Call Option Payoff

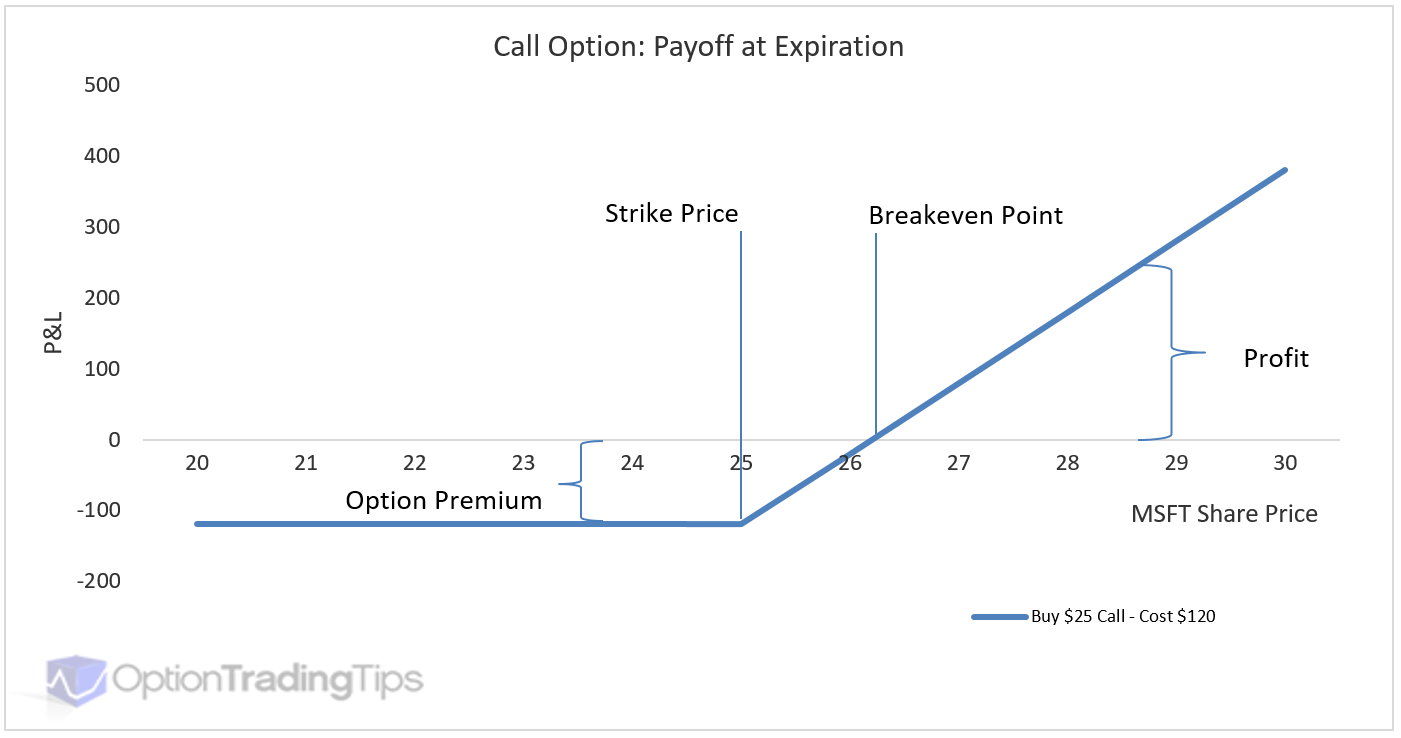

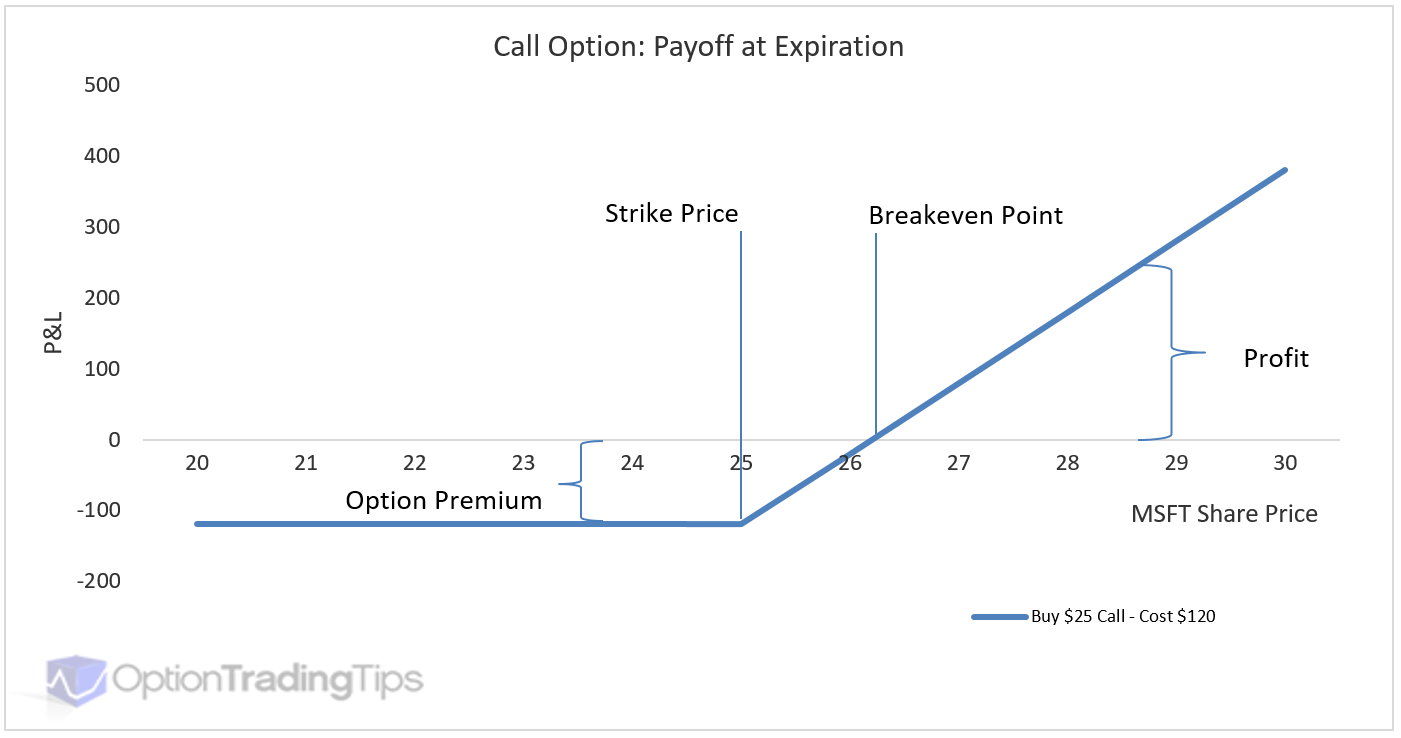

Let's look again at the basics of a Call Option. Here is an example;

Underlying: MSFT

Type: Call Option

Exercise Price: $25

Expiry Date: 25th May (30 days until expiration)

The market price of this call option $1.2. Buying the option means you pay this price to the seller. As the option is a call option, exercising the option means you will buy the shares at the exercise price of $25. You would only exercise if it is profitable to do so. But the exercise price alone is not doesn't determine probability.

You also need to consider that you paid something to have the right to exercise; the option premium, in this case $1.20. Therefore, the shares have to be trading at $26.20 for us to break even (Exercise Price of $25 plus the Option Premium of $1.20). If the shares are trading anywhere above $26.20 then we can say the option is profitable. Anywhere below $26.20 and we lose out by the premium - $1.20. So, with a long call we have limited risk (the Option Premium) while at the same time having uncapped profit potential. Let's look at a graph of this concept;

The horizontal line across the graph (the x-axis) represents the price movement of the underlying instrument - in this example, the share price of Microsoft. The vertical axis illustrates our profit/loss. The blue line is our payoff of our option position.

You can see that the vertical distance between the 0 profit line and the blue line is our maximum loss, i.e. the amount we paid for the option. So, anywhere under our break even point of $26.20 means that the option isn't profitable, we will not exercise the option and we will lose any premium we paid ($1.20). Even if the market crashes and the stock goes bankrupt, our maximum loss will still only be the premium we paid.

However, as the shares trade past the $26.20 mark we start making money on the position. If, at expiry, Microsoft shares are trading at $50 then we will make $23.80 per share. How? Because we will exercise our right and have the seller of the option hand over Microsoft shares at a value of $25 (the exercise price). Minus the amount we have already paid for the option ($1.20) and we have a profit per share of $23.80.

