Short Call Credit Spread (RAD)

Closed: Profit $92

Market Close July 3

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| RAD Short Call Spread | ||||

| RAD Jul02 $8.50 Call | -5 | 0.292 | 0 | 146 |

| RAD Jul02 $9.00 Call | 5 | 0.108 | 0 | -54 |

| Total | -0.92 | 0 | 92 |

19th June, 2015

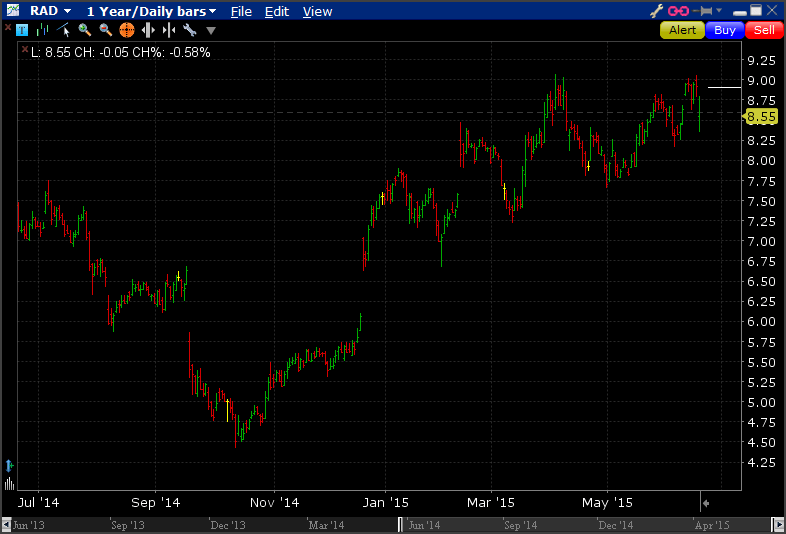

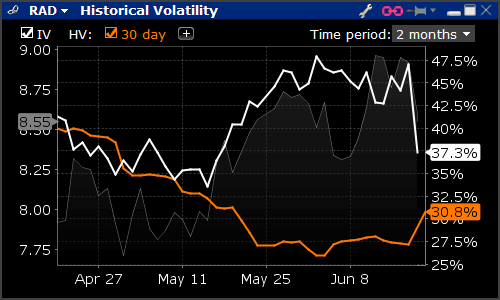

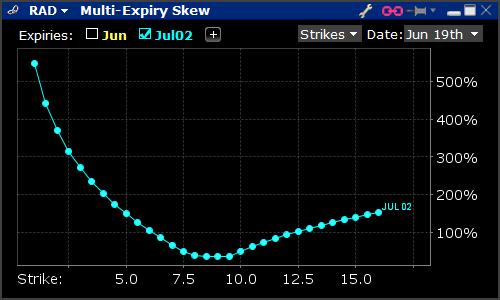

Going for a bearish spread on RAD today. I am neutral to bearish on the direction on the stock and implied vol is relatively high, even though it has already started a decline. The put skew indicates negative sentiment with high prices pushing up the implied volatilities.

