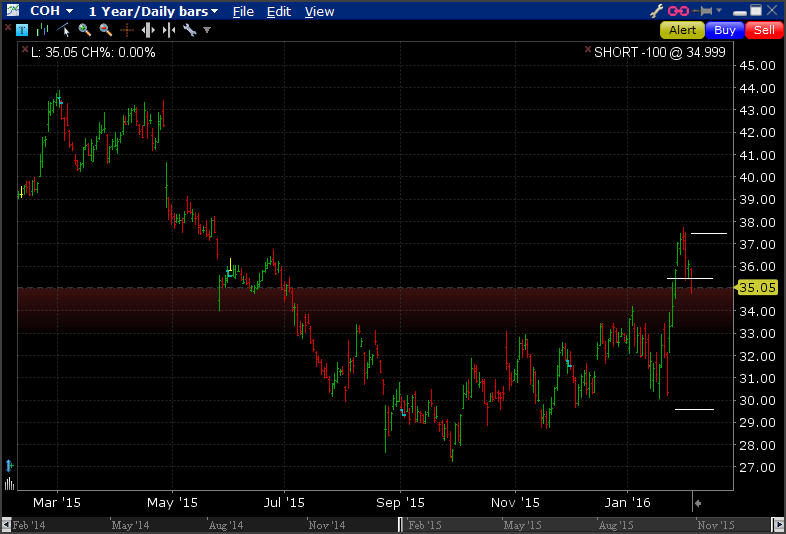

Coach trade closed out Friday just below the upper break level for the Iron Condor, however, it was still 5 cents higher than the short $35 strike call option. This means that I was assigned on the position and have how had to deliver stock to the buyer of the option. My position is now short 100 shares of COH stock. P&L in total for the two option spreads was $118.30 profit. But now I have to unwind the stock leg. I may just short a put on the stock as the stop level...I'll see. Here is the before and after chart of the trade:

Call Option Assignment

February 5th

Coach (COH) trade closed out Friday just below the upper break level for the Iron Condor, however, it was still 5 cents higher than the short $35 strike call option. This means that I was assigned on the position and have how had to deliver stock to the buyer of the option. My position is now short 100 shares of COH stock. P&L in total for the two option spreads was $118.30 profit. But now I have to unwind the stock leg. I may just short a put on the stock as the stop level...I'll see.

February 8th

Coach (COH) After being assigned the short stock position, I decided to sell an ATM put option. If the market falls, I will be exercised on the put and take delivery of 100 shares closing out my short assignment at the same price. I received $75 for the sale of the put. I still have risk on the upside if the market rallies. If this happens, I will perhaps look to sell another put with a higher strike depending on how far the market trades.

February 11th

Adjustment is doing ok. I'll likely be assigned stock due to the short put expiring ITM, which will close out my short stock position. The stock will close out for zero profit but I will keep the $74.60 premium for the short put.

Expiration, February 12th

COH. I let the short position go until expiration. The stock closed at $34.53, which means the $35 put option was in the money so I ended up being assigned a long position for that leg. This cancelled out my short stock position and I keep the premium of $74 as profit

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| COH Iron Condor | ||||

| COH Feb05 $29 Put | 1 | 0.714 | 0 | -71.4 |

| COH Feb05 $30 Put | -1 | 1.026 | 0 | 102.6 |

| COH Feb05 $35 Call | -1 | 0.216 | 0.05 | 16.6 |

| COH Feb05 $36 Call | 1 | 0.164 | 0 | -16.4 |

| Total | -0.312 | -0.05 | 31.4 | |

| COH Adj Short Call Spread (comms $4.75) | ||||

| COH Feb05 $37.50 Call | -3 | 0.492 | 0 | 147.6 |

| COH Feb05 $38 Call | 3 | 0.307 | 0 | -92.1 |

| Total | -0.555 | 0 | 55.5 | |

| COH Assignment (comms $0.34) | ||||

| COH Short Stock | -100 | 35 | 34.53 | 47 |

| COH Feb12 $35 Put | -1 | 0.746 | 0.47 | 27.6 |

| Total | 74.6 | |||

| Grand Total | 161.50 |

RahulFebruary 7th, 2016 at 8:34pm

sell ATM put

Add a Comment