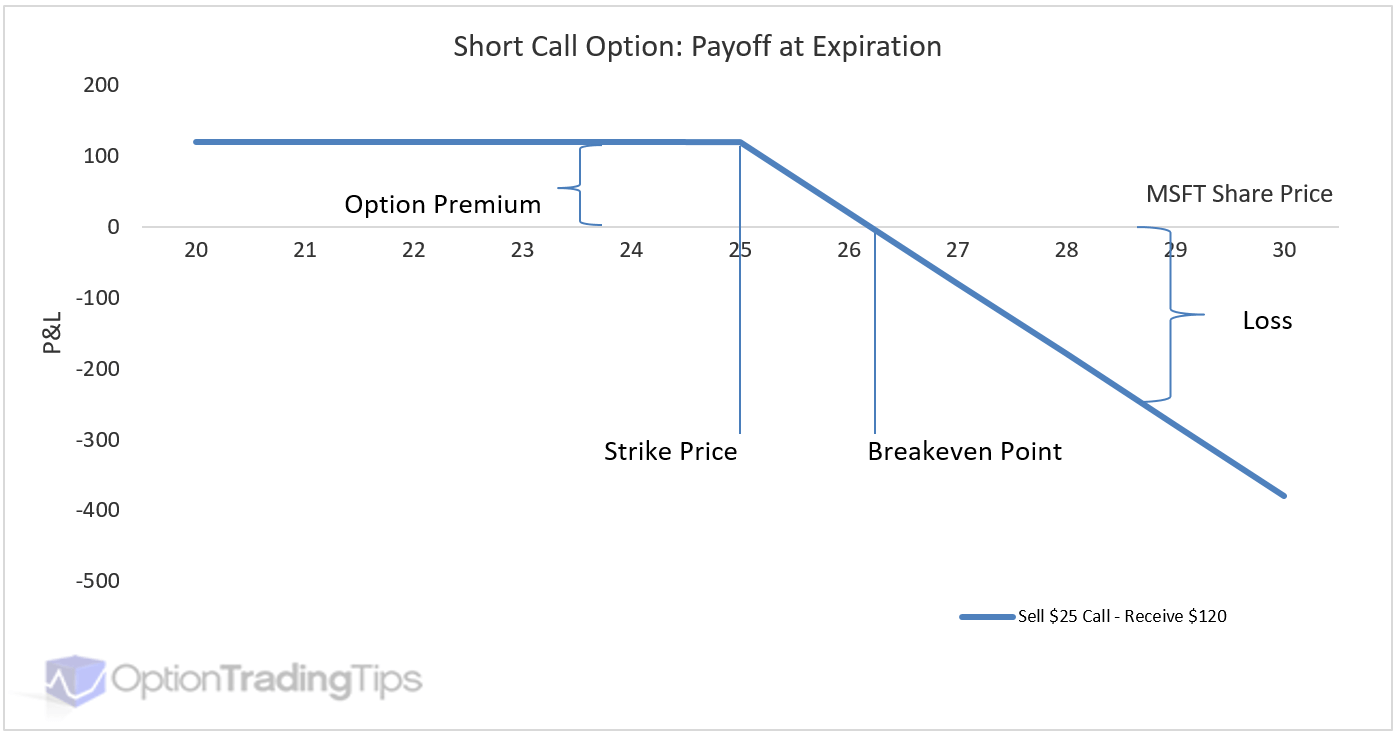

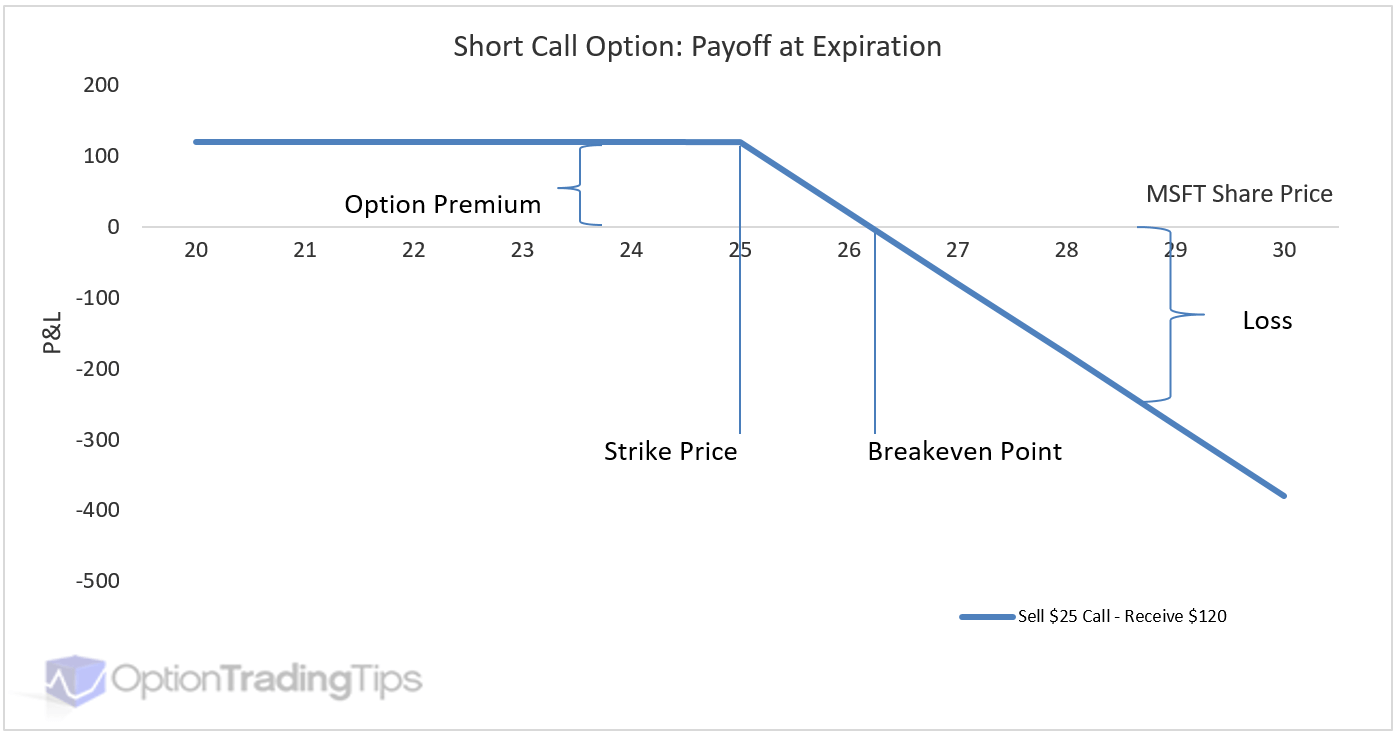

Selling a Call Payoff

When we reverse the position and sell a call option, here is the payoff diagram for that.

We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. If the shares trade anywhere below $25 then we keep the $1.20 that we received when we sold the call option.

However, if the market rallies then our losses become uncapped as the stock price rises.

