You can think of the above Iron Condor a couple of ways;

Long or Short?

Depending on who you ask, the above composition (where the body is sold and the wings bought) can be referred to as either Long or Short. Some say that it is a long condor as you are buying the wings others say short as you receive premium for the trade.

I prefer to call this spread a short spread. Not just because it is a credit spread but that it fits nicely with other option concepts. i.e. short options/spreads will typically be long theta/short gamma, which is what this specific strategy will be. If you pay premium for a strategy, I say you are long options/long the spread and if you receive premium then you are short options/short the spread.

This is, I believe, a key difference between an "Iron" Condor and a standard Condor. That is, if you construct a condor of only calls where you sell the body and buy the wings you will most likely pay premium for this spread. So, while the pay profile graph has the same characteristics as the Iron Condor construction at the top of this article, the premium transaction is the opposite.

Here is what I mean...take a look at these two other articles describing a Long Condor and Short Condor. Note, these are NOT Iron Condors. These are constructed by using either calls or puts exclusively, not calls and puts together.

Executing an Iron Condor

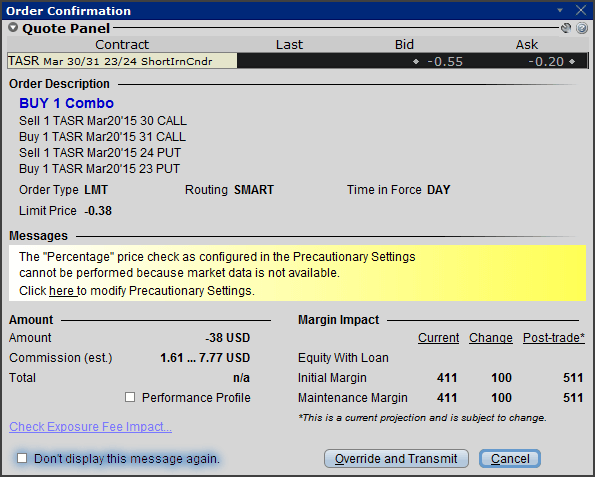

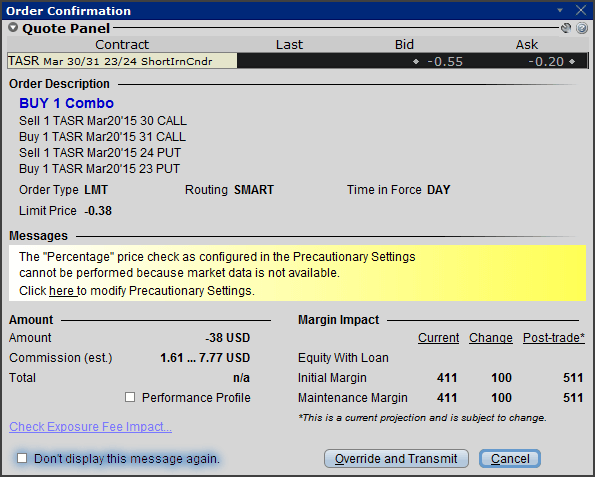

If you are trading Iron spreads via a broker, you will need to be careful of their construction before placing any orders to be sure of the direction of each leg. For example, I refer to the first graph above as a short spread. However, when I place the order electronically my brokers tells me I am "buying" the combo at a credit. Here is a sample screen shot.

Note in the order panel, my broker refers to the spread as a Short Iron Condor - consistent with my preference because net premium is a credit.

Risk / Reward

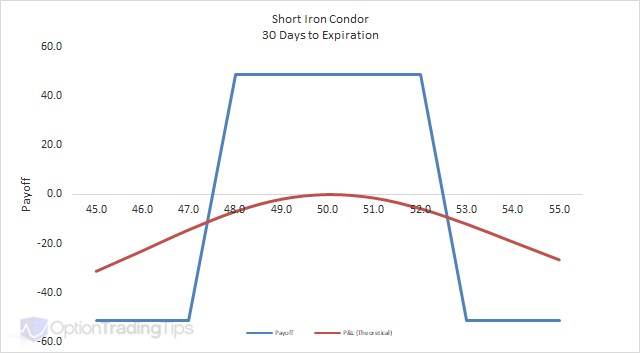

Iron Condors have limited risk and limited profit potential.

Short Iron Condor

Max Loss = Limited. Assuming the distance between the strikes for the call and put spreads are the same, the maximum loss is the difference between the upper/lower vertical spreads minus the net premium received.

Max Profit = Limited to the credit received when initiating the trade.

Long Iron Condor

Max Loss = Limited to the premium paid for the spread.

