Characteristics

When to use: When you are bearish on market direction and bullish on volatility.

This strategy could also be referred to as a Short Put Backspread, however, I will refer to this strategy simply as a Put Backspread.

A Put Backspread should be done as a credit. This means that after you buy 2 OTM puts and sell 1 ITM put the net effect should be a credit to you. I.e. you should receive money for this spread as your are short more than you are long.

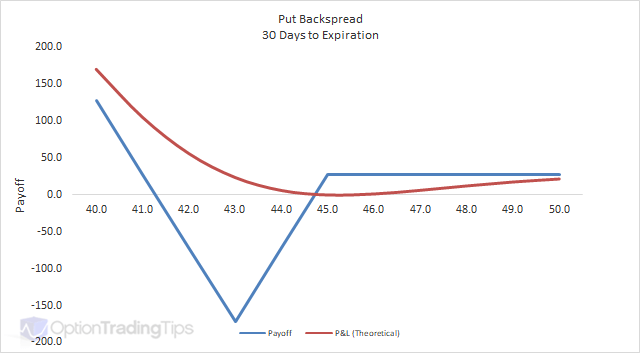

Put Backspread's are a great strategy if you are bullish and bearish at the same time, however, have a bias to the downside. Looking from the payoff, you can see that if the market sells off you make unlimited profits below the break even point. If, however, you are wrong about the direction and the market stages a rally instead, you still win - though your profits are limited.

You might say that this type of strategy is similar to a Long Straddle - and you would be right. The difference is that 1) the profits are limited on one side and 2) Backspread's are cheaper to put on.