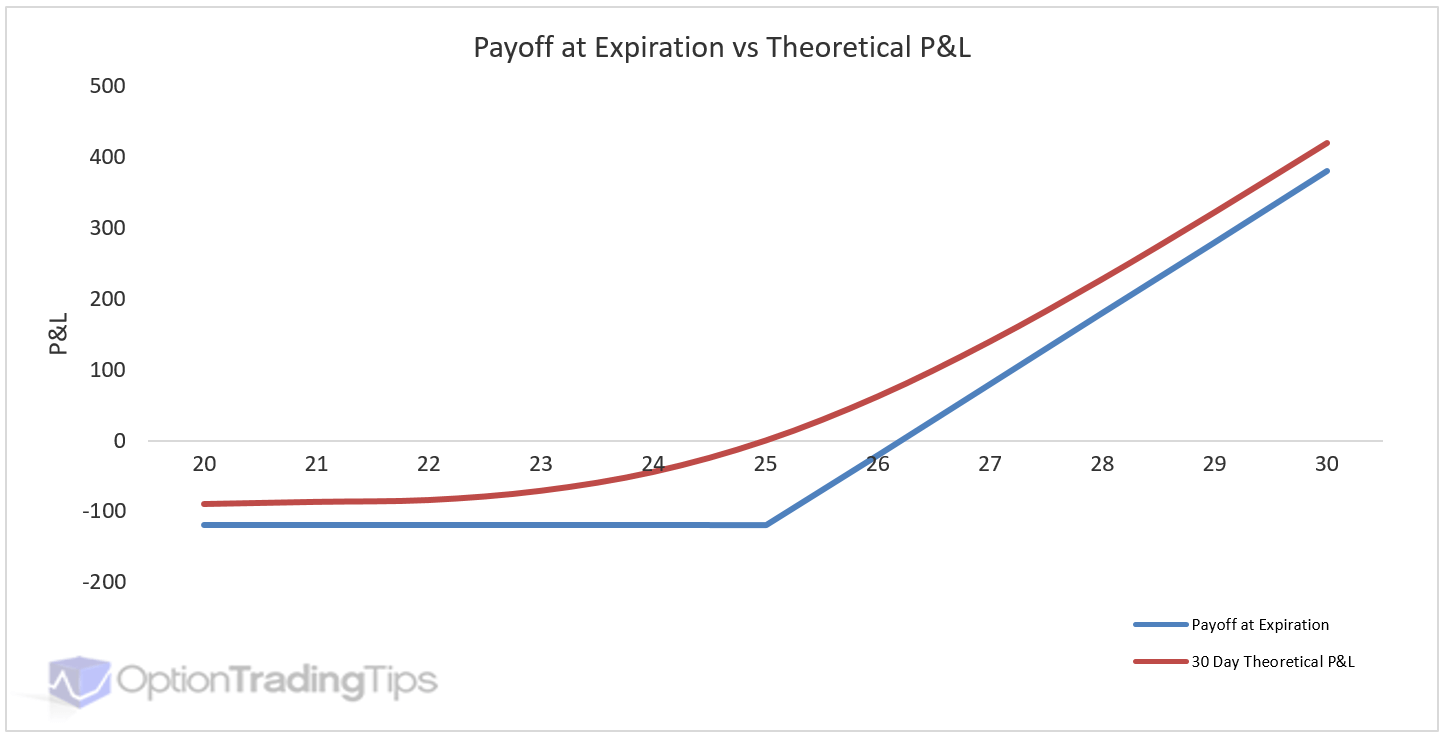

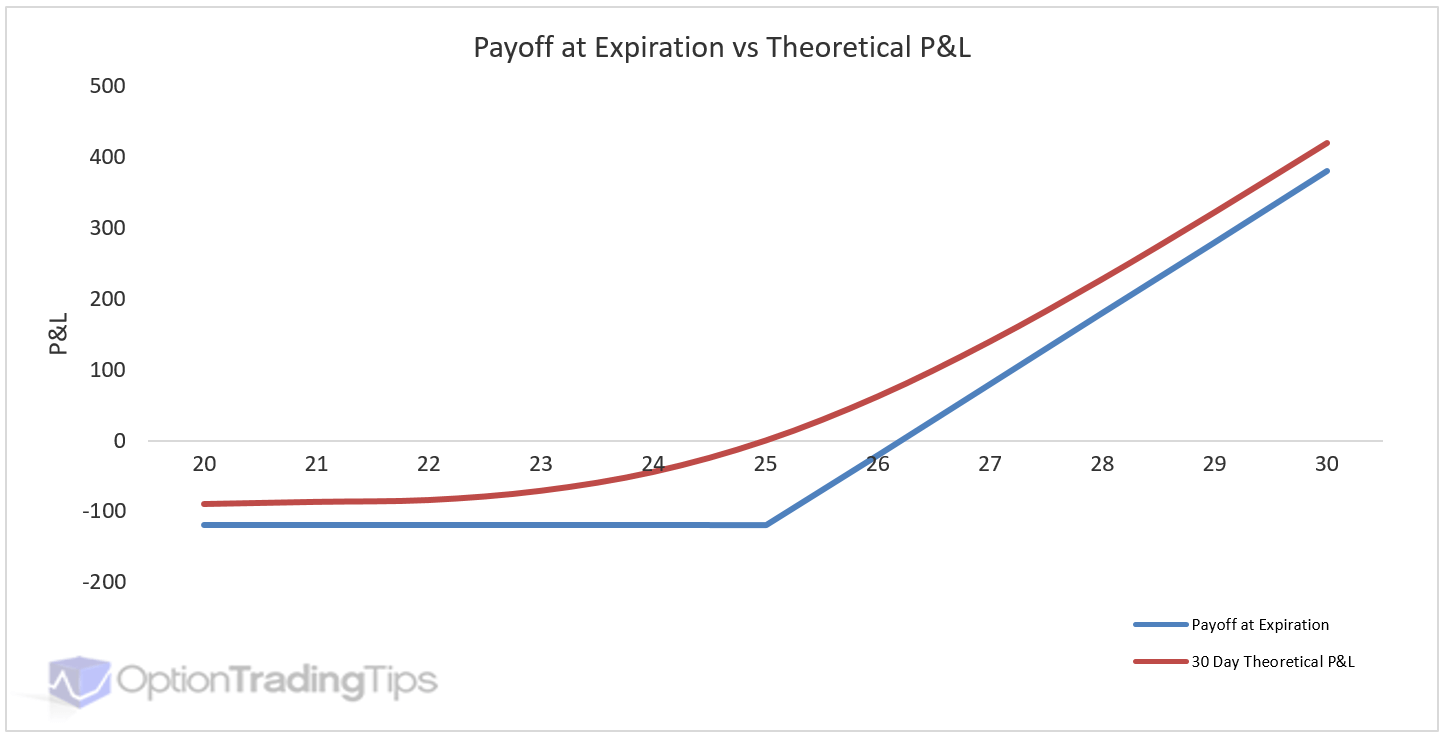

Theoretical P&L vs Payoff at Expiration

The above graphs have looked at what option will be worth at the expiration date only. However, you will often see another line inside payoff charts that is usually smooth and referred to as the Theoretical P&L.

This theoretical line graphs what the option is worth today and is calculated from a theoretical pricing model, such as Black and Scholes or Binomial Model. Given the time to expiration, the graph will show how your P&L will change "today" should you have this position vs the axis graphed; usually the stock price.

Here is the same MSFT call option chart now with theoretical P&L added.

The place on the x-axis that represents the current stock price should be where the P&L is zero i.e at the time and stock price of purchase you have not made or lost anything. The payoff line at the same point on this chart is the premium, or price, of the option. (This isn't always the case though regarding the premium for the option and the payoff/P&L line. For certain combinations it can be either the premium or max profit/loss.)

This example was calculated when the option has 30 days until expiration and is worth $1.20. With all other things being equal (time, interest rates, volatility) the smoothed line shows how the P&L will change for each corresponding price movement of the stock as per the axis.

As each day passes, this line will move closer and closer until the point of expiration, which will be the final payoff line.