Max Profit = Limited. Assuming the distance between the strikes for the call and put spreads are the same, the max loss is the difference between the upper/lower vertical spreads minus the net premium paid for the spread..

Iron Condor xls

Iron Condor xls

I prefer to use Excel for calculating profit/loss/break even points. You can download this Iron Condor Calculator. This is a macro enabled Excel workbook. If this doesn't work for you try the Excel 2003 version.

Usage

I would say that generally, retail traders will short an Iron Condor (credit spread) more than buying. It is a popular strategy to use when your view of the underlying is that it will trade in a narrow range while also experiencing a drop in volatility. Option courses that teach "income generating" strategies with options will almost always include Iron Condor credit spreads.

Because this spread benefits from low volatility price movements many traders like to apply them to options on stock indices like the OEX or ETF's that replicate an index e.g. SPY. Indices like these are less likely to experience abnormal price spikes as the index is the broad representation of all of its component stocks.

Options on outright indices are attractive for trading Iron Condors is that there is zero risk of assignment happening on the short option legs as index options are typically European and also don't pay dividends. ETF's, however, can pay dividends so you need to understand the risk there, however, with Iron Condors the short legs are out-of-the-money to begin with so not as likely to being assigned on the short legs as standard call/put condors.

Example Trades of Mine

You don't have to limit yourself to indices though. If your view on a single stock is for range bound price action in the short term and/or the stock has experienced a spike in volatility, short Iron Condors are great trade for these situations. Two winning trades below are both on single stocks.

Losing trade

SPY Short Iron Condor (Index ETF)

Winning trades

TASR Short Iron Condor (Equity)

COH Short Iron Condor (Equity)

