Why Time Decay is the Enemy of the Option Buyer

Even when the market moves in your favor, your option position may still lose value. Many of my recent live trades have experienced this over the past week; initially, the whole portfolio was up as volatility increased and I had a few small wins on the direction. However, in the days that followed, as expiration approached, the portfolio of long options began to lose value quickly.

This is what time decay does to long option positions.

As the buyer of an option contract, you have the benefit of a leveraged, limited risk investment in which you can benefit if the market moves in your favor. Getting the market direction right is one thing, however, there is another risk that works against the option buyer; time decay.

Options are a decaying asset

All option contracts have a time limit, called the expiration date. After this date, the option is either transferred into the underlying asset or it simply expires worthless.

The buyer of the option is the one who decides whether or not to exercise this option. As with anything that involves a choice, the more time you have to decide the better. Conversely, as the time to decide to choose becomes smaller and smaller, the value of the choice erodes with the reduction of time.

This is the same with call and put options; as each trading day passes this "choice value" becomes less and less. Not only does this value decline, but it declines at faster rate as the expiration date closes in.

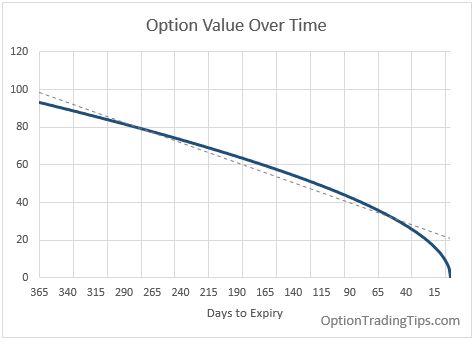

The above graph demonstrates the erosion of the price of the option over a one year time frame. This is the price of an at-the-money call option, valued every day using constant values, except time. Time is the only input that has been changed from one day to the next.

The important take away here is to notice that when the option has more time to expiry, the change in price from one day to the next are small but also are more linear. However, as the option moves closer to the expiration date, the option begins to experience an increasing rate of decay.

A quick note on the option value

Remember: the price of an option is made up of two components; intrinsic value and extrinsic value. Time value refers to extrinsic value only. Read more on Option Value.

How decay works either for or against you

Now you can see that all other things being equal, an option contract will always be worth less tomorrow than it is worth today as there is one less day of opportunity for the option to be profitable. This change in value, however, can actually work in your favor.

Consider a stock that rises and falls in price. If you are the buyer of the stock and the market price falls, you will lose money as a result of the drop in value. However, if you are short the same stock then you of course will benefit from the price drop as you can buy-back the stock at a lower price.

The same effect happens for options in relation to the value eroded due to time decay:

- If you buy options: Time Decay hurts your position

- If you sell options: Time Decay helps your position.

Therefore as a net buyer of options, whether as a single contract or via a spread, you must expect a portion of your position to lose value as time goes by; your choice of whether or not to exercise your option reduces the value of the position as the expiration date nears.

Now, as a seller of options the reverse is true; all other things being equal, a net seller of options can expect his/her position to benefit in value as time passes. If you are the seller and have shorted the contract at a given premium, the drop in premium due to the passing of time increases the profit of your position.

Now, this isn't to suggest that you should just go out and start shorting options or selling credit spreads. Being aware of the effects of time decay can help you make better decisions on where to use a long or short option spread.

Time and Magnitude (Volatility)

Another thing to consider when evaluating an options time value is volatility. Time and volatility have the same effect on the price of an option. That is, more time or more volatility will increase the extrinsic value of the option. Conversely, when you reduce time and/or volatility the time value of the option will also be reduced.

Volatility is a kind of proxy for time. When a stock is highly volatile there are more opportunities for the stock to pass through the various price points as the market swings around. The concept is the same for time; when you have more time, there are more opportunities and has time reduces so do your opportunities.

The effect volatility has on the value of an option is the same as time; the more of it you have the more value the option has.

So, the best time to sell options is when volatility is high and when expiration is close.

Theta and Vega

The value gained/lost in an option as a result of time and volatility aren't just concepts. They can be numerically evaluated via the use of a pricing model. For more on these two calculations, please read option Theta and option Vega pages.

Short Spread Examples Capturing Time Value

If you'd like see some real trade examples of strategies that make money using the concepts described here, then below are some links to some trade examples. Profitable ones of course!

Short Condor Trade - $80 profit on $200 margin (40% return)

Short Call Spread - $92 profit on $150 max loss (61% return)

Iron Condor with Adjustments - $161.50

This is an interesting one as this trade had some adjustments when the intial position didn't quite go to plan. I ended up being assigned a short stock position due to being exercised on a short call option. I ended up coming out of the trade profitable.

Any questions, please leave a comment below.

PeterSeptember 4th, 2019 at 11:37pm

Hi Christian,

You can take a look at my option spreadsheet for some ideas on what you might want to build for options analysis.

Or what about building something in VBA that downloads the option data from finance.yahoo.com? That would be pretty useful!

Peter.

ChristianSeptember 4th, 2019 at 2:57pm

Hi,

thank you for your response, the concept is now clear to me. I am currently in the process of learning VBA for a trading internship and would like to do so by doing projects. However, I have a hard time with coming up with something interesting. I would highly appreciate, if you could give me any suggestions.

Thank you in advance.

PeterJuly 25th, 2019 at 10:34pm

Hi Christian,

Yes, a deep ITM put with a high strike price and high interest rate will benefit more from exercising and selling the stock at the strike and then receiving the cash. The strike price (which will be the dollar value you receive by exercising) plus the interest you are expected to earn on that money will be greater than the decreasing value of the eroding extrinsic value by the same interest rate.

The higher the strike and interest rate, the more you will see this effect. It becomes more advantageous to exercise and take delivery of the cash be selling the stock as the probability of the option expiring in the money becomes 100%.

Let me know if I haven't explained it well enough.

ChristianJuly 25th, 2019 at 1:52pm

Hi,

Could you please elaborate on why far itm put (stock) options with strictly positive interest rates can gain value due to time ‚decay‘. Thanks in advance.

PeterDecember 30th, 2014 at 5:26pm

Noted, fair enough, I'll remove shortly, I'm away from my computer right now.

AaronDecember 29th, 2014 at 7:07pm

Reads so much like an advertisement for this 'David'. Please correct the article to remove the bias.

shesha1970November 4th, 2009 at 9:14am

hey add ore exmples from other markets

Add a Comment