A short put is the sale of a put option. It is also referred to as a naked put.

Shorting a put option means you sell the right buy the stock. In other words you have the obligation to buy the stock at the strike price if the option is exercised by the put option buyer.

The Max Loss is unlimited in a falling market, although in practice is really limited to the total value of the exercised stock position - as a stock cannot trade below zero.

The Max Gain is limited to the premium received for selling the put option.

Characteristics

When to use: When you are bullish on market direction and bearish on market volatility.

Like the Short Call Option, selling naked puts can be a very risky strategy as your losses can be significant in a falling market.

Although selling puts carries the potential for large losses on the downside they are a great way to position yourself to buy stock when it becomes "cheap". Selling a put option is another way of saying "I would buy this stock for [strike] price if it were to trade there by [expiration] date."

A short put locks in the purchase price of a stock at the strike price. Plus you will keep any premium received as a result of the trade.

For example, say AAPL is trading at $98.25. You want to buy this stock buy think it could come off a bit in the next couple of weeks. You say to yourself "if AAPL sells off to $90 in two weeks I will buy."

At the time of writing this the $90 November put option (Nov 21) is trading at $2.37. You sell the put option and receive $237 for the trade and have now locked in a purchase price of $90 if AAPL trades that low in the 10 or so days until expiration. Plus you get to keep the $237 no matter what.

The risk here is that the stock tanks before the expiration date leaving you with the potential to be exercised and take delivery of the stock at $90 when it, say, is trading at $80 when you are assigned the stock.

If the drop occurs early, and it is significant i.e. at or below the strike, you would want to re-evluate your trade and potentially exit the option position before the losses increase. If the drop in stock value occurs close to the expiration date and is not yet through the strike price, a good exit plan is to put a short stop order on the stock itself. That way you'll be covered on the exercise if it happens while leaving the option position open to capture the remaining time value.

Strategy Swipe File

Enter your details for immediate delivery!

Option Strategy Swipe File

Ditch the text books. Instantly choose the right strategy for your needs with my one-page strategy template guide.

No problem, happy to help! Let me know if there's anything else.

pkFebruary 22nd, 2015 at 9:44pm

Peter,

Thank you. I think I understand now. So there is no actual interest fees the trader is paying for that margin being issued from the broker for selling non-cash secured puts. But there will be hold placed on a part of your account funds while the sold put is in play, thus not being free for other trades.

Not being charged a interest fee on the non-cash secured margin amount while selling puts seems like a pretty good deal to me.

I appreciate you being patient with some of us newer traders as we try to understand the game.

Thanks again

PeterFebruary 22nd, 2015 at 9:15pm

Hi PK,

I see - I think there is some confusion in terms here. What you're referring to is a "margin" account, where the broker "lends" you some portion of money to trade securities.

However, for retails traders the margined (borrowed) value would typically only apply to stocks i.e. you couldn't trade options on the margin value - only cash can be used. I could be wrong, but seeing as options and futures are already leveraged instruments it would be too risk for brokers to allow these to be traded on borrowed money.

The margin I am referring to is the "initial margin" - or the amount of money allocated in order to support the position.

I.e. for a short option contract, you've not actually bought or sold the stock; only a promise to deliver if exercised. Therefore, the broker needs to allocate some of your account to reflect the risk involved in this position. This amount is also called a margin.

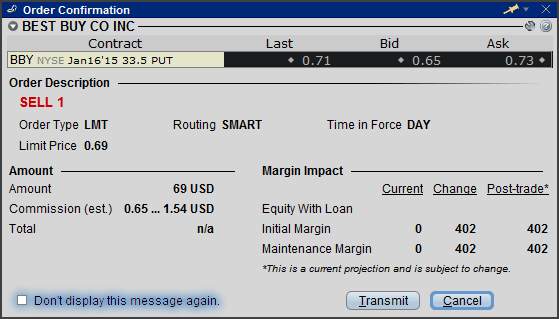

Take a look at the order confirmation pad of this short put option order I placed on BBY stock; [Click to Enlarge]

I am selling a $33.50 put option, so expecting to go long the stock at a buy price of $33.50 for 100 shares if exercised. The total exposure would therefore be $3,350, however, the broker only allocates $402 of my account to support this position; 12% of the obligated size.

This margin won't "cost" you any interest; but will be deducted from the total amount of money in your account available for other positions.

Make sense? Let me know if not!

PkFebruary 20th, 2015 at 12:56am

Hi Peter,

I guess I might have misunderstood the concept of margin account totally?

I thought that margin account works this way: say I have 50k in cash and based on that money they give a margin amount of 20k (I don't know the % numbers they use to come up with margin). so now I can use up to 50k freely as it is cash backed, but the extra 20k I can use but I pay interest on it to the broker. I was using roughly 6% interest rate I would have to pay them. So going back to my example in the previous question, if I sold puts and stayed within that amount of 50k then I don't pay interest. But if I sold more number of puts and had to use 50k plus the 20k to cover my sold puts, I would be paying interest on the 20k to the broker? so there comes my question if selling a vertical put spread decreases the margin required from my account and thus me having to pay less interest but not maximizing my intake by not only selling puts but also buying puts in the vertical put spread VS. only selling naked puts and using up all my margin (50k + 20k) and paying some interest to the broker for the 20k?

if I did the selling of vertical put spread, I would buy an deep OTM put which is cheap just for the purposes of decreasing the margin needed.

I hope I explained it, I know it's kinda long. what i'm trying to get to know is if saving that interest payment on the margin I don't have to borrow anymore by doing the vertical put spread worth more vs. maximizing the full intake of selling naked puts without decreasing intake with the buying part of the vertical put spread?

Thank you very much!

PeterFebruary 19th, 2015 at 10:32pm

Hi PK,

Yep, I hear you on the lower margin to free up capital - but not sure on the interest side of things.

I was under the impression that money allocated for margin doesn't impact interest earned on your balance? I.e. you will still earn interest on the money whether it is taken up in margin or just sitting there. Maybe I'm mistaken - may need to clarify with my broker.

Also, going for a put spread instead of naked put depends on your view of the stock. If you're punting on an upward movement and at the same time selling high vol options, then some downside protection is a good idea.

However, you might also be keen to go long the stock at the strike level - if it reaches that price by the expiration date - and at the same time collecting some premium in doing so.

pkFebruary 19th, 2015 at 8:28pm

Hi Peter,

I tried posting several hours ago, but my question has not showed up yet so please excuse me if this ends up being a repeat post.