Put Backspread Greeks

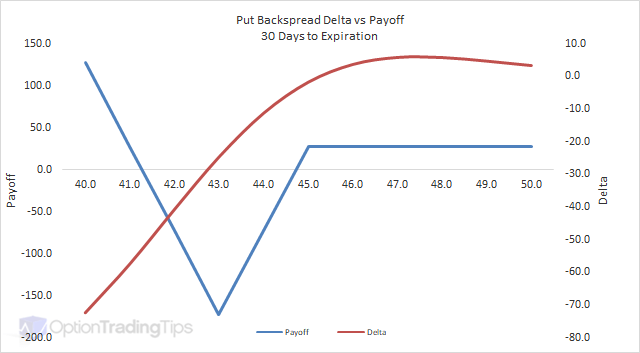

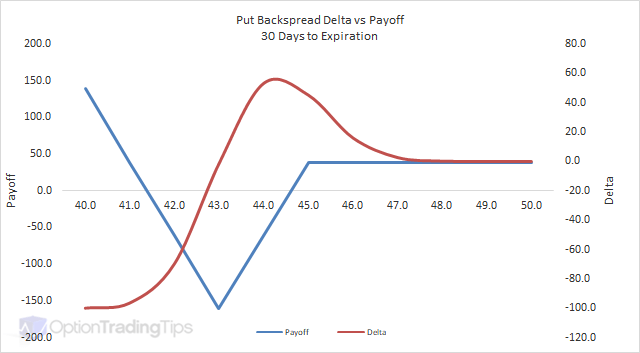

Delta

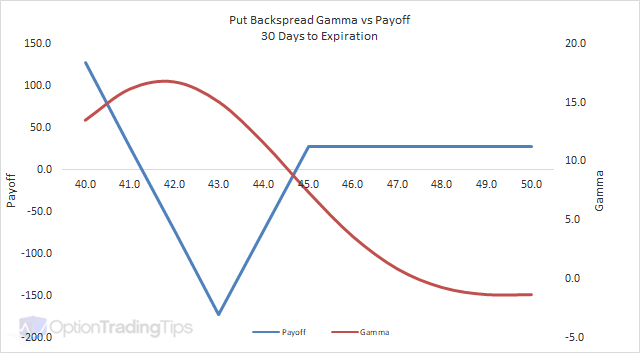

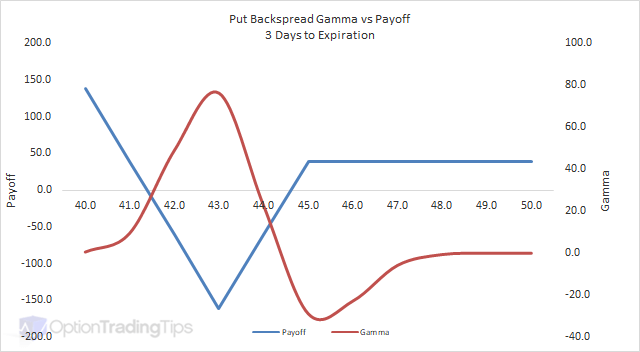

Gamma

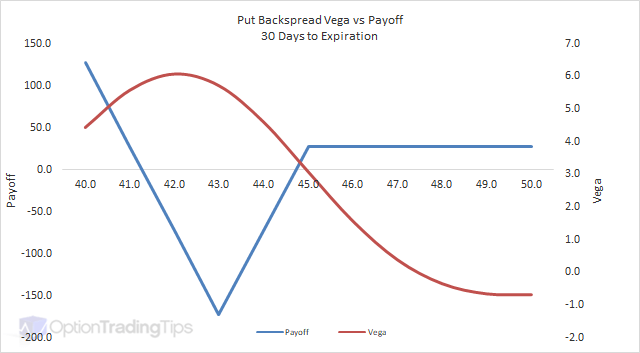

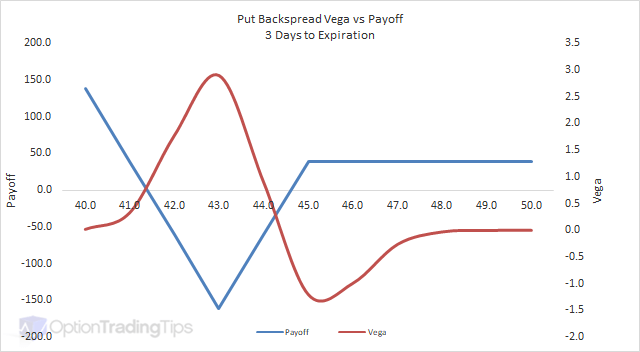

Vega

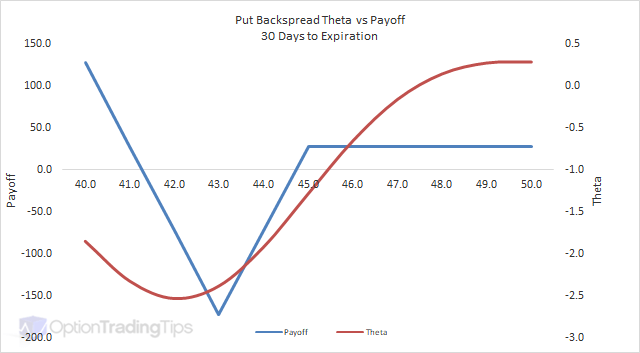

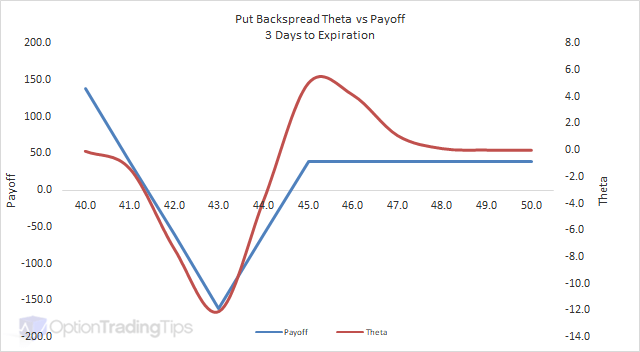

Theta

PeterMarch 27th, 2017 at 10:40pm

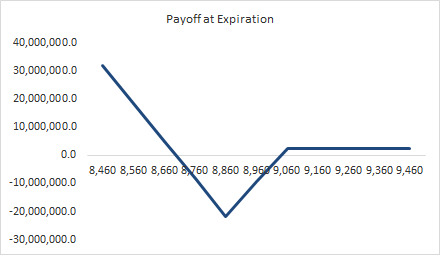

I see now...I believe the NIFTY option contracts convert 1 to 1 with the NIFTY futures, correct? If so, here is what I get for your payoff profile when using a spreadsheet to replicate your position:

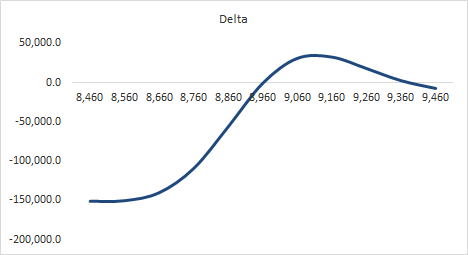

And here is your delta profile:

Your position delta is very sensitive around the 8,960 level for the NIFTY...below that your position is negative and above your position becomes positive. So with the NIFTY now at 9,045 your position is now long.

What is your view now? If the market goes higher your returns look to be capped on the upside from my calculations. If you cannot hold until expiry, why not just exit the position now?

ravinderMarch 23rd, 2017 at 12:00am

hi peter

screen shot is not possible but below i give you detail of my greeks

delta long +55

gamma short -1.90

vega short -3000

theta positive +250

Long 8700 $8900 Puts @ 8.55

Short 6000 $9000 Puts @ 21

Short 300 Futures @ 9128

expiry date is 30 march 2017, i cant hold it till expiry

PeterMarch 22nd, 2017 at 12:04am

Your delta is net long? It should be short as you are 1) long more puts than short, and 2) short futures.

What system are you using? Can you email me a screen shot of your position and greeks?

ravinderMarch 21st, 2017 at 11:54pm

Hi Peter,

but my portfolio delta is already 100 out, if I buy some future back then it become more out.

PeterMarch 21st, 2017 at 10:28pm

Hi Ravinder,

Your combined position here is more short than neutral and looks more like a long put if I understand correctly. Is this the breakdown of you trade:

Long 8700 $8900 Puts @ 8.55

Short 6000 $9000 Puts @ 21

Short 300 Futures @ 9128

Are you short or neutral the Nifty? If you are neutral then I'd suggest buying back some of those futures.

ravinderMarch 21st, 2017 at 2:37am

hi peter

I have a position in nifty as, buy 8900 strike pe qty 8700 at 8.55, sell 9000 strike pe qty -6000 at 21 and also sell nifty future qty -300 at 9128,

all expiry are same 30 march 2017, i cant hold it till expiry

i getting confuse about profit and lose, my view is market is neutral or near about down, Are you think it is ok

PeterDecember 6th, 2016 at 7:17pm

Hi Prashant,

You receive premium when selling options (credit) and pay when buying options (debit).

PrashantDecember 2nd, 2016 at 11:06am

When do we recive premimum?

In short put or long put?

PeterMarch 29th, 2012 at 11:45pm

Hi Azad,

Are you mixing different underlyings here? What is SBI?

A put backspread as described here is done at a ratio of 2 to 1 on options on the same underlying within the same expiry date.

AzadMarch 29th, 2012 at 11:01am

Hi Peter,

I used 3 lots of Nifty and 1 lot of SBI.I am very surprise that Put back spread not working at all, I give you one Example : When Nifty trade above 5400, I buy 2 lots of 5400 PE at 68 and Short 1 lot of 5700 PE at 218 now today is the expire day and my long 5400 PE expire at 214 and short 5700 PE expire at 534, now you see where is the profit ? One other example I give you I buy 2 lots of SBI {125 shares } 2150 PE at 84 and Short 1 lot of 2350 PE at 178 now after expire today price is 2150 PE at 88 and 2350 PE at 300 when SBI spot last close at 2060, huge loss, My other two Nifty position went more losses. I told you these are the worst strategy I used in my entire trading carrier, God save all who used these.

