Characteristics

When to use: When you are mildly bullish on market price and/or volatility.

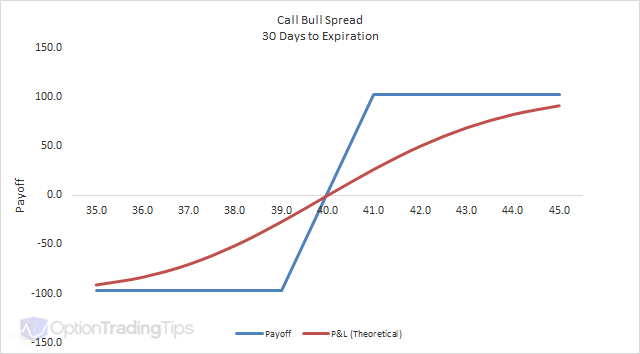

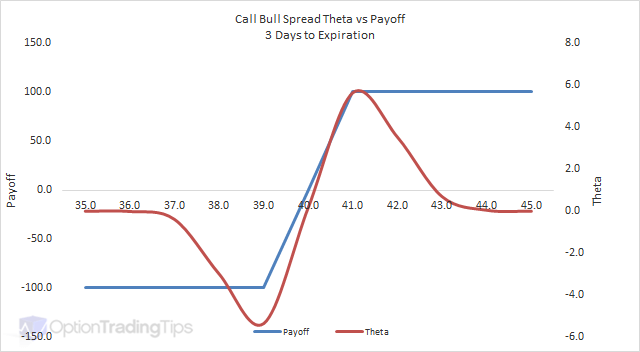

You can see from the above graph that a call bull spread can only be worth as much as the difference between the two strike prices. So, when putting on a bull spread remember that the wider the strikes the more you can make. But the downside to this is that you will end up paying more for the spread. So, the deeper in the money calls you buy relative to the call options that you sell means a greater maximum loss if the market sells off.

Like I mentioned, a call bull spread is a very cost effective way to take a position when you are bullish on market direction. The cost of the bought call option will be partially offset by the premium received by the sold call option. This does, however, limit your potential gain if the market does rally but also reduces the cost of entering into this position.

This type of strategy is suited to investors who want to go long on market direction and also have an upside target in mind. The sold call acts as a profit target for the position. So, if the trader sees a short term move in an underlying but doesn't see the market going past $X, then a bull spread is ideal. With a bull spread he can easily go long without the added expenditure of an outright long stock and can even reduce the cost by selling the additional call option.