Is it better to sell vertical put spreads instead of selling naked puts? What I mean is say have stock ABC at 100, selling 95 strike puts x 10 for $1/per and buying 85 strike put x10 for roughly $0.25/per instead of just selling naked put 95 x10 for $1/per?

I am asking because this will reduce the margin needed. Which would decrease the amount of interest I would have to pay on the extra margin used, roughly 6%. Plus it would free up margin that I could use for another trade. Does the extra $0.25/contract I would not lose by doing a naked put vs a vertical put, more than worth worrying about paying margin interest.

I would like to hear your thoughts?

Thank you.

PkFebruary 19th, 2015 at 1:22pm

Peter,

Thanks for your response.

Quick question, what is your thoughts on a vertical put spread instead of just selling puts? If ABC is currently at $98, selling 95 10 puts ABC for $1 and buying 85 or 80 strike 10 puts for $0.25-$0.20; expiration date roughly 1 month out. I know this reduces your net intake but doesn't it also reduce the margin needed? Thus freeing up margin for use in other trades and also reducing interest on the margin? Or do you think the money saved on interest on the margin is not usually equal to the amount needed to buy the put? Given margin interest around 4-5%?

Thanks, Ok

PeterFebruary 17th, 2015 at 4:02am

Hi Pk,

The problem is that as the stock crosses the strike level there is no guarantee that it will still be under the strike at expiration - and hence in need to be exercised.

What I meant to get across is that the short put option still has time value left in it i.e. a chance that it will expire out of the money and you keep the premium.

If you short the stock (by putting in a sell stop order) before the option expires, you could be left holding that position if the market rallies without taking delivery of the stock to offset it.

Sure, you can go and buy back the stock, but by that time you will surely be making a loss.

Unless I've misunderstood. I would also love to know a better way to play short puts ;-)

PkFebruary 16th, 2015 at 8:16pm

Peter,

I just came across this article today, don't know if you still get messages from it...

I'm kinda new to options and trying to learn.

In your last response to Francois, you said that the risk is that if the stock rallies, you are left with only the short position. But what if we did the final part in Francois's suggestion and placed a stop order to sell if the stock recovers above 89?

Thanks.

FrancoisApril 28th, 2014 at 7:02am

Hi Francois,

Nice, I like your thoughts on this, thanks for posting!

I think one problem is that you aren't guaranteed to be assigned long stock by selling the $90 put, but if the stock does go to $89 and you have a short stop order - that you will be filled on. So, if the stock does drop to $89 then you have upside risk; you're short the put sure, but if the market rallies prior to expiration you will only have a short stock position.

FrancoisApril 26th, 2014 at 10:25am

Protecting 'naked' positions when the market moves against you.

Why not simply add a stock position (place stop order at same time you enter naked put or call) to your naked positions when they get ITM?

IE: XYZ trading at $100 - SELL 90PUT for $2 (break-even is now $88, max profit $2, max loss $88) - Place stop order to SHORT stock at, say, $89 - IF stock goes down below $89 then you are entered SHORT on XYZ @ $89 so that you then get to keep $1 of your premium sold AND you are fully protected as the stock continues to decline - From there you can place stop order to sell stock if price recovers above $89, etc.

If at expiry XYZ declined to $80: - you have the $2 premium on the 90PUT sold - you get assigned the stock at $90 (pay $90 minus $2 credit received but it's worth $80 so loss of $8) - you cover your short position (sold for $89, buy back at $80 = profit of $9) - overall profit of $1

Same goes for selling naked calls; place stop order slightly ITM to enter LONG stock and you get to keep some of your premium sold AND fully protected as stock climbs further.

Adds slightly to cost of maintenance (commission, spread) but is definitely much cheaper than buying pack a deflated option...

Am I missing something here??

PeterMarch 5th, 2012 at 5:51am

Well, I suppose that is the strategy ;-) short the put, wait for it to decline until you reach your profit target.

NewbzMarch 1st, 2012 at 7:10pm

Peter, yeah it would be a loss if I bought a short I sold at a higher price -- that makes sense.

Well, are there any strategies that involve writing a short contract for $1, hoping it goes down to 50cents then buying it back so you end up with a Net Gain of 50cents instead of the $1 premium?

Ideally, you want the option to expire, but maybe in the case of a naked call/put you'd buyback if you're worried about the buyer going through with the contract.

PeterMarch 1st, 2012 at 6:38pm

Hi Newbz, if you sell short a put at $1 and then buy the same put for $2 then you make a loss of $1. Just like you would if you bought it first for $2 and sold it out for $1.

But yes, the participant who holds the short position is the one who is ab ligated to deliver if assigned.

It might not necessarily be the same person who was on the other side of your transaction. The options clearing house aggregates all of the option positions based off the trading through a process called novation (see the section titled "Application in financial markets").

NewbzMarch 1st, 2012 at 4:56pm

Peter, it turns out there weren't any buyers for that option I was selling -- problem solved.

I have another question, and I asked a similar one to this in the Long Call entry on this site.

If I write a Short Put for $1 and lets say the value of that contract increases to $2 and now I want turn a profit. Is the person who buys the short put contract from me now obligated to fulfill the contract instead of me?

PeterMarch 1st, 2012 at 4:48pm

Hi Newbz, what is the simulator you are using?

I'm not sure how it all works with a simulator i.e. why there aren't any buyers or where the bids are supposed to come from...but if the option has some intrinsic value there will always be a buyer as market makers will bid basis getting a hedge in the underlying.

However, if the option is out-of-the-money and very close to expiration then it is possible that there won't be any buyers and you will just have to allow the option to expire worthless.

NewbzMarch 1st, 2012 at 10:59am

I'm using a stock simulator for short putting and I'm trying to sell 10 contracts of a 50cent strike price. The bid is 0 and the ask is 20cents.

Obviously selling it at 0 is pointless, so I tried 10cents and waited a bit...the order remained open. Moved it to 5cents and waited...still an open order.

I don't care about getting a sell price closer to the ask, but I don't want to settle on a bid of 0 either. This simulator only lets me increase the price in increments of 5cents, so I can't set my price to 1cent either.

This is only paper trading so it's not a big deal, but what happens if I encounter this problem during real trading. The contract will never get sold because it's not at bid price, which is 0 so why would I sell it.

PeterNovember 16th, 2011 at 7:46pm

Mmm..yeah, not too sure. I could guess and say that the $178 is the loss between the sold price and the current market price, however, you say 0.27 is the current price? Unless the position is valued against a price other than 0.27 - say average of the bid/ask spread or last, which may be some other price.

Then I would have said that the $280 was the loss including commissions. But that would suggest that you pay approximately $10 per contract in brokerage. What are your rates?

