Characteristics

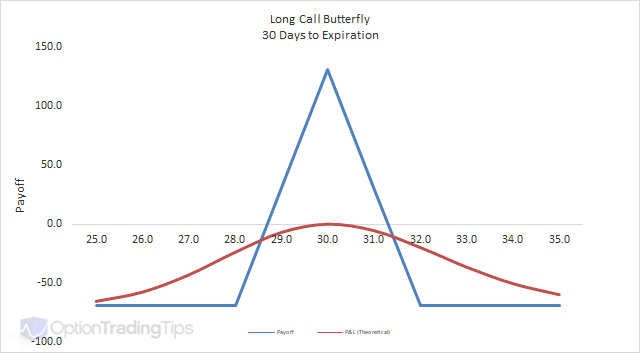

When to use: When you are neutral on market direction and bearish on volatility.

A long butterfly is similar to a short straddle except your losses are limited. This means that you make money when the market remains flat over the life of the options.

You might be thinking that it looks like a "short" strategy because of the similarity to the short straddle. You are right in thinking that they have similar characteristics, however, the difference between a Long Butterfly and a Short Straddle is the premium - a Long Butterfly will cost you money (or premium) to establish whereas a Short Straddle won't cost you anything as you receive money (premium) up front for putting on the position.

Long Call Butterfly Greeks

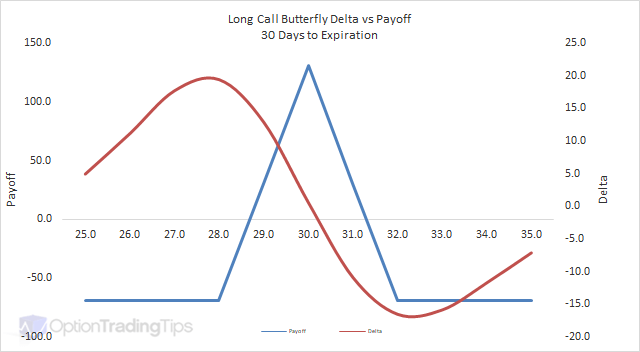

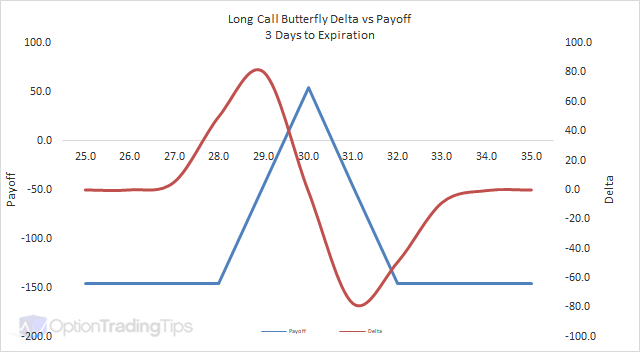

Delta

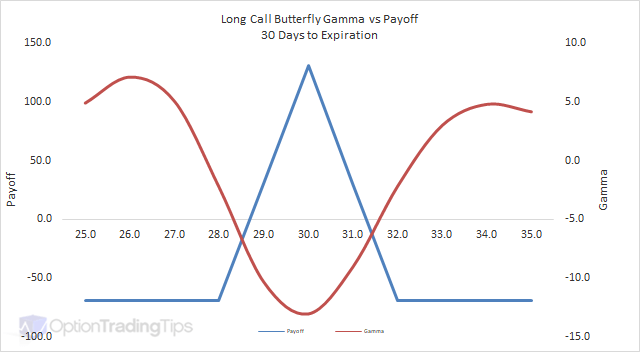

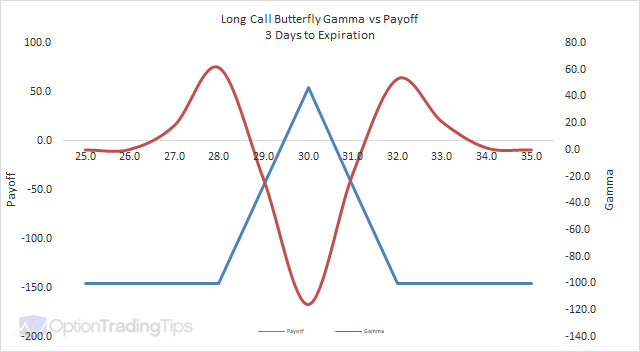

Gamma

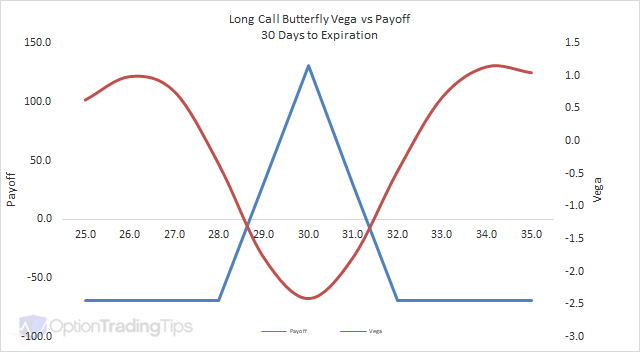

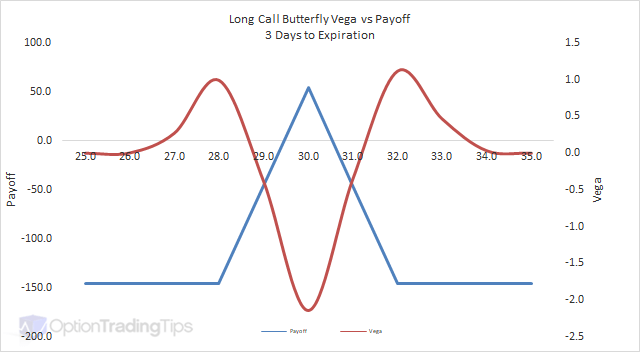

Vega

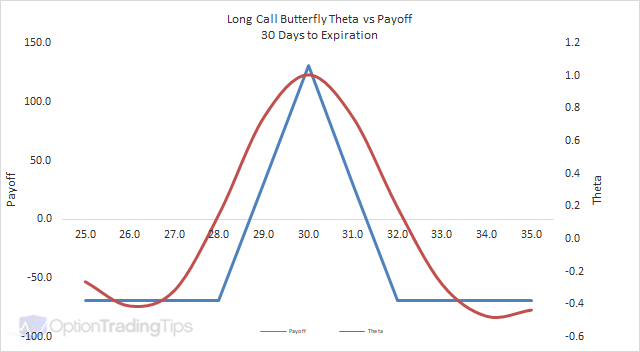

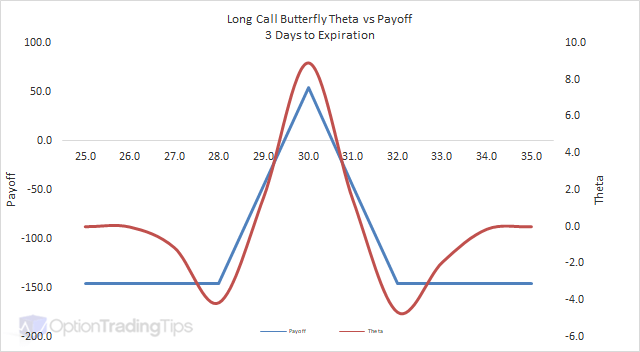

Theta

PeterJuly 26th, 2015 at 10:33pm

Yes, you're right - I've corrected that, thanks!

asekJuly 26th, 2015 at 6:14pm

it seems like you have the maximum gain and maximum loss backward? Shouldn't it be the other way around?

PeterJanuary 15th, 2012 at 5:32pm

That's right - when you're net long options your losses are limited to the premium paid.

SamJanuary 13th, 2012 at 3:38am

Yes I know you are net long options. But as I undrstand it if you are net long an option you can only lose what you paid and nothing more.

PeterJanuary 10th, 2012 at 5:33am

Hi Sam,

The cash position to your broker is needed as you are net long options.

SamJanuary 10th, 2012 at 1:37am

Hi!

I guess you can also buy a lower call for the third leg and therefore if the price of the underlying goes beyond the third leg you can insure yourself at least some part of the profit.