PeterMarch 28th, 2012 at 6:13pm

Is this on the NIFTY? What strikes and expiration date are you trading?

AzadMarch 28th, 2012 at 4:33am

Hi, Peter

I am using Put Back Spread in all my trade. I am expecting market to go down and infact market going down but still I am lossing big money, better to short in futures I think.

PeterMarch 26th, 2012 at 7:52pm

Hi Azad,

Sorry to hear of your losses!

Long option positions (including combinations) are negatively affected by the passage of time (time-decay), which is determined by the volatility.

So if you are planning on being long options (or long a combination of options) it is best to choose an underlying where the implied volatility is relatively low. If you buy options with a high volatility it can often happen that when the market moves in your favor the value change as a result of the decrease in volatility is greater than that of the gain due to price movements.

What underlying are you trading?

AzadMarch 19th, 2012 at 9:15am

Hi Peter,

Today I book losses half of my Put Back Spread position, Our markets are bearish for last one month but still I am losing money. I do every thing in this market but still I am not made any money rather I loss almost every thing I have and now I am in huge debt.I am very depress and don't know what to do, where I go .

Thanks

PeterMarch 5th, 2012 at 5:58am

Sounds like the market is not moving fast enough. Remember that with this position you are also fighting time decay - so if the market moves slowly then the decrease in volatility for the position will have a greater negative impact on your P&L than the market move itself.

AzadMarch 2nd, 2012 at 9:27am

Hi Peter,

One thing I am not understand, I am in this market since 2005 but never used this options strategy. I buy options earlier and always losing money, now after visiting your sites I try to used these complex strategy. Now I have three open positions {put back spread } here in our markets, two in nifty and one in SBI, both Nifty and SBI are gradually declining but I still losing money, why ?

PeterFebruary 27th, 2012 at 5:15pm

Hi Azad,

If I am bullish I would look first at a call backspread. Bearish a put backspread. Neutral a long condor (also called iron condor if you use both calls and puts).

AzadFebruary 27th, 2012 at 7:19am

Hi Peter,

Just tell me one thing ? out of all these option strategy's which one you personally prefer ? In other word when you are bearish or bullish which one option strategy's you used.

PeterMay 1st, 2011 at 7:14pm

If you were to exit the trade, you would exit both legs at the same time. The timing, however, is up to you - if the position has made huge gains quickly you might want to exit immediately and move onto your next trade.

KenMay 1st, 2011 at 11:39am

Do you hold both legs of this until expiration, or close your positions before then? In other words when and how do you exit?

PeterJanuary 19th, 2011 at 4:34pm

It is cheaper to put on as a put backspread is normally done for a credit i.e. you receive money in your account when this trade is established rather than paying out money.

It is similar to a long straddle because of the payoff profile. Not exactly the same as the payoff flattens on the upside, but similar all the same.

sonaliJanuary 18th, 2011 at 3:10am

how backspread is cheaper to put on....in put backspread n how long straddle n put backspread is similar

PeterSeptember 2nd, 2010 at 5:47pm

Volatility of price is best described on the Volatility page.

adarshSeptember 2nd, 2010 at 7:26am

please define volatility of price

PeterSeptember 1st, 2010 at 9:12pm

Hi Adarsh, a bear market defines a period where the prices of an asset are in a declining phase. Bear volatility defines a period where the volatility of prices are declining.

They do not necessarily happen at the same time. Many times, especially for equities volatility declines when the stock price rises.

adarshSeptember 1st, 2010 at 8:30pm

please explain the basic difference between bear market and bear volatility. i will greatful.

PeterAugust 12th, 2010 at 6:10pm

Buy Call = Right to Buy Stock

Sell Call = Obligation to Sell Stock

Buy Put = Right to Sell Stock

Sell Put = Obligation to Buy Stock

Emmanuel ArmahAugust 12th, 2010 at 6:38am

please can someone explain the following terms to me.

buy CALL option

buy PUT option

Sell CALL option

Sell PUT option

I will be grateful .

BR.

emmanuel

Add a Comment