By the time the option expires, if it is still out-of-the-money, then the price of the option will have traded from 0.27 to zero so the unrealized losses will have been credited back into your account and you will be left with the $110 credit from the initial sale (minus brokerage fees).

MarkNovember 16th, 2011 at 6:11pm

Sorry I guess I should have mentioned that I purchased 10 option contracts

MarkNovember 16th, 2011 at 6:06pm

Thanks for the quick reply Peter. I am using Etrade as the broker. I do see the margin of 4400 or so where there are accounting for what you are talking about.I am hoping that it doesnt have to get excerised and my concern is why the show of a loos. when I looked at the position in my main account it does show a market value loss of -$280 however in my trader platform it shows a loss of -$178. The strike price for the option I bought is 119 which expires in a few days. Assuming we never get that low by the end of the week, say maybe 121, which would still showing a loss. What happens to the loss? Do i still get the premium?

PeterNovember 16th, 2011 at 5:23pm

Hi Mark,

When you initially sold the put, $11 would have been credited to your account. But your position will be revalued according to the current market prices, so with the option now at 0.27 you would have a $16 loss on the position.

However, because you are short a naked option your broker will also deduct some money from your account as a margin in case you are exercised and have to take delivery of the underlying position. In this case, as it is an index, there won't be an exercise so the margin is used as a buffer against a large loss.

Is there a way that you can see the transaction breakdown to confirm? What broker do you use?

MarkNovember 16th, 2011 at 4:06pm

Hi Peter

I sold a naked put today... (sell to open a put OTM for SPY) It was the 119 nov put and i sold it for .11. I just wanted the premium for it. The market went down today and that same put is now .27. It is now showing a loss in my positions of about $180. Is this normal. I am assuming i can let this expire but what about the loss, dows it expire with the option?. Is it charged to me? because I dont see a premium recieved anywhere on my site.

PeterSeptember 7th, 2011 at 7:48pm

Yes, you're right - the $5 put vs the $5 call implies a forward price for the stock of $3.13. I'm not sure why. I thought at first that it could be because of a dividend but the company has never paid a dividend and a $2.17 per share dividend seems a bit unrealistic.

I've asked a friend of mine who is a market maker for Australian stock options if he has any ideas and I'll reply when/if I find out.

SamSeptember 6th, 2011 at 1:42am

Thanks, Peter.

As I can see, the market is not that simple ir practice. If you take LDK solar, the put options are severly overpriced. Current stock price is $5,3, and December calls/ puts with strike price 5 are $0,7/$2,3 and the put is not even ITM...

The problem is that it is difficult to get the stock short, so you can't really hedge fully. Anyway, a week ago it was possible to form a position of -100 stocks, +2 calls and -1 put with guaranteed profits of ~ 18% in four months, the only problem is that you can't really go short easily :)

And i guess you can't be sure you will profit since the short might be recalled anytime.. Not a perfect market

PeterSeptember 5th, 2011 at 5:34pm

Hi Sam, no you are right. This would present an arbitrage opportunity. Calls and puts must be priced according to the put call parity theorem.

Thank you, Peter. One more thing that is on my mind:

If ATM call and put options are traded at a huge difference, might there be an arbitrage opportunity?

Lets say: the stock is at $10 $10 call trades at $1 while 10 put trades at $5

As I understand, they should trade close to each other.. What is my mistake?

In this example, if you short the stock, long 2 calls and short the put, you will fully hedge yourself and stay long with profits from an increase in price.

here is an improvised table based on the numbers. Am I missing something?

0 5 10 15 20 stock price

10 5 0 -5 -10 short the stock -2 -2 0 10 20 long 2 calls -5 0 5 5 5 short 1 put

3 3 5 10 15 RESULT

Based on these prises (if you are able to find this misspricing), you get a quaranteed hedged profit with it going up if the prices go up. I AM PUZZLED, so please tell me where is my mistake :) Thank you in advance :)

PeterSeptember 1st, 2011 at 2:13am

Because you've sold the put your risk is that the market goes down and the buyer of the option exercises it.

If the put buyer exercises his/her option then you are obliged to buy the stock from him/her at the strike price.

So, in your case, if exercised you would have to take delivery of the stock at $10 and pay $1,000 per contract ( 10 x 100).

You would, however, keep the premium received when you initially sold the put option.

SamSeptember 1st, 2011 at 2:04am

Hi, I am a bit confused now: let's say I short a put with a strike price of 10. Isn't the maximum loss I can take is -10 per share minus the premium (-1000 per contract)? In the same way as the put has a limited profit payout?

Are there any other points I need to look into? How do options react to splits, bankruptcy and so on? I am pretty new in options trading, and sold a put with the plan to hold it until expiry, what are the risks involved?

PeterAugust 9th, 2011 at 4:06am

ha ha, it's no problem!

1. If you need to calculate the premium of an option then you will need to first understand the mechanics of option pricing. Then you will need a calculator - you can download my option spreadsheet, which calculates an option's fair value.

However, you'll probably not need to calculate the option price yourself - the bids and offers in the market are what you'll be buying and selling against anyway.

2. Yes. If the order is still in the market waiting to be filled, the trader can just remove the order before it is filled if s/he changes his/her mind.

3. Yes. There is a screen shot on this page that shows what we call an option chain.

4. Yes. But it depends on the platform that you're trading with. I use Interactive Brokers and they have a "reverse position" button that if you click it opens up an order ticket to do the opposite of your existing position.

NatAugust 9th, 2011 at 12:37am

Hello Peter,

I just hate myself for bothering you again, but you seem to be the perfect options teacher. I have 4 questions as follows?

1. How do you calculate the premium of the option? 2. If the seller of the option realizes that he doesn't want to sell his option although he has placed a sale order, but no one has bought it yet, can he cancel his sale? 3. When the buyer enters the trading platform (goes into the market to do his shopping), does he see a list of option contracts offered at different prices? Then he chooses to buy the one he wants that meet his specification, by placing an order? 4. When offsetting the position, do you simply place a sale or purchase order? There is no specific offset button, right?

Thank you so much and I hope that I don't have to bother you anymore after this.

PeterAugust 8th, 2011 at 7:59pm

Correct. Although technically, you don't actually "pay" a margin to the broker. The margin amount is "allocated" from your account by your broker in case you incur a large loss. The difference is that you should still earn interest on the margin.

NatAugust 8th, 2011 at 7:28pm

Hello Peter,

I think I understand almost everything now, thanks to your explanation. One last question is, if the seller of the put option (or call option) offsets his position, when he does that does the margin that he has placed with the broker get returned to him after he closes his position? Thank you.

