Long Strangle

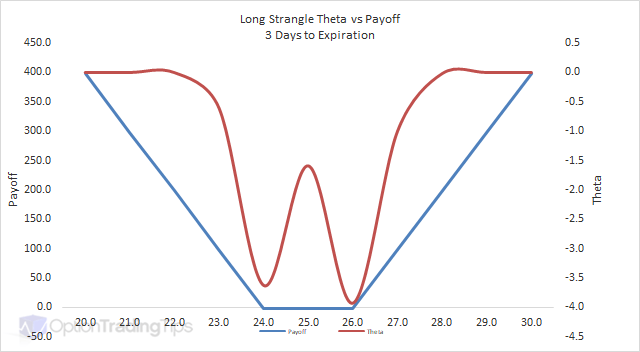

A Long Strangle is where you are long one put option with a lower strike price for every one long call option at a higher strike price.

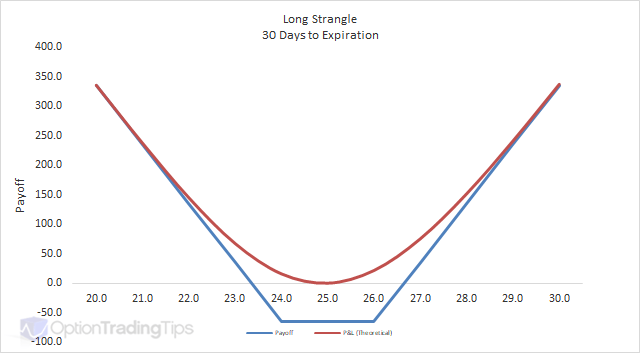

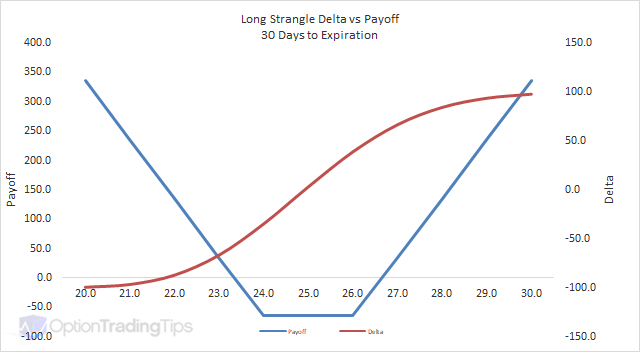

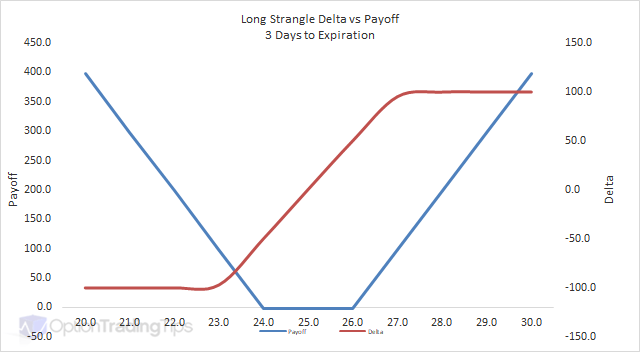

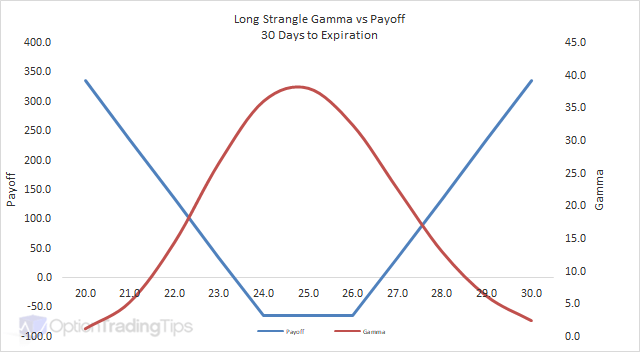

The Max Loss is limited to the total premium paid for the call and put options.

The Max Gain is uncapped as the market moves in either direction.

PeterJune 14th, 2013 at 2:03am

There is software that can do this. I use Interactive Brokers who have an implied volatility skew graph as part of their trading platform. I'm sure Think or Swim do too though I've not used them.

spytraderJune 3rd, 2013 at 8:49pm

hi peter,

is there a way to graph the implied volatility of a call and put in real-time? also is there a graph for seeing the delta shift in real-time as well?

i have done a few long strangle and i noticed that even though sometimes a stock might move as much as 10% in a given direction the strangle will still end up losing money due to an imbalance in implied volatility.

PeterNovember 5th, 2011 at 4:08am

Hi Frank, it depends on the platform that you use and the market that you are trading.

For example, I use Interactive Brokers and they support option combination orders on most markets, where the call and put are sent together as a single order. But not all markets are supported with this feature.

So, you would have to check with your broker to be sure.

FrankNovember 4th, 2011 at 1:04pm

will my strangle position sell as a "strangle" meaning: my call and put sold at the same time ?

PeterOctober 24th, 2011 at 10:18pm

Hi Chopper,

I would say that for a long strangle/straddle the max loss % will always be 100% as your max loss is the same as your entire investment.

You can try use my option spreadsheet to test payoffs and values under different stocks and strike prices etc.

choppercityOctober 22nd, 2011 at 11:09pm

Hi Peter,

Great website, if I have a long straddle what is the largest % loss I could have if I buy both options with 7 days to expiration and I will sell them the next day. I know this depends on a lot of things but I'm just looking for a rough estimate. I know what I'm paying is the loss of the premium as expiration approaches, I would also like to understand better how increasing the days to expiration or increasing the distance from the strike price of the options affects the loss of the premium.

I ran the following scenario through my broker's P&L calculator and it show a max ~$200 loss on an initial investment of $4200 or about 5%. nflx 6 long call's at 3.7 strike of 130, 8 short call's at 2.65 strike of 100. current stock price of 117.

Thanks.

PeterNovember 21st, 2010 at 5:52am

Yep, but it depends on the price of the straddle compared to the strangle. Straddle prices are more expensive and this raises the break-even price of the trade.

gaurav bhattNovember 20th, 2010 at 11:19am

Peter, I am a firm believer that whenever you are betting for an increase in implied volatility on a historical basis, then option traders should always go for long straddle as it gives you much benefit than in the case of long strangle but for that we have to be sure wherever the option price move it should be nimble footed so that we make profit not loses and for that we have to be a veteran and long strangle strategy is not as secure as long straddle is.

RhinaSeptember 26th, 2010 at 4:40am

@sunny

You put this trade on when implied volatility is low because that's when the options would be the cheapest. When implied volatility is high, that is priced in to the options, so you pay a higher price at that time. This way you put the trade on while implied volatility is low and just wait for the volatility to rise as it regresses to the mean and hopefully above.

PeterMay 13th, 2010 at 4:03am

You might be thinking of a short straddle/strangle. For a long straddle/strangle you want the implied volatility to be low and expect it to rise as an increase in volatility helps this kind of a position.

SunnyMay 12th, 2010 at 12:24am

I'm quite new to options so I might seem a bit dense but what do you mean by implied volatility being low? Isn't this strategy meant to be used when you believe volatility will be high?

PeterDecember 28th, 2009 at 3:46am

Sorry RK, but not sure what you mean by a "Big" strangle. And what do you mean by "profit in ex"?

RKDecember 26th, 2009 at 1:07pm

Kindly give any example of Big Strangles that how to make profit in ex

Add a Comment