Call Bull Spread Greeks

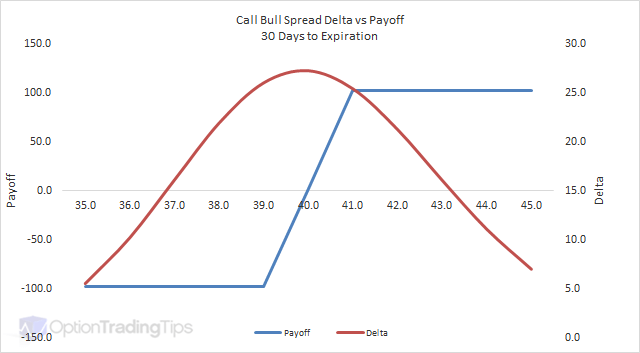

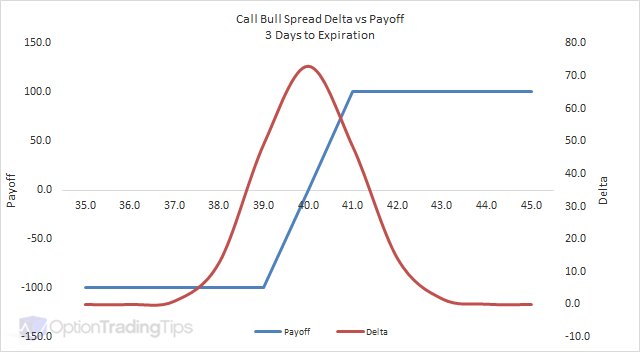

Delta

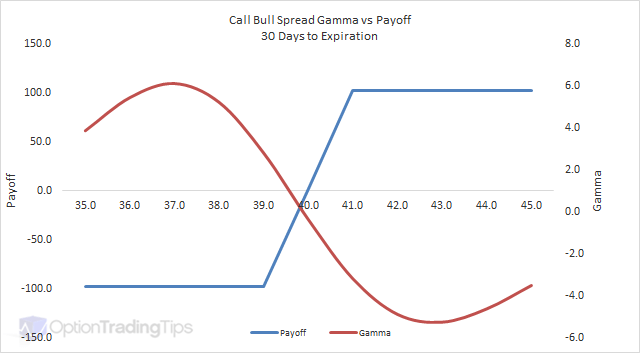

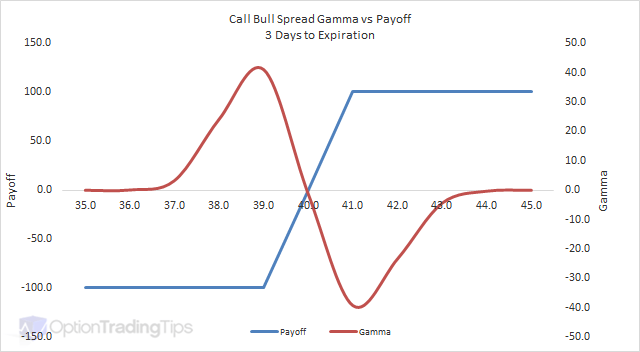

Gamma

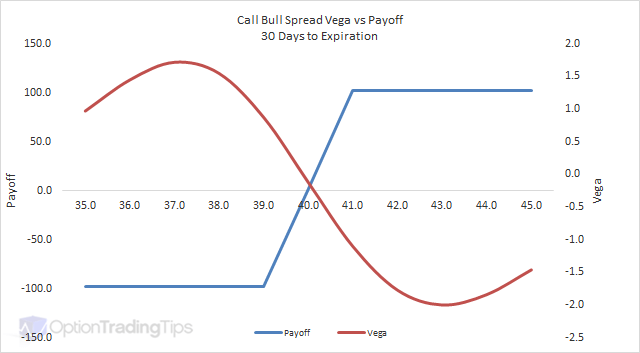

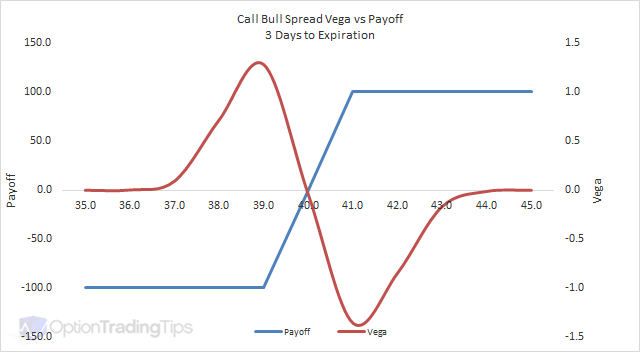

Vega

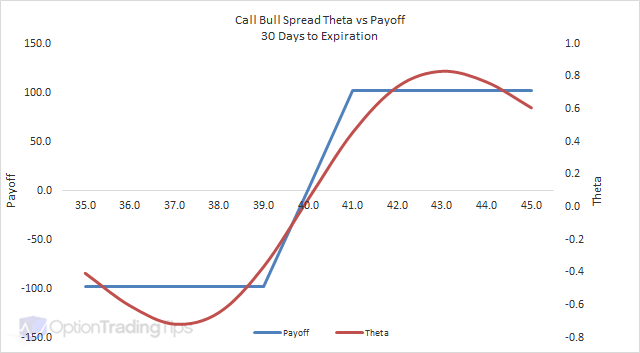

Theta

PeterMay 20th, 2020 at 6:44am

Hi Franc, $40 in this example.

FrancMay 19th, 2020 at 4:14pm

Hi,

what is the ATM level of the stock?

THanks

PeterApril 23rd, 2020 at 6:06pm

Hi Franc,

There isn't a stock position in this call spread example; there are only options.

FrancApril 23rd, 2020 at 7:47am

Hi,

what is the position of the stock in all these examples?

THanks

PeterSeptember 21st, 2017 at 12:08am

Hi Leonard,

By disarm do you mean exit? You can always exit a spread by entered the opposite orders into the market to close out the spread. Please let me know if I have misunderstood.

leonardSeptember 18th, 2017 at 12:18pm

hello, I wanted to consult how to get out of this strategy or how I disarm it, greetings

PeterJanuary 12th, 2017 at 5:26pm

Hi Amol,

Yes, if the direction is wrong, you will lose capital. For "long" options/spreads, the most you can lose is the total premium you have paid to buy the option/spread. So, to achieve the lowest loss or lowest entry point to risk, is simply the cheaper the option.

AMOL G.December 29th, 2016 at 9:22am

If the direction goes wrong we may loose some capital , is there any strategy with lowest loss ?

PeterApril 12th, 2012 at 10:35pm

Yes - otherwise it will be a time spread.

HelenaApril 12th, 2012 at 9:28am

Do the two options purchased have to have the same expiration date?

PeterNovember 29th, 2010 at 6:24pm

Hi Amol, it's like any asset that you sell - you receive a payment for the delivery. In the case of selling options you are assigned a short position against the buyer who then holds a long position. The buyer pays the seller for the option, which is called the premium. This premium will appear in your trading/brokerage account as a cash amount.

amolNovember 29th, 2010 at 7:50am

Hi Peter, I'm new to option trading I don't understand that how can we receive premium while selling the call option? Please explain

PeterAugust 14th, 2010 at 4:09pm

Hi James, you mean you want to place an entry stop order to buy the stock at $11 if it gets there? If you're bullish on the stock, then this is the trade to do.

However, a lot of traders who like covered calls will roll into another covered call at the next expiration - so buy the stock at $11 and then cover it will another short call option. But then it depends on how quickly the stock hits $11 after your first covered position.

JamesAugust 14th, 2010 at 8:48am

Assume you own "xyz" now worth $10 a share... You sell a covered call @ $1 for 2-month expiration...

At the same time you place an order to buy to cover @ $11... Is this an accepted practice?

PeterSeptember 2nd, 2009 at 7:14am

Hi Rahul, in the payoff graphs for each strategy you will see a pink coloured line, which represents the non-linear payoff of the option component.

Is this what you mean?

PeterSeptember 2nd, 2009 at 7:13am

Hi Dhaka, I would say Option Volatility and Pricing by Sheldon Natenberg.

rahul pandeySeptember 1st, 2009 at 2:58am

options has non linear payoff. futures has linear ones. both combined generates more complex payoffs . can u give some more inf. regarding payoffs

DHAKAAugust 31st, 2009 at 5:42am

HIi plz suggest me a book for [OPTION TRADING] which is best in all.

PeterJuly 19th, 2009 at 8:16am

Ideally you would do the trades at the same time via a "spread trade", however, if your broker's system doesn't allow that then you can "leg" into the strategy by completing one side first.

victorJuly 18th, 2009 at 1:56pm

do you long a call option and short the other at the same time or do you first long a call and then short the other call after the stock moves up.

thanks victor

Add a Comment