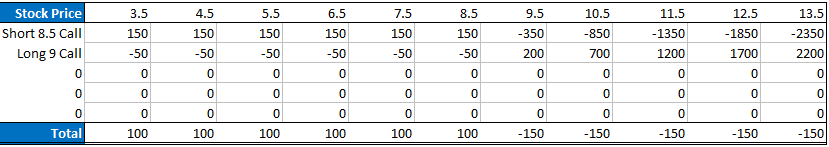

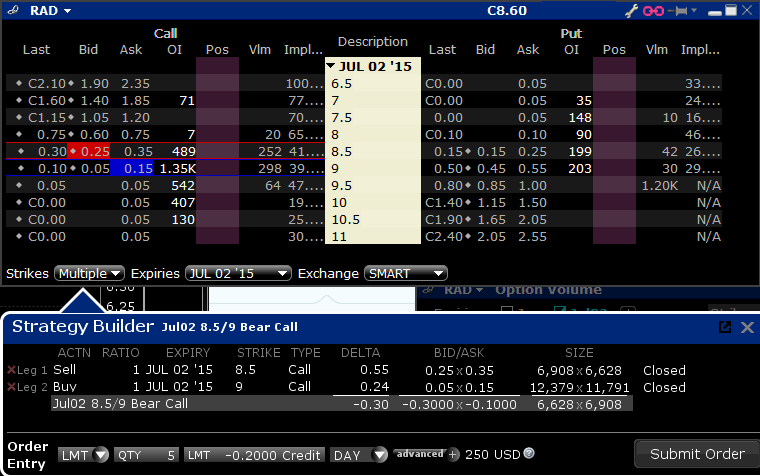

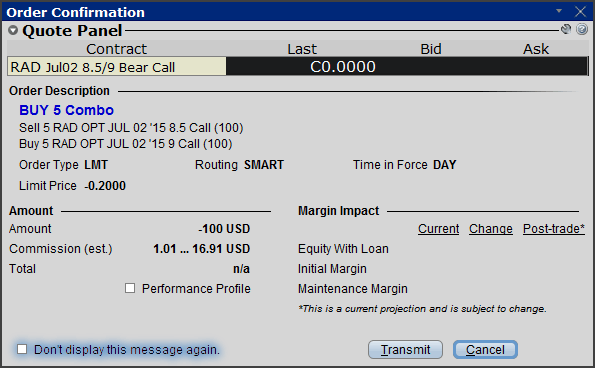

At 37% implied at the money vol, the $8.50/$9 call spread gives a breakeven point of $8.90 on the upside. With 12 days to go there is a 74.21% chance that the stock will remain under this price by the expiration date.

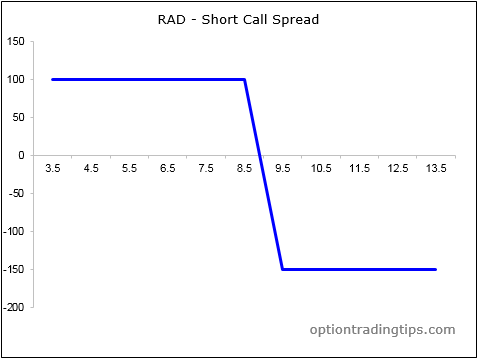

At 5 contracts, I will make $100 if the stock remains below $8.90 but lose $150 if it rallies above that level by 2nd July.

Update 19th June

Post Friday's session, RAD ended the sessio slightly positive but the position is down $45.50 already.

Update 3rd July

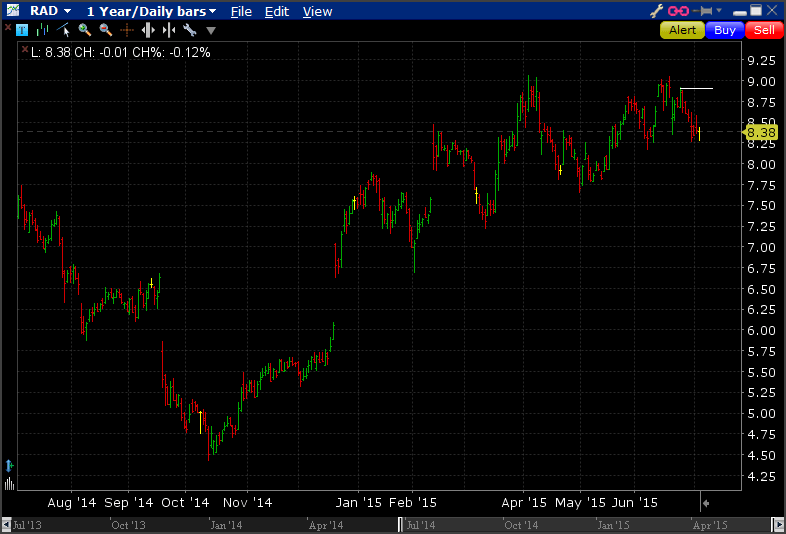

RAD closed the week out at $8.39, below the $8.90 upper limit. Both calls expired worthless so the spread was profitable by the premium received when establishing the trade of $92. Here's the chart;

There are zero comments

Add a Comment