PeterAugust 8th, 2011 at 1:48am

Kind of - although the buyers and sellers at the time of the transaction are not necessarily the ones to swap obligations for delivery.

If an option buyer decides to exercise, then the clearer will choose (at random I believe) a participant who has a short option position to exercise.

Do you mean that the seller (let's call him seller a) buys it back from any seller (in this case, let's call him seller b) in the market? Then, seller b (the person he bought the option from) will be obliged to buy from the original buyer whom he sold his put option to in the first place instead of him? Is that how seller a closes out his position and exits any obligations that he has on him?

Thank you and sorry for taking so much of your time. You have been most helpful to me.

PeterAugust 7th, 2011 at 7:55pm

A short position is offset in the same way that a long position is - by doing the opposite trade. In this case by buying the same option contract back from a seller in the market.

NatAugust 7th, 2011 at 7:35pm

Hello Peter,

Now I am confused about how the seller of a put closes out his position. He will buy the same contract with the same strike price and expiry date to offset the one he sold. Now, who does he buy it from and how does this close out his position as the seller of the put contract and leaves him with no obligation?

Thank you once gain for your help.

PeterJuly 14th, 2011 at 10:56pm

Hi Larry, the term "naked" is used to describe an option position where you don't have any downside/upside protection. In the case of a short put it is referred to as "naked" because your risk as the market sells off continues all the way until the market reaches zero.

LarryJuly 14th, 2011 at 9:40pm

I don't understand what you mean by naked when you state "selling naked puts..." in your description above. I understood that by selling a put option I might have the stock "put" to me at the strike price of the option, but I don't see what I'm "naked" of.

PeterOctober 25th, 2010 at 7:20pm

Some solid tips there Joel...thanks!

When you say 50/200 trend zone...are these simple moving averages?

JoelOctober 25th, 2010 at 5:41pm

I agree that selling the put is a good way to buy the stock for a bit less than the current selling price - in other words, to take advantage of a dip during the option period. I'm using this to buy strong dividend paying stocks at a discount if they are above the 50/200 day trend line, and I want to own that stock anyway - as Mjasko noted about Goodyear.

So the strategy for dealing with otherwise idle and unneeded cash that is sitting besides an otherwise fully diversified portfolio:

1 - find a reliable stock you want to own that also pays a good dividend - Motley Fool Income report has many suggestions, as do other sources/articles. 2 - understand the stock's valuation, making sure it has room to rise 3 - look at the 'technical' chart (e.g., on Yahoo) and see the zone between the 50-day and 200-day trend lines. If you're basically bullish on the stock, you'll want to buy between them, expecting a bounce at or above the 200 day line. 4 - Look at the next dividend date 5 - If the current price is within the 50/200 day zone, buy the stock and sell a covered call (Buy-Write); you've already got the price you want, and you can start collecting dividends and option premiums. If then option is called and you 'lose' the stock - although you've 'missed' additional upside, you've still made money - repeat all steps, including step 6 below. 6 - If the current price is above the 50/200 day zone, look for a strike price within that zone, and pick an option exercise date that has reasonable volume (you can see all of that on Yahoo Quote on the symbol, and then Options). Sell the put, pocket the cash, and see if the price drops into the 50/200 day zone and you get the stock. If it doesn't, then do all the stpe over again - you're only missing the upside of something you don't own.

If somehow this is your primary investment strategy, you are probably better off doing it through a buy/write ETF or closed end mutual fund and not on your own....

Mike GriffinSeptember 23rd, 2010 at 5:08pm

Here's how a short-put works: you sell the put (thus getting the put-price x 100). You either keep the put until expiration, or you buy the same put (at whatever the current put-price is) to "close" your position. If you close then your profit (or loss) is the difference between the sold put-price and the current put-price (put-price is another way of saying "premium"). If it looks like the stock-price will remain above the strike-price then you should probably hold the short position until expiration, because the put will probably expire worthless and you will be able to keep the "premium" you got for selling the put in the first place. If it looks like the stock-price will drop below the strike price at any time before expiration, (because of expected bad news, bad earnings report, etc.) then you should close your short position as soon as possible. Got it? PS-being long a put is the opposite of being short, (i.e. you buy the put instead of selling it).

PeterAugust 11th, 2010 at 6:04pm

It is only worthless if the underlying is trading above the strike price at the expiration date.

If the underlying is trading below the strike price at the expiration of the option then the option is worth the strike price minus the underlying price, which is your loss if you are short the option.

Emmanuel ArmahAugust 11th, 2010 at 10:29am

I don't understand why we use unlimited loss, because you know your losses right from day one that the maximum loss is when the option expires the option becomes worthless.

am i right ?

MjaskoApril 16th, 2009 at 12:52pm

All of these comments deal with short term loses or gains. For me the question is whether the stock or company in question is a good buy at some price. If you believe that Goodyear is a good buy in any case at 15 and the stock is 20 who is really worried if Goodyear goes to 5 in the short term. All my equities have loss value lost value in the past year. Do I like it? No. But I am not in the market short term. Do I expect the market to go to zero. If it does then I have a lot more to worry about than the lost of a few dollars. Goodyear at zero is absurd...so why all the talk of unlimited loss...If you are so worried about loss stay out of the market. If you are long-term bullish then selling puts makes sense

AdminFebruary 15th, 2009 at 2:23am

You aren't anticipating the stock to drop...you are anticipating it to rally. If the stock is above the strike at expiration you keep the premium.

SGL#February 15th, 2009 at 1:33am

How is a short put considered bullish if you are anticipating the stock to drop?

AdminDecember 18th, 2008 at 6:22pm

Yep, noted. I mentioned it below too:

"I guess it is not really unlimited as a stock price cannot go below 0."

RickDecember 18th, 2008 at 1:13pm

"Maximum Loss: Unlimited in a falling market.", not really , how far can AAPL fall , cant go beyond 0 (zero)

AdminDecember 8th, 2008 at 3:15am

Hi Marlowe,

Not sure what you mean. Are you saying that your broker won't allow you to sell a put option?

MarloweNovember 27th, 2008 at 10:29am

I would like to carry out the AAPL trade for real, however I am told I can not carry naked put. But, I can buy a call which will cover me. What are the suggestions for this? Happy to own the stock.

AdminNovember 7th, 2008 at 7:10pm

I think the max loss on a short put is [(stock - strike) + premium] and seeing as the stock price is unknown and can therefore be anything it is reasonable to say unlimited.

johnOctober 31st, 2008 at 9:03am

yes i agree the max loss is [(Strike-Premium) - 0]. There can be large losses if the strike is large, but there is certainly limited downside.