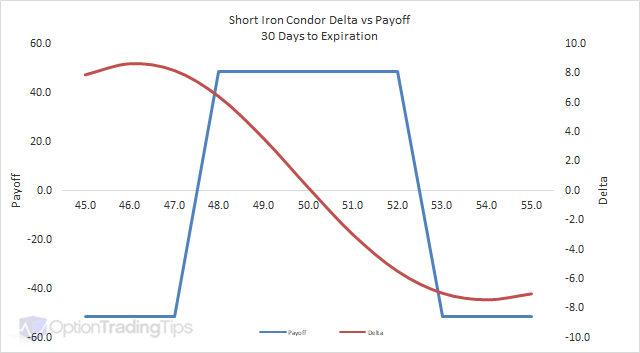

Iron Condor Greeks

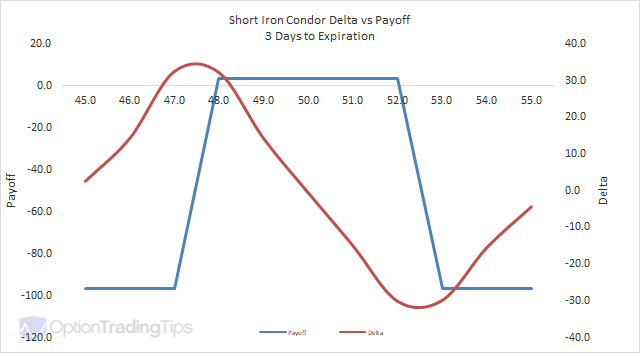

Delta

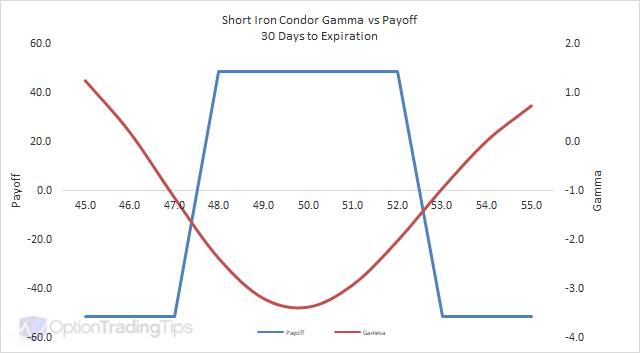

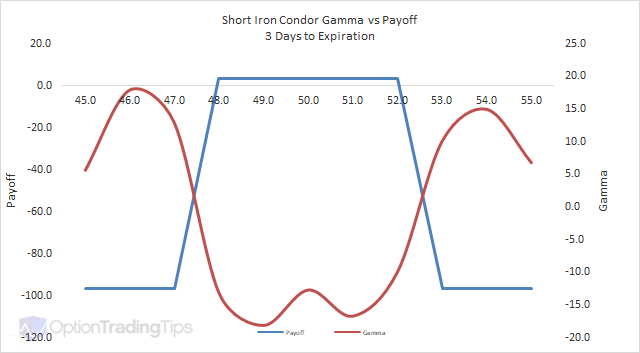

Gamma

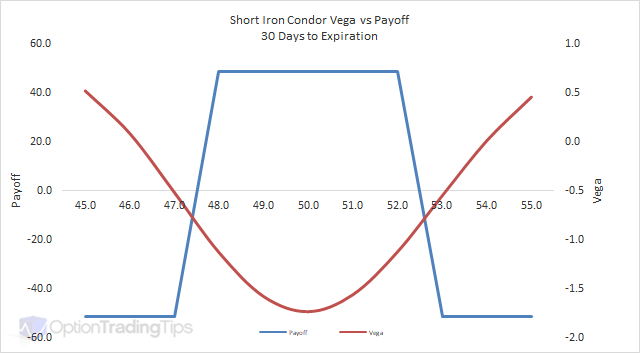

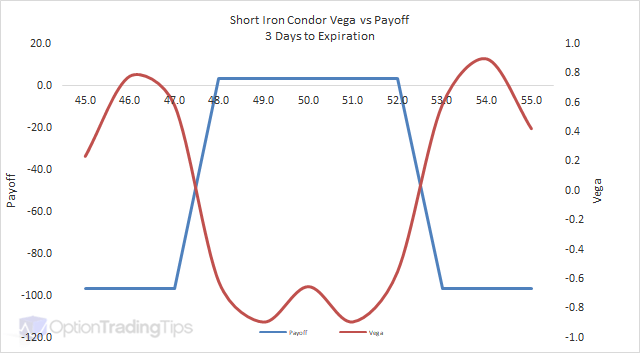

Vega

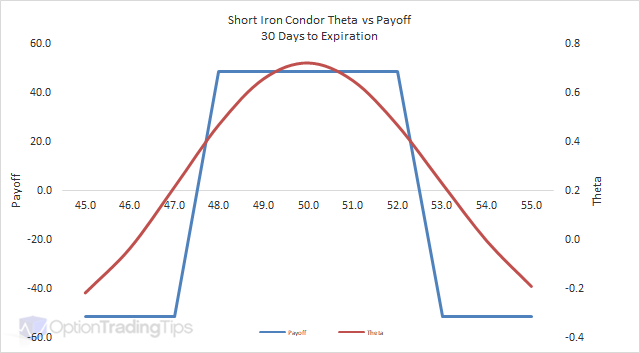

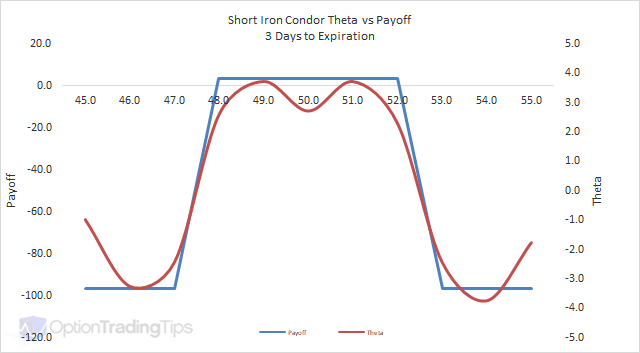

Theta

PeterDecember 28th, 2017 at 5:44pm

You can trade any optionable stocks, however, stocks can be quite volatile so it is best to pick stocks where you expect the implied volatility to decline for shorting iron condors.

Most that short iron condors do so on index options e.g SPY, which are also extremely liquid.

DDecember 28th, 2017 at 10:27am

What stocks people trade in an Iron Condor ?

PeterMarch 8th, 2017 at 11:03pm

Hi Aman,

The same strategies for end of day; the shorter time frame doesn't change the way the P&L works vs the market price. Unless I've misunderstood your question?

AmanMarch 7th, 2017 at 10:01am

Which strategy to use for intraday trading in bullish, bearish and neutral market situation?

PeterNovember 16th, 2016 at 10:32pm

Hi James,

I'm not sure...I've never used the TOS platform. I'll reply to your email sent and see if you can send me a screen shot so I can have a look.

JamesNovember 15th, 2016 at 11:29pm

Hi:

How would one adjust the initial iron condor strikes if on the analysis chart (think or swim) the option sale price is not centered between the short strikes?

Thanks

PeterJanuary 26th, 2016 at 5:12am

Hi James,

Understanding the basics of calls and puts are probably the hardest part to any option strategy. But the Iron Condor specifically is not difficult to learn. Let me know what part you're not sure of and I'll see what I can do to help.

JamesJanuary 25th, 2016 at 9:29am

Hard to learn about this?

Add a Comment