The only thing I do not understand here then is why if you do this the broker wants a cash position for options requirement.

I think the situation is the same as the one on the picture above or even better because if the underlying goes up dramatically you can still ensure yourself at least some profit or at least no lose.

Tnx for your comments

PeterDecember 11th, 2011 at 5:06pm

You mean with the same expiration date? Well, it is "possible" but very very unlikely as the professional market makers will ensure that any arbitrage (risk-free trades) opportunities are quickly taken.

LatvianDecember 11th, 2011 at 3:47am

Is possible with 2 short ATM Call options cover premiums of both long Call options. So then I have open this strategy with no paying?

ManishDecember 5th, 2011 at 6:30am

IS IRON BUTTERFLY IS BETTER THAN BUTTERFLY? IF YES OR NO WHAT IS THE NORMAL PRICE RANGE FOR BOTH IN INDIAN STOCK CONTEXT?

akbarSeptember 1st, 2011 at 12:03pm

ATM = at the money.

OTM= out the money.

ITM= In the money.

PeterAugust 7th, 2011 at 7:32am

Please see the in-the-money page.

subhraAugust 5th, 2011 at 9:15am

what is ATM call options ?

what is ITM call option ?

what is OTM call option ?

PankazDecember 16th, 2008 at 2:31am

Nitesh's comment is dumb. The max loss is the same on both of his described cases, whether st. price is over OTM or below ITM. and

And for Max gain, The max gain is at one point only, not between the two strike prices.

NiteshAugust 25th, 2008 at 7:25am

Hi,

I guess under Maximum Loss it should be: If the stock price exceeds OTM call Option on expiry or if the stock price reduces less then ITM call option on expiry.

And Maximum Gain: If the stock price is at ATM on expiry or if the stock price is between ITM & OTM call option on expiry

Just an comment, to make it simple. In Maximum Gain I guess it couldn't be Limited to the premium received as in geneal buying both ITM and OTM call option will cost more then selling two ATM call option

Add a Comment