AdminSeptember 23rd, 2008 at 10:27pm

A short put means that you are obligated to buy the underlying at the strike price if the buyer decides to exercise. So the payoff is the stock price minus the strike price less the premium received.

Once the underlying stock trades below the strike price price the option becomes out of the money. The option will continue to lose money as the stock continues a downward price movement.

I guess it is not really unlimited as a stock price cannot go below 0.

chrisSeptember 23rd, 2008 at 2:01pm

Isn't the maximum loss for a short put the Strike price, not unlimited? This is not including the premium made on the sell of the put. So the net loss would be the Strike price minus premium

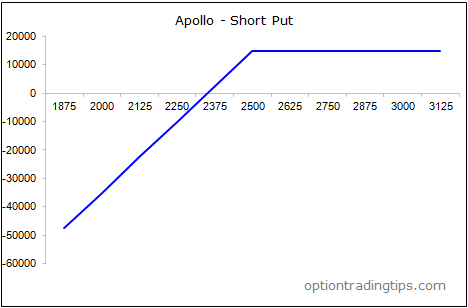

PeterMarch 23rd, 2015 at 6:26am

Like this?

SkMarch 22nd, 2015 at 6:11am

Say you bought Apollo Options contract at Strike 2500 Premium 150

Draw a Short Put Pay off at below prices

2000,2100,2200,2300,2400,2500,2600,2700,2800,2900,3000

PeterFebruary 22nd, 2015 at 10:46pm

No problem, happy to help! Let me know if there's anything else.

pkFebruary 22nd, 2015 at 9:44pm

Peter,

Thank you. I think I understand now. So there is no actual interest fees the trader is paying for that margin being issued from the broker for selling non-cash secured puts. But there will be hold placed on a part of your account funds while the sold put is in play, thus not being free for other trades.

Not being charged a interest fee on the non-cash secured margin amount while selling puts seems like a pretty good deal to me.

I appreciate you being patient with some of us newer traders as we try to understand the game.

Thanks again

PeterFebruary 22nd, 2015 at 9:15pm

Hi PK,

I see - I think there is some confusion in terms here. What you're referring to is a "margin" account, where the broker "lends" you some portion of money to trade securities.

However, for retails traders the margined (borrowed) value would typically only apply to stocks i.e. you couldn't trade options on the margin value - only cash can be used. I could be wrong, but seeing as options and futures are already leveraged instruments it would be too risk for brokers to allow these to be traded on borrowed money.

The margin I am referring to is the "initial margin" - or the amount of money allocated in order to support the position.

I.e. for a short option contract, you've not actually bought or sold the stock; only a promise to deliver if exercised. Therefore, the broker needs to allocate some of your account to reflect the risk involved in this position. This amount is also called a margin.

Take a look at the order confirmation pad of this short put option order I placed on BBY stock;

[Click to Enlarge]

I am selling a $33.50 put option, so expecting to go long the stock at a buy price of $33.50 for 100 shares if exercised. The total exposure would therefore be $3,350, however, the broker only allocates $402 of my account to support this position; 12% of the obligated size.

This margin won't "cost" you any interest; but will be deducted from the total amount of money in your account available for other positions.

Make sense? Let me know if not!

PkFebruary 20th, 2015 at 12:56am

Hi Peter,

I guess I might have misunderstood the concept of margin account totally?

I thought that margin account works this way:

say I have 50k in cash and based on that money they give a margin amount of 20k (I don't know the % numbers they use to come up with margin). so now I can use up to 50k freely as it is cash backed, but the extra 20k I can use but I pay interest on it to the broker. I was using roughly 6% interest rate I would have to pay them.

So going back to my example in the previous question, if I sold puts and stayed within that amount of 50k then I don't pay interest. But if I sold more number of puts and had to use 50k plus the 20k to cover my sold puts, I would be paying interest on the 20k to the broker? so there comes my question if selling a vertical put spread decreases the margin required from my account and thus me having to pay less interest but not maximizing my intake by not only selling puts but also buying puts in the vertical put spread VS. only selling naked puts and using up all my margin (50k + 20k) and paying some interest to the broker for the 20k?

if I did the selling of vertical put spread, I would buy an deep OTM put which is cheap just for the purposes of decreasing the margin needed.

I hope I explained it, I know it's kinda long. what i'm trying to get to know is if saving that interest payment on the margin I don't have to borrow anymore by doing the vertical put spread worth more vs. maximizing the full intake of selling naked puts without decreasing intake with the buying part of the vertical put spread?

Thank you very much!

PeterFebruary 19th, 2015 at 10:32pm

Hi PK,

Yep, I hear you on the lower margin to free up capital - but not sure on the interest side of things.

I was under the impression that money allocated for margin doesn't impact interest earned on your balance? I.e. you will still earn interest on the money whether it is taken up in margin or just sitting there. Maybe I'm mistaken - may need to clarify with my broker.

Also, going for a put spread instead of naked put depends on your view of the stock. If you're punting on an upward movement and at the same time selling high vol options, then some downside protection is a good idea.

However, you might also be keen to go long the stock at the strike level - if it reaches that price by the expiration date - and at the same time collecting some premium in doing so.

pkFebruary 19th, 2015 at 8:28pm

Hi Peter,

I tried posting several hours ago, but my question has not showed up yet so please excuse me if this ends up being a repeat post.

Is it better to sell vertical put spreads instead of selling naked puts? What I mean is say have stock ABC at 100, selling 95 strike puts x 10 for $1/per and buying 85 strike put x10 for roughly $0.25/per instead of just selling naked put 95 x10 for $1/per?

I am asking because this will reduce the margin needed. Which would decrease the amount of interest I would have to pay on the extra margin used, roughly 6%. Plus it would free up margin that I could use for another trade. Does the extra $0.25/contract I would not lose by doing a naked put vs a vertical put, more than worth worrying about paying margin interest.

I would like to hear your thoughts?

Thank you.

PkFebruary 19th, 2015 at 1:22pm

Peter,

Thanks for your response.

Quick question, what is your thoughts on a vertical put spread instead of just selling puts? If ABC is currently at $98, selling 95 10 puts ABC for $1 and buying 85 or 80 strike 10 puts for $0.25-$0.20; expiration date roughly 1 month out.

I know this reduces your net intake but doesn't it also reduce the margin needed? Thus freeing up margin for use in other trades and also reducing interest on the margin? Or do you think the money saved on interest on the margin is not usually equal to the amount needed to buy the put? Given margin interest around 4-5%?