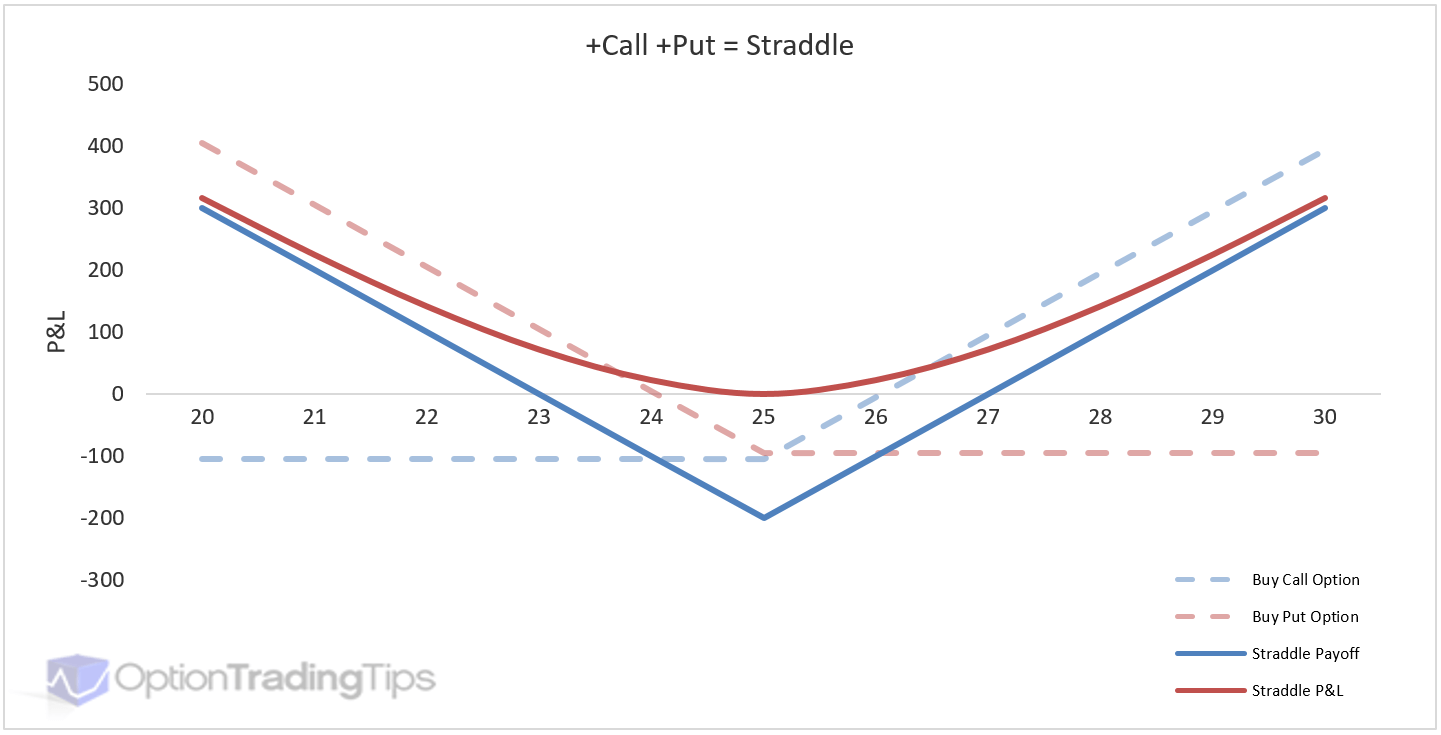

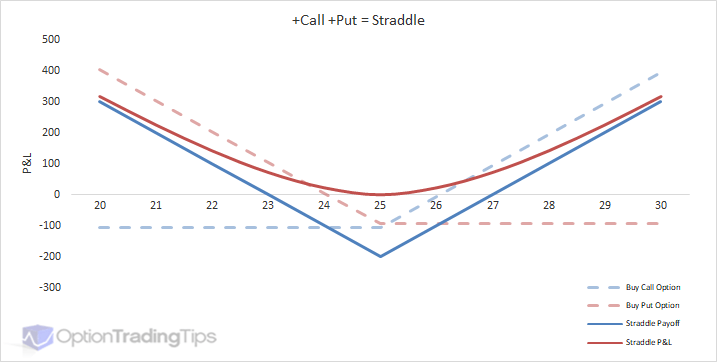

Combination Payoffs

Outright calls and puts are fairly straight forward to understand when it comes to payoff and P&L. However, payoff charts become very useful when looking at combinations of options