Characteristics

When to use: When you are bearish on volatility and neutral to bearish on market price.

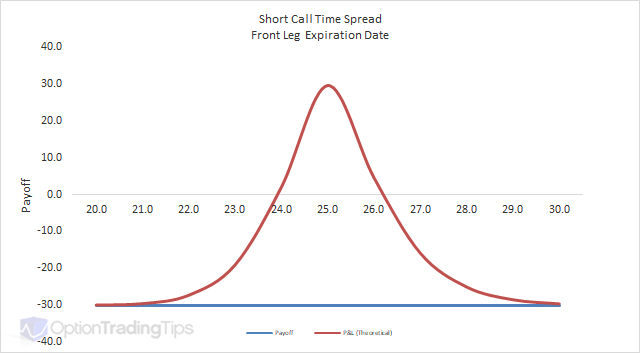

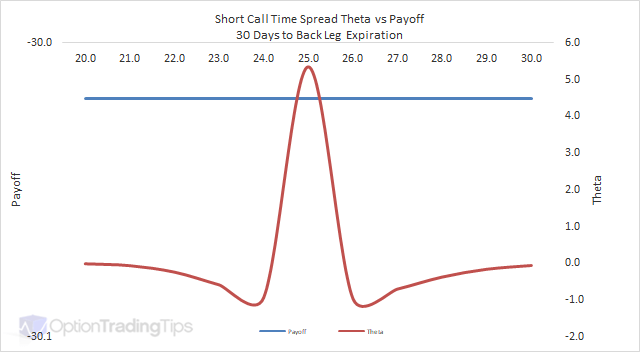

Note that with this payoff graph I have shown the net theoretical result only at the first expiration date when with the underlying trading at 100, which is the best result: the near month call will expire worthless and you will still have a long call ATM position.

Traders use time spreads to take advantage of time decay - the property of options being a decaying asset. However, due to the risk involved in selling naked options, a time spread protects the position buy buying an option in the next month.

The long back month option position can help to partially offset large losses that can result from being short options when the underlying market moves unfavorably.

It is best to implement a time spread when there is < 30 days to expiration in the front month. That is for the short side i.e. selling an option with 30 days or less to expiration.

Call Time Spread Greeks

