Call Bear Spread, also called Short Call Spread

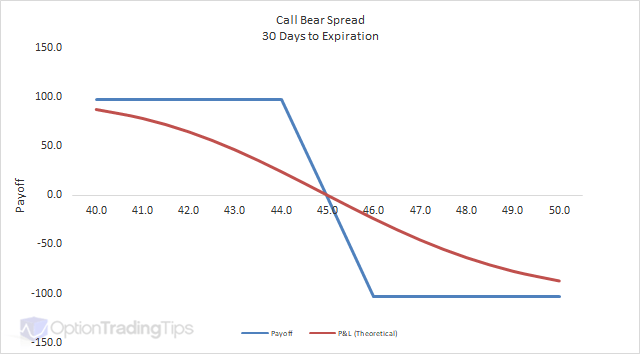

A call bear spread involves selling a call with a lower strike price and subsequently buying a call with a higher strike price. Both call options need to have the same expiration date.

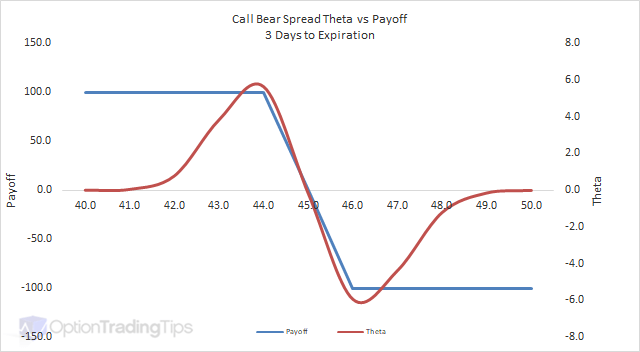

The Max Loss is limited to the difference between the two strikes minus the net premium.

The Max Gain is limited to the net premium received for the position. I.e. the premium received for the short call minus the premium paid for the long call.

PeterNovember 16th, 2014 at 10:34pm

Hi Paul,

Your actual gains and losses here depend on the premiums involved in the option transactions. Let's assume the $10 call is sold for $1.50 and the $15 call is bought for $0.25.

Regardless of how low the stock trades, your maximum gain for a credit spread will be the amount of premium received for the trade; in this case $125 ($1.50 - $0.25 * 100). So, if the stock is at $9 then you will make $125, if trading at $5 you will still make $125.

Once the stock above the upper strike ($15) then the loss will be the difference between the two strike prices less the net premium received. I.e. ($15 - $10) - ($1.25) * 100 = $375.

Hard to say exactly what the loss will be with the stock at $12 without putting the numbers in a spreadsheet.

Hope this makes sense - let me know otherwise.

PAULNovember 14th, 2014 at 7:28pm

Example: I sell a $10 call and buy a $15 call. Let's suppose at expiration the stock is at $12, what happens? Now, let's say the stock is at $16 by expiry date, what happens? I guess I'm asking what are the dangers? I'm thinking of the day where we think it is going to expiry next Friday and not this one by mistake....what are the consequences?

edwardlog2June 4th, 2012 at 5:24am

Yes it is really like a credit spread. It is all about the buying and selling and its net cost. As well as call bull spread is reversed of that. This is very nice topic you discuss. Today these strategies are very popular in the field of stock marketing...Thanks...Keep it up

PeterFebruary 29th, 2012 at 4:04pm

Yep, you're right, that's a good point. It would be best to put it on the put side.

Leib chaiFebruary 29th, 2012 at 8:31am

Hi

Doesnt this spread suffer from early excercise risk unlike the put bear spread if so why utilize this spread?

Add a Comment