i.e. when more than one leg is in the strategy.

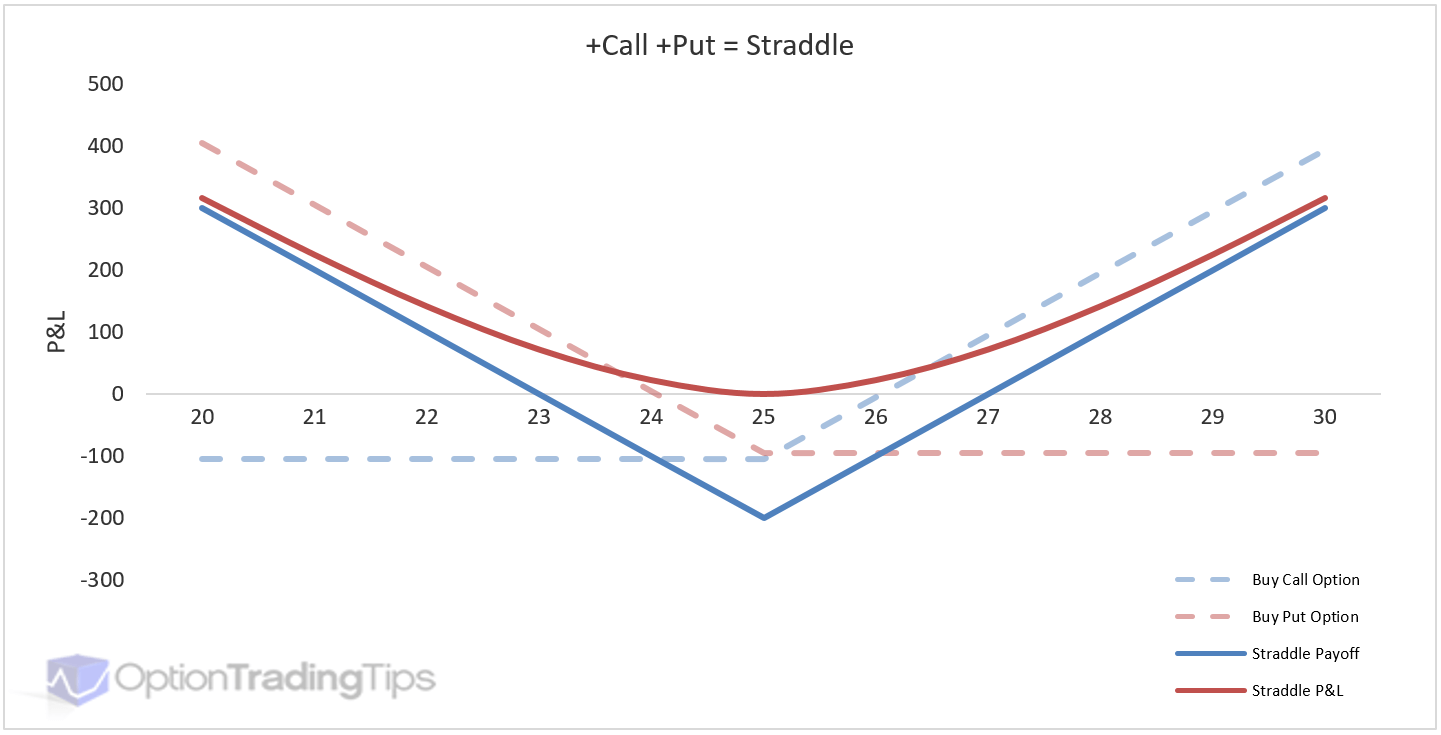

Take an option straddle for example. A straddle is a combination of two options; a long call and long put option with the same expiration dates and strike prices. Below is a straddle graph.

