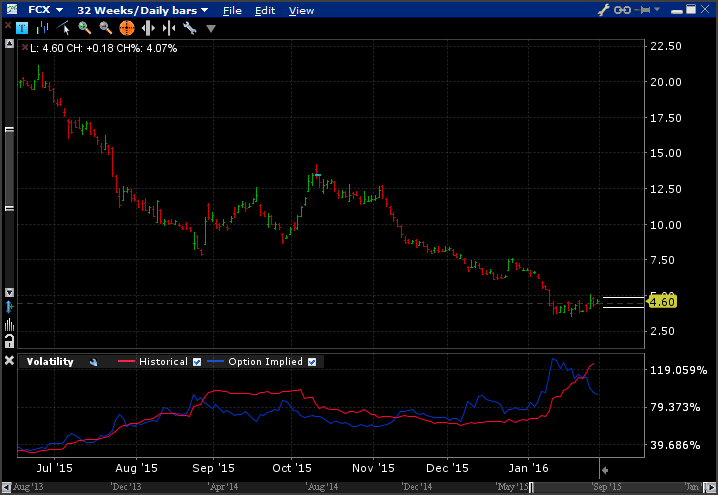

Short Iron Butterfly (FCX)

Trade Start: 28th January

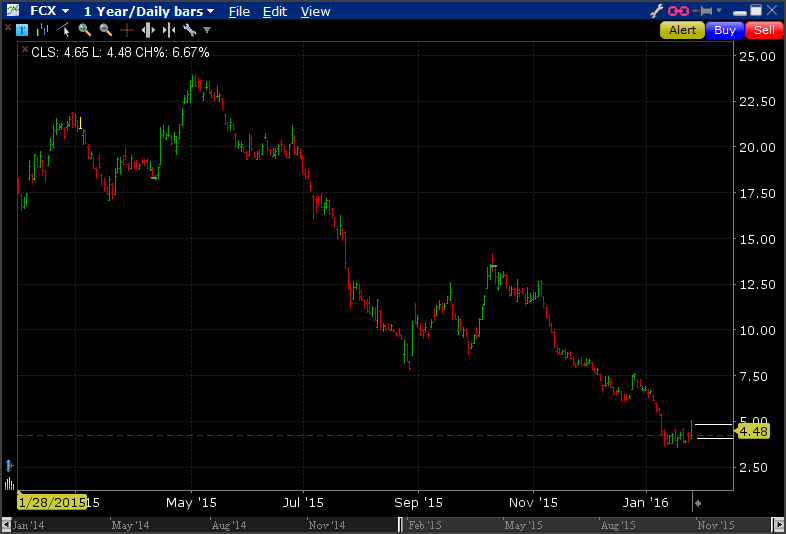

FCX have already announced their earnings on Tuesday the 26th January. The stock has been trading in a tight range up until that day and didn't move too much after the announcement.

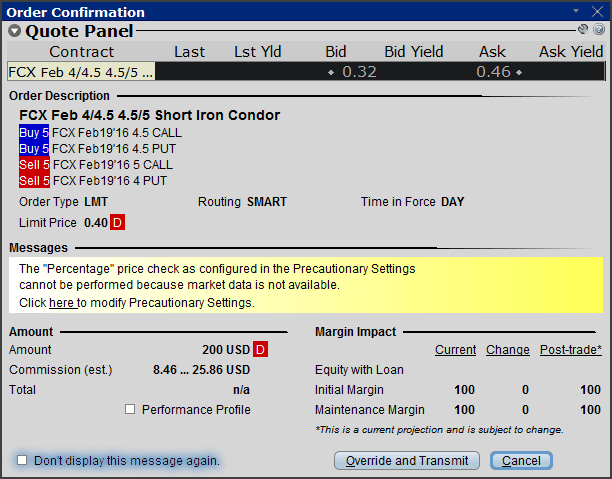

I expect the stock to move though I don't know what way. I decided to put on an Iron Condor. Trade confirmation is below:

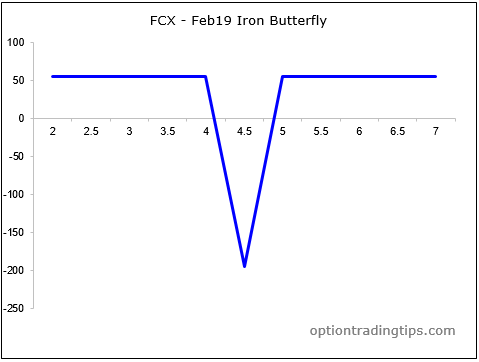

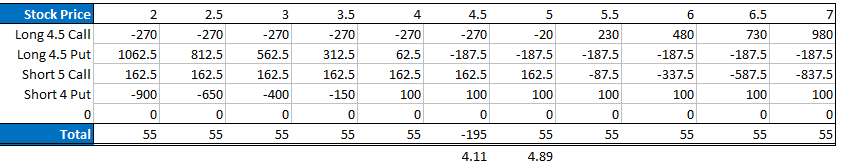

Here is the payoff value for 5 contracts:

The breakeven points are 9% either side of the current price. Sounds large but there's 3 weeks until expiration.

January 28th

Position is down slightly but the trade has 3 weeks to expire. The setup has created a narrow band for the stock to trade out of for it to be profitable. It seems likely when looking at the chart, but we'll see how it ends up I guess.

January 29th

Freeport-McMoRan (FCX) up 4.07% on Friday. Stock is inside the levels for the Iron Butterfly. The stock is still volatile but would like to see it explode in either direction. I'm not concerned at this point as the position still has 3 weeks until expiration.

February 1st

Freeport-McMoRan (FCX) up 2.61% to $4.72. Upper breakeven point that we need to trade beyond to be profitable by expiration is $4.89, which is 3.6% away from current price. Still just under 3 weeks to go until expiry.

February 2nd

Freeport-McMoRan (FCX) down -8.23% to $4.35! Still inside the range we need to break out of but a good result.

February 3rd

Freeport-McMoRan (FCX) up 12%! It is trading right on the upper level, which I need it to stay above over the next two weeks. Expiry isn't until 19th Feb, so again not too worried about this one yet.

February 4th

The stock is now trading 17$ above the upper break level of $4.89, which is a great result, however, the P&L for the spread is flat.

This is something that confuses people new to trading options; when the market goes in the direction that expect but still don't make money.

There are two reasons this can happen; volatility and time-decay. Both of these factors have the same effect on the value of an option contract. That is, if you increase time or increase volatility the value of the option also increase and vice versa.

As this particular Iron Butterfly strategy is a "long" spread I am net long options - meaning that a decrease in time or decrease in volatility hurts my position. Therefore the impact of the underlying price move needs to be significant enough to overcome the negative effects of time and volatility.

In this case, the volatility of the February 19 options has remained relatively unchanged - up by 3% at 101%. But the decrease in the value of the option due to the erosion of time has been enough to offset the positive impact of the underlying price jump. Therefore the P&L remains at 0 for the spread.

This isn't all bad for the strategy - the price trading above the upper level is still positive; I just need it to remain there as the options approach the expiration date. If that happens the the payoff of the strategy will be in my favor and I will take the profit of the wings of the butterfly.

February 5th

Freeport-McMoRan (FCX) little changed Friday. Position showing small profit of $4.

February 8th

Freeport-McMoRan (FCX) down 6%. Spread showing small loss of -$15.

February 11th

The downward momentum of the market generally has also moved FCX towards the upper level that I need the stock to remain above for it to be profitable. The P&L hasn't changed much; down -$27.50 today from down -$22.50 yesterday. There is still a week to go though.

February 16th

FCX - big move up 15%. Stock is well above BE now with an open profit now of +$22.50 for the spread.

February 17th

Another strong day, up 14%. Stock is now 48.6% outside of the channel provided by the Iron Butterfly. The spread is now trading at it's max value so I will look to exit this at the next open - just so I don't get assigned the stock due to the long call expiring ITM.

February 18th

I closed out the FCX trade by selling back the Call Spread leg of the Iron Butterfly. The put side is still open but unlikely to make that far by tomorrow. I will check prior to the close to be sure though.

Net Profit on the trade was $35. I really should have left it another day to close it out to realize the full P&L.

There are zero comments

Add a Comment