Short Guts

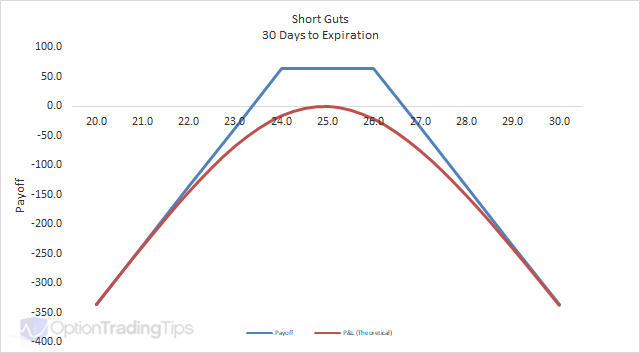

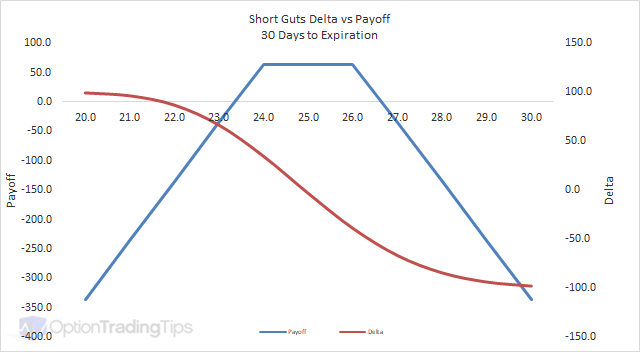

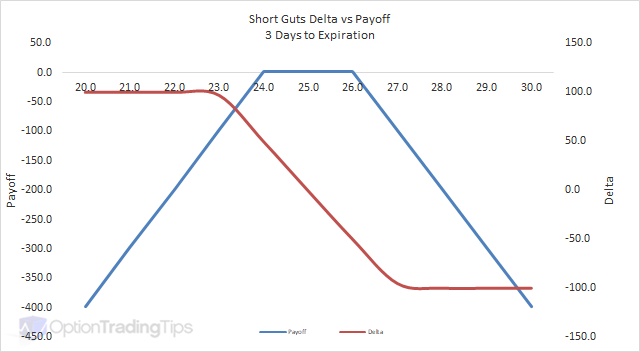

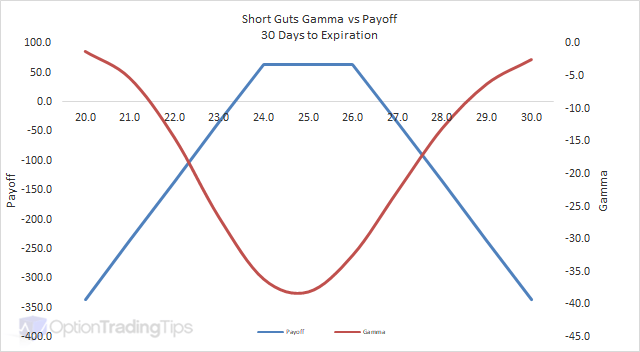

A Short Guts is selling one call option while selling a put option with a higher strike price in the same expiration month.

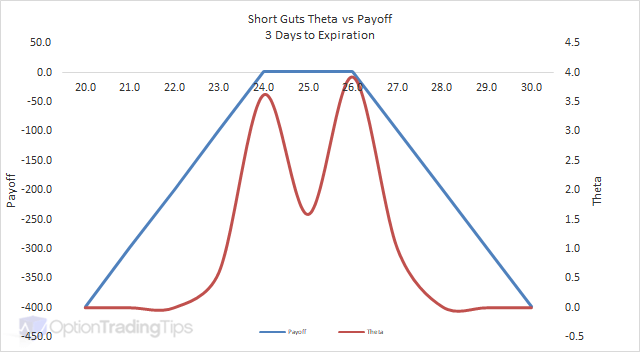

The Max Loss is uncapped as the market moves in either direction.

The Max Gain is limited to the total premium received for the call and put options.

PeterJune 12th, 2011 at 7:09am

By "expensive" I meant that the options have higher prices.

SwissguyJune 11th, 2011 at 10:47pm

You said GUTS would be more expensive but why do you say that when you are selling? That only makes it more attractive because you get paid more premium.

madhuFebruary 27th, 2011 at 12:44pm

use full information

Arun007November 29th, 2010 at 1:02am

Thanks for the information

AnonymousNovember 3rd, 2010 at 5:59am

Thanks for the post

JoelJanuary 21st, 2009 at 3:47am

Depends on the premiums of both strategies. Guts would be more expensive as they are ITM options.

DeepakJanuary 19th, 2009 at 10:25am

how to make choice bet strangle and gut ?

Add a Comment