Typically when you see combinations charts you will only have the total of all legs plotted. Here, I've plotted each single leg, buy call and buy put, in a lighter color and dashed in the background and then the combination as the darker solid line in the foreground. The P&L line is for the combination.

PeterFebruary 6th, 2017 at 4:11am

Hi Ali,

Yes, fair point there. The graphs label the blue line as P&L; some of the content probably needs to be updated. Thanks!

AliFebruary 5th, 2017 at 4:10am

Dear author,

I am sorry, But the "blue line" you talked about is the "Profit".

Its not the payoff. Payoff is the line which doesn't represent the impact of the Future values of costs and Premiums paid or received.

Actuarial Student

maheshFebruary 26th, 2015 at 5:02am

thanks

PeterFebruary 25th, 2015 at 6:54am

Hi Mahesh,

The option will be worth at least its' intrinsic value - for a call option it will be the stock pice minus the strike price. So, there will always be a buyer at this price - typically a market maker who will offset it against the stock or another option.

You could also exercise the option (if a call) and take delivery of the stock and then sell it immediately in the open stock market to realise the gains.

maheshFebruary 25th, 2015 at 6:27am

hi

if i baught xyz call at 5 and after a week it is 25 .but now it has no buyer at this value

what should i do should i buy put of same strike prise ?

explain profits in that case

PeterAugust 29th, 2012 at 7:19pm

Hi Migh,

Sure, here's a payoff graph of a $35 call option with 60 days to maturity, 25% volatility, 0% dividend yield, 8% interest rate and an underlying price of $40.

mighAugust 24th, 2012 at 3:06am

suppose a stockm price is 40 and effective annual interest rate is 8%.draw a single payoff and profit diagram for the following option

strike price is 35 with premium of 9

PeterFebruary 15th, 2012 at 10:17pm

I'd say the best way to trade is to paper trade your ideas. If you don't want to wait until opening a brokerage account before testing then you can use an application like Visual Options Analyzer [link removed as the product no longer exists] where you can enter trades and manage them against downloaded option prices.

JonFebruary 15th, 2012 at 4:04pm

So what would be the best way to just 'test the waters' without extreme risk of loosing a lot of money? The least risky version of options trading?

PeterFebruary 6th, 2012 at 8:28pm

If the option expires worthless, yes, you will always keep 100% of the premium received.

JasonFebruary 6th, 2012 at 7:50pm

If you sell short an option at $1.20 and the stock goes lower - the direction you intended you would most likely not walk with $120. Within the last 30 days to expiration, even in the money options can take a beating. You may only walk with $20. So, what is the best strategy? Buy to close with 15% profit?

PeterOctober 30th, 2011 at 6:13am

Hi Steve, if the bond doesn't convert to anything (i.e. convert to a call option on the stock) then the payoff in this example would simply be the stock price plus $500 per year. Unless I have misunderstood?

SteveOctober 28th, 2011 at 9:34am

Will someone please offer some help?

Draw a final payoff diagram for a stock and a bond, where the bond promises to pay off $500.00 in one year

PeterOctober 12th, 2011 at 6:43pm

Hi Nancy,

It really depends on your view of the underlying stock. If your view is extremely bullish then you would be more likely to buy deep OTM options as your rate of return on the premium will be greater if the stock does rise as expected compared to the same amount invested in ATM/ITM options.

You can buy deep ITM money options as an alternative to buying the shares outright. Doing this means you can have a large exposure to the stocks' movements without spending as much to buy the shares.

NancyOctober 12th, 2011 at 9:06am

I'm struggling with how to arrive at a good strike price for a call. Does one ever choose, for instance, a strike price which is below the current stock price? As the price, goes up, I would still be profitable regardless of the strike price, right? Specifically, I'm looking at AMZN April 225 call. It is currently floating around that number now.

PeterSeptember 5th, 2011 at 5:55pm

Hi Gurko, if the price only reaches $26 then your loss would be less at $1.00 instead of $1.20.

GurkoSeptember 5th, 2011 at 6:08am

Greetings ,

In the first example you said that if the price of the stock is below $26.20 you wouldn't exersize it and you will lose the premium that you paid ($1,20).

What if the price reaches $26 - wouldn't it be more profitable to exersize the option and to lose only $0.2 ?

Could you make that clear to me ?

PeterDecember 7th, 2010 at 9:09am

What figures do you mean...the payoff charts? They are not currency specific...they are the same no matter what asset/currency the options are traded in.

nicDecember 7th, 2010 at 7:40am

Hi, I was just wondering how recent these figures are? and do you how i would get hold of the british figures if possible?

Thanks!

PeterOctober 9th, 2010 at 6:41am

It depends on your broker. Short positions require a margin, rather than just paying out the premium if you were to buy the option. A good guide, however, is to multiply the volume of contracts by the strike price and then multiplied by the contract size, which for US options is 100.

benjaminOctober 9th, 2010 at 2:48am

i am looking to short uncovered options. i will be short selling 5-7 option contracts. how much $$$ would i need in my account?

PeterJune 9th, 2010 at 12:37am

Hi Dolf, the question Carter asks is in relation to a naked call, not a covered call - they have different payoff profiles. Sure, a covered call's losses is technically limited to the stock price going to zero. Not unlimited - but a lot.

With a covered call, you're short a call option. Once the stock trades below the strike the holder of the option won't exercise, so you just lose the premium and the option value goes to zero. However, you are still long stock, which will lose value as the price drops - not unlimited, sure, but all the way to zero.