Thanks,

Ok

PeterFebruary 17th, 2015 at 4:02am

Hi Pk,

The problem is that as the stock crosses the strike level there is no guarantee that it will still be under the strike at expiration - and hence in need to be exercised.

What I meant to get across is that the short put option still has time value left in it i.e. a chance that it will expire out of the money and you keep the premium.

If you short the stock (by putting in a sell stop order) before the option expires, you could be left holding that position if the market rallies without taking delivery of the stock to offset it.

Sure, you can go and buy back the stock, but by that time you will surely be making a loss.

Unless I've misunderstood. I would also love to know a better way to play short puts ;-)

PkFebruary 16th, 2015 at 8:16pm

Peter,

I just came across this article today, don't know if you still get messages from it...

I'm kinda new to options and trying to learn.

In your last response to Francois, you said that the risk is that if the stock rallies, you are left with only the short position.

But what if we did the final part in Francois's suggestion and placed a stop order to sell if the stock recovers above 89?

Thanks.

FrancoisApril 28th, 2014 at 7:02am

Hi Francois,

Nice, I like your thoughts on this, thanks for posting!

I think one problem is that you aren't guaranteed to be assigned long stock by selling the $90 put, but if the stock does go to $89 and you have a short stop order - that you will be filled on. So, if the stock does drop to $89 then you have upside risk; you're short the put sure, but if the market rallies prior to expiration you will only have a short stock position.

FrancoisApril 26th, 2014 at 10:25am

Protecting 'naked' positions when the market moves against you.

Why not simply add a stock position (place stop order at same time you enter naked put or call) to your naked positions when they get ITM?

IE: XYZ trading at $100

- SELL 90PUT for $2 (break-even is now $88, max profit $2, max loss $88)

- Place stop order to SHORT stock at, say, $89

- IF stock goes down below $89 then you are entered SHORT on XYZ @ $89 so that you then get to keep $1 of your premium sold AND you are fully protected as the stock continues to decline

- From there you can place stop order to sell stock if price recovers above $89, etc.

If at expiry XYZ declined to $80:

- you have the $2 premium on the 90PUT sold

- you get assigned the stock at $90 (pay $90 minus $2 credit received but it's worth $80 so loss of $8)

- you cover your short position (sold for $89, buy back at $80 = profit of $9)

- overall profit of $1

Same goes for selling naked calls; place stop order slightly ITM to enter LONG stock and you get to keep some of your premium sold AND fully protected as stock climbs further.

Adds slightly to cost of maintenance (commission, spread) but is definitely much cheaper than buying pack a deflated option...

Am I missing something here??

PeterMarch 5th, 2012 at 5:51am

Well, I suppose that is the strategy ;-) short the put, wait for it to decline until you reach your profit target.

NewbzMarch 1st, 2012 at 7:10pm

Peter, yeah it would be a loss if I bought a short I sold at a higher price -- that makes sense.

Well, are there any strategies that involve writing a short contract for $1, hoping it goes down to 50cents then buying it back so you end up with a Net Gain of 50cents instead of the $1 premium?

Ideally, you want the option to expire, but maybe in the case of a naked call/put you'd buyback if you're worried about the buyer going through with the contract.

PeterMarch 1st, 2012 at 6:38pm

Hi Newbz, if you sell short a put at $1 and then buy the same put for $2 then you make a loss of $1. Just like you would if you bought it first for $2 and sold it out for $1.

But yes, the participant who holds the short position is the one who is ab ligated to deliver if assigned.

It might not necessarily be the same person who was on the other side of your transaction. The options clearing house aggregates all of the option positions based off the trading through a process called novation (see the section titled "Application in financial markets").

NewbzMarch 1st, 2012 at 4:56pm

Peter, it turns out there weren't any buyers for that option I was selling -- problem solved.

I have another question, and I asked a similar one to this in the Long Call entry on this site.

If I write a Short Put for $1 and lets say the value of that contract increases to $2 and now I want turn a profit. Is the person who buys the short put contract from me now obligated to fulfill the contract instead of me?

PeterMarch 1st, 2012 at 4:48pm

Hi Newbz, what is the simulator you are using?

I'm not sure how it all works with a simulator i.e. why there aren't any buyers or where the bids are supposed to come from...but if the option has some intrinsic value there will always be a buyer as market makers will bid basis getting a hedge in the underlying.

However, if the option is out-of-the-money and very close to expiration then it is possible that there won't be any buyers and you will just have to allow the option to expire worthless.

NewbzMarch 1st, 2012 at 10:59am

I'm using a stock simulator for short putting and I'm trying to sell 10 contracts of a 50cent strike price. The bid is 0 and the ask is 20cents.

Obviously selling it at 0 is pointless, so I tried 10cents and waited a bit...the order remained open. Moved it to 5cents and waited...still an open order.

I don't care about getting a sell price closer to the ask, but I don't want to settle on a bid of 0 either. This simulator only lets me increase the price in increments of 5cents, so I can't set my price to 1cent either.

This is only paper trading so it's not a big deal, but what happens if I encounter this problem during real trading. The contract will never get sold because it's not at bid price, which is 0 so why would I sell it.

PeterNovember 16th, 2011 at 7:46pm

Mmm..yeah, not too sure. I could guess and say that the $178 is the loss between the sold price and the current market price, however, you say 0.27 is the current price? Unless the position is valued against a price other than 0.27 - say average of the bid/ask spread or last, which may be some other price.

Then I would have said that the $280 was the loss including commissions. But that would suggest that you pay approximately $10 per contract in brokerage. What are your rates?

By the time the option expires, if it is still out-of-the-money, then the price of the option will have traded from 0.27 to zero so the unrealized losses will have been credited back into your account and you will be left with the $110 credit from the initial sale (minus brokerage fees).

MarkNovember 16th, 2011 at 6:11pm

Sorry I guess I should have mentioned that I purchased 10 option contracts

MarkNovember 16th, 2011 at 6:06pm

Thanks for the quick reply Peter. I am using Etrade as the broker. I do see the margin of 4400 or so where there are accounting for what you are talking about.I am hoping that it doesnt have to get excerised and my concern is why the show of a loos. when I looked at the position in my main account it does show a market value loss of -$280 however in my trader platform it shows a loss of -$178. The strike price for the option I bought is 119 which expires in a few days. Assuming we never get that low by the end of the week, say maybe 121, which would still showing a loss. What happens to the loss? Do i still get the premium?

PeterNovember 16th, 2011 at 5:23pm

Hi Mark,

When you initially sold the put, $11 would have been credited to your account. But your position will be revalued according to the current market prices, so with the option now at 0.27 you would have a $16 loss on the position.

However, because you are short a naked option your broker will also deduct some money from your account as a margin in case you are exercised and have to take delivery of the underlying position. In this case, as it is an index, there won't be an exercise so the margin is used as a buffer against a large loss.

Is there a way that you can see the transaction breakdown to confirm? What broker do you use?

MarkNovember 16th, 2011 at 4:06pm

Hi Peter

I sold a naked put today... (sell to open a put OTM for SPY) It was the 119 nov put and i sold it for .11. I just wanted the premium for it. The market went down today and that same put is now .27. It is now showing a loss in my positions of about $180. Is this normal. I am assuming i can let this expire but what about the loss, dows it expire with the option?. Is it charged to me? because I dont see a premium recieved anywhere on my site.

PeterSeptember 7th, 2011 at 7:48pm

Yes, you're right - the $5 put vs the $5 call implies a forward price for the stock of $3.13. I'm not sure why. I thought at first that it could be because of a dividend but the company has never paid a dividend and a $2.17 per share dividend seems a bit unrealistic.

I've asked a friend of mine who is a market maker for Australian stock options if he has any ideas and I'll reply when/if I find out.

SamSeptember 6th, 2011 at 1:42am

Thanks, Peter.

As I can see, the market is not that simple ir practice. If you take LDK solar, the put options are severly overpriced. Current stock price is $5,3, and December calls/ puts with strike price 5 are $0,7/$2,3 and the put is not even ITM...

The problem is that it is difficult to get the stock short, so you can't really hedge fully. Anyway, a week ago it was possible to form a position of -100 stocks, +2 calls and -1 put with guaranteed profits of ~ 18% in four months, the only problem is that you can't really go short easily :)

And i guess you can't be sure you will profit since the short might be recalled anytime.. Not a perfect market

PeterSeptember 5th, 2011 at 5:34pm

Hi Sam, no you are right. This would present an arbitrage opportunity. Calls and puts must be priced according to the put call parity theorem.

This states that Call - Put = Stock - Strike.

Read more about put call parity here.

SamSeptember 1st, 2011 at 6:24am

Thank you, Peter. One more thing that is on my mind:

If ATM call and put options are traded at a huge difference, might there be an arbitrage opportunity?

Lets say:

the stock is at $10

$10 call trades at $1

while 10 put trades at $5

As I understand, they should trade close to each other.. What is my mistake?

In this example, if you short the stock, long 2 calls and short the put, you will fully hedge yourself and stay long with profits from an increase in price.

here is an improvised table based on the numbers. Am I missing something?

0 5 10 15 20 stock price

10 5 0 -5 -10 short the stock

-2 -2 0 10 20 long 2 calls

-5 0 5 5 5 short 1 put

3 3 5 10 15 RESULT

Based on these prises (if you are able to find this misspricing), you get a quaranteed hedged profit with it going up if the prices go up. I AM PUZZLED, so please tell me where is my mistake :) Thank you in advance :)

PeterSeptember 1st, 2011 at 2:13am

Because you've sold the put your risk is that the market goes down and the buyer of the option exercises it.

If the put buyer exercises his/her option then you are obliged to buy the stock from him/her at the strike price.

So, in your case, if exercised you would have to take delivery of the stock at $10 and pay $1,000 per contract ( 10 x 100).

You would, however, keep the premium received when you initially sold the put option.

SamSeptember 1st, 2011 at 2:04am

Hi, I am a bit confused now:

let's say I short a put with a strike price of 10. Isn't the maximum loss I can take is -10 per share minus the premium (-1000 per contract)? In the same way as the put has a limited profit payout?

Are there any other points I need to look into? How do options react to splits, bankruptcy and so on?

I am pretty new in options trading, and sold a put with the plan to hold it until expiry, what are the risks involved?

PeterAugust 9th, 2011 at 4:06am

ha ha, it's no problem!

1. If you need to calculate the premium of an option then you will need to first understand the mechanics of option pricing. Then you will need a calculator - you can download my option spreadsheet, which calculates an option's fair value.

However, you'll probably not need to calculate the option price yourself - the bids and offers in the market are what you'll be buying and selling against anyway.

2. Yes. If the order is still in the market waiting to be filled, the trader can just remove the order before it is filled if s/he changes his/her mind.

3. Yes. There is a screen shot on this page that shows what we call an option chain.

4. Yes. But it depends on the platform that you're trading with. I use Interactive Brokers and they have a "reverse position" button that if you click it opens up an order ticket to do the opposite of your existing position.

NatAugust 9th, 2011 at 12:37am

Hello Peter,

I just hate myself for bothering you again, but you seem to be the perfect options teacher. I have 4 questions as follows?

1. How do you calculate the premium of the option?

2. If the seller of the option realizes that he doesn't want to sell his option although he has placed a sale order, but no one has bought it yet, can he cancel his sale?

3. When the buyer enters the trading platform (goes into the market to do his shopping), does he see a list of option contracts offered at different prices? Then he chooses to buy the one he wants that meet his specification, by placing an order?

4. When offsetting the position, do you simply place a sale or purchase order? There is no specific offset button, right?

Thank you so much and I hope that I don't have to bother you anymore after this.

PeterAugust 8th, 2011 at 7:59pm

Correct. Although technically, you don't actually "pay" a margin to the broker. The margin amount is "allocated" from your account by your broker in case you incur a large loss. The difference is that you should still earn interest on the margin.

NatAugust 8th, 2011 at 7:28pm

Hello Peter,

I think I understand almost everything now, thanks to your explanation. One last question is, if the seller of the put option (or call option) offsets his position, when he does that does the margin that he has placed with the broker get returned to him after he closes his position?

Thank you.

PeterAugust 8th, 2011 at 1:48am

Kind of - although the buyers and sellers at the time of the transaction are not necessarily the ones to swap obligations for delivery.

If an option buyer decides to exercise, then the clearer will choose (at random I believe) a participant who has a short option position to exercise.

This process is called novation.

NatAugust 8th, 2011 at 12:28am

Do you mean that the seller (let's call him seller a) buys it back from any seller (in this case, let's call him seller b) in the market? Then, seller b (the person he bought the option from) will be obliged to buy from the original buyer whom he sold his put option to in the first place instead of him? Is that how seller a closes out his position and exits any obligations that he has on him?

Thank you and sorry for taking so much of your time. You have been most helpful to me.

PeterAugust 7th, 2011 at 7:55pm

A short position is offset in the same way that a long position is - by doing the opposite trade. In this case by buying the same option contract back from a seller in the market.

NatAugust 7th, 2011 at 7:35pm

Hello Peter,

Now I am confused about how the seller of a put closes out his position. He will buy the same contract with the same strike price and expiry date to offset the one he sold. Now, who does he buy it from and how does this close out his position as the seller of the put contract and leaves him with no obligation?

Thank you once gain for your help.

PeterJuly 14th, 2011 at 10:56pm

Hi Larry, the term "naked" is used to describe an option position where you don't have any downside/upside protection. In the case of a short put it is referred to as "naked" because your risk as the market sells off continues all the way until the market reaches zero.

LarryJuly 14th, 2011 at 9:40pm

I don't understand what you mean by naked when you state "selling naked puts..." in your description above. I understood that by selling a put option I might have the stock "put" to me at the strike price of the option, but I don't see what I'm "naked" of.

PeterOctober 25th, 2010 at 7:20pm

Some solid tips there Joel...thanks!

When you say 50/200 trend zone...are these simple moving averages?

JoelOctober 25th, 2010 at 5:41pm

I agree that selling the put is a good way to buy the stock for a bit less than the current selling price - in other words, to take advantage of a dip during the option period. I'm using this to buy strong dividend paying stocks at a discount if they are above the 50/200 day trend line, and I want to own that stock anyway - as Mjasko noted about Goodyear.

So the strategy for dealing with otherwise idle and unneeded cash that is sitting besides an otherwise fully diversified portfolio:

1 - find a reliable stock you want to own that also pays a good dividend - Motley Fool Income report has many suggestions, as do other sources/articles.

2 - understand the stock's valuation, making sure it has room to rise

3 - look at the 'technical' chart (e.g., on Yahoo) and see the zone between the 50-day and 200-day trend lines. If you're basically bullish on the stock, you'll want to buy between them, expecting a bounce at or above the 200 day line.

4 - Look at the next dividend date

5 - If the current price is within the 50/200 day zone, buy the stock and sell a covered call (Buy-Write); you've already got the price you want, and you can start collecting dividends and option premiums. If then option is called and you 'lose' the stock - although you've 'missed' additional upside, you've still made money - repeat all steps, including step 6 below.

6 - If the current price is above the 50/200 day zone, look for a strike price within that zone, and pick an option exercise date that has reasonable volume (you can see all of that on Yahoo Quote on the symbol, and then Options). Sell the put, pocket the cash, and see if the price drops into the 50/200 day zone and you get the stock. If it doesn't, then do all the stpe over again - you're only missing the upside of something you don't own.

If somehow this is your primary investment strategy, you are probably better off doing it through a buy/write ETF or closed end mutual fund and not on your own....

Mike GriffinSeptember 23rd, 2010 at 5:08pm

Here's how a short-put works: you sell the put (thus getting the put-price x 100). You either keep the put until expiration, or you buy the same put (at whatever the current put-price is) to "close" your position. If you close then your profit (or loss) is the difference between the sold put-price and the current put-price (put-price is another way of saying "premium").

If it looks like the stock-price will remain above the strike-price then you should probably hold the short position until expiration, because the put will probably expire worthless and you will be able to keep the "premium" you got for selling the put in the first place.

If it looks like the stock-price will drop below the strike price at any time before expiration, (because of expected bad news, bad earnings report, etc.) then you should close your short position as soon as possible. Got it?

PS-being long a put is the opposite of being short, (i.e. you buy the put instead of selling it).

PeterAugust 11th, 2010 at 6:04pm

It is only worthless if the underlying is trading above the strike price at the expiration date.

If the underlying is trading below the strike price at the expiration of the option then the option is worth the strike price minus the underlying price, which is your loss if you are short the option.

Emmanuel ArmahAugust 11th, 2010 at 10:29am

I don't understand why we use unlimited loss,

because you know your losses right from day one that the maximum loss is when the option expires the option becomes worthless.

am i right ?

MjaskoApril 16th, 2009 at 12:52pm

All of these comments deal with short term loses or gains. For me the question is whether the stock or company in question is a good buy at some price. If you believe that Goodyear is a good buy in any case at 15 and the stock is 20 who is really worried if Goodyear goes to 5 in the short term. All my equities have loss value lost value in the past year. Do I like it? No. But I am not in the market short term. Do I expect the market to go to zero. If it does then I have a lot more to worry about than the lost of a few dollars. Goodyear at zero is absurd...so why all the talk of unlimited loss...If you are so worried about loss stay out of the market. If you are long-term bullish then selling puts makes sense

AdminFebruary 15th, 2009 at 2:23am

You aren't anticipating the stock to drop...you are anticipating it to rally. If the stock is above the strike at expiration you keep the premium.

SGL#February 15th, 2009 at 1:33am

How is a short put considered bullish if you are anticipating the stock to drop?

AdminDecember 18th, 2008 at 6:22pm

Yep, noted. I mentioned it below too:

"I guess it is not really unlimited as a stock price cannot go below 0."

RickDecember 18th, 2008 at 1:13pm

"Maximum Loss: Unlimited in a falling market.", not really , how far can AAPL fall , cant go beyond 0 (zero)

AdminDecember 8th, 2008 at 3:15am

Hi Marlowe,

Not sure what you mean. Are you saying that your broker won't allow you to sell a put option?

MarloweNovember 27th, 2008 at 10:29am

I would like to carry out the AAPL trade for real, however I am told I can not carry naked put. But, I can buy a call which will cover me. What are the suggestions for this? Happy to own the stock.

AdminNovember 7th, 2008 at 7:10pm

I think the max loss on a short put is [(stock - strike) + premium] and seeing as the stock price is unknown and can therefore be anything it is reasonable to say unlimited.

johnOctober 31st, 2008 at 9:03am

yes i agree the max loss is [(Strike-Premium) - 0]. There can be large losses if the strike is large, but there is certainly limited downside.

AdminSeptember 23rd, 2008 at 10:27pm

A short put means that you are obligated to buy the underlying at the strike price if the buyer decides to exercise. So the payoff is the stock price minus the strike price less the premium received.

Once the underlying stock trades below the strike price price the option becomes out of the money. The option will continue to lose money as the stock continues a downward price movement.

I guess it is not really unlimited as a stock price cannot go below 0.

chrisSeptember 23rd, 2008 at 2:01pm

Isn't the maximum loss for a short put the Strike price, not unlimited? This is not including the premium made on the sell of the put. So the net loss would be the Strike price minus premium

Add a Comment