As the stock rallies past the strike, yes, you would be called out and have to sell the stock at the strike price offsetting the long position already held in the stock making the profit realized the premium already received for selling it. This is why a coverved call is a bullish strategy as you want the market to rally so you are called away and give up the stock.

DolfandaveJune 8th, 2010 at 1:46pm

Peter, As Carter mentione (two years ago:) in the first post below there is some question to "unlimited" losses. Yes if this is a naked call. I have been studying covered calls in my trek to learn options trading and if it were a covered call I personally don't view it as an unlimited loss. If I buy an OTM option as I understand this is the best technique w/ covered calls, then I will make the premium paid to me for writing the call plus the difference between the purchase price of my stock and the strike price. I don't think this is a bad deal nor would I really cry about it if I got called out in this situation. I wouldn't necessarily buy back the same security if I got called out. Your thoughts?

joelApril 8th, 2010 at 1:54pm

thanks guys i was struggling to understand the pay offs now it has become easy

PeterJune 11th, 2009 at 12:03pm

Hi Henry,

Hard to say exactly, but the following article points to the CBOE saying 10% of options are actually exercised:

http://www.protraderdigest.com/articles/20081025_7

Mmm, I've never heard of this happening. If the option is very close to expiration and a company is bidding up the options above their intrinsic value, market makers would arb them out by selling the options and hedging with the stock.

henryJune 9th, 2009 at 9:10am

Hi, silly question im sure...

but what ratio (about) are options actually exercised and go through to trade? Im guessing people get it wrong more than right and therefore it is extremely common to not exercise the trade.

Secondly, are there companies out there that buy up your options once they have alot of intrinsic value very near to expiration and you dont have the liquidity/cash to exercise the trade (hence why you would sell it). I hope that makes sense. Thanks

PeterMay 21st, 2009 at 6:37am

Hi Rajeev,

Your clearer decides who the counterparty is if you decide exercise your option. The person on the other side will be a holder of a short call option.

About your second question...if you bought the option and then sold it 3 months later, you no longer have a position. You would only be obliged to sell shares if you were short the call option and the buyer exercised the option.

RajeevMay 20th, 2009 at 9:52pm

This is very useful After going through the whole thing, I have a question. If I decide to exercise the call option, who is the other side, who is going to sell the stock. On the same thought, if I bought the call option for 1.20, sold it for 2.00 3 months later, at the time of maturity, if the buyer decides to exercise the right, am I supposed to provide the shares or the whoever wrote the call option originally.

PeterMay 5th, 2009 at 7:32pm

Hi Tom,

It depends on the specifications of the options, but generally, yes. In the US exchange traded options have a "multiplier" or "contract size" of 100, so the price is multiplied by 100. However, in Australia the multiplier is 1,000. So it depends on the exchange where the options are traded.

TomMay 5th, 2009 at 10:59am

Sorry for the very basic question, but if you're buying an option priced at $1.20 as in the above example, are you physically paying $1.20, or is it multiplied by 100, i.e. $120?

PeterApril 13th, 2009 at 7:01am

Hi Chuck,

It depends on the exchange. For example, in the US there is no charge for exercise and assignment for US stock options, however, in Australia and Europe you will be charged commissions.

This was taken from the Interactive Brokers website under Fees and Commissions:

IB Commissions

ChuckApril 11th, 2009 at 5:04pm

If you intend to exercise your in the money call option and sell the stock immediately to realize your profit, would you also incur two stock trade fees as well as the original option purchase fee ? Are option trading fees similar to stock trading fees ?

PeterApril 9th, 2009 at 7:42am

The last trading day for April 09 options in the US is Friday the 17th. CBOE shows the 18th (Saturday) as the expiration date but Yahoo! is currently showing 17th when checking MSFT options. I couldn't see the 11th mentioned. I would say that's what it comes down to..."technically" they expire on the Saturday following the third Friday of the expiration month. But really Friday is the last trading day...i.e. you cannot get out of the option by trading it on a Saturday.

JackApril 8th, 2009 at 1:39pm

april contracts on scottrade expire on 4/18. april contracts on yahoo financial expire on 4/11. I don't understand.

AdminOctober 9th, 2008 at 4:52am

Hi Queenie,

Sorry...don't fully understand your question.

You will know the Microsoft is trading at $50 because of the price in the open market.

QueenieOctober 6th, 2008 at 7:44am

"If, at expiry, Microsoft shares are trading at $50 then we will make $23.80 per share."

How would you know the shares are trading at $50 and will will make &23.80 per share.

AdminOctober 3rd, 2008 at 8:43pm

Hi Carter,

When you sell a call option you are obliged to sell stock to the option buyer if s/he decides to exercise. Once the stock trades upwards past the strike price the buyer will certainly exercise the option as it is now ?in-the-money?. At this point you are effectively short the stock at the strike price of $25. Your losses have no limit and will continue to increase as the stock rallies. For example, if the stock is trading at $40 at expiration, you will be exercised and have to sell stock at $25 and buy them back on the open market at $40 for a $15 loss per contract.

Make sense?

carterOctober 3rd, 2008 at 6:57pm

Why would our options be unlimited if the market rallies in the last example? Wouldn't we only lose the price of the contract, as in the other scenario, if the stock doesn't go above $26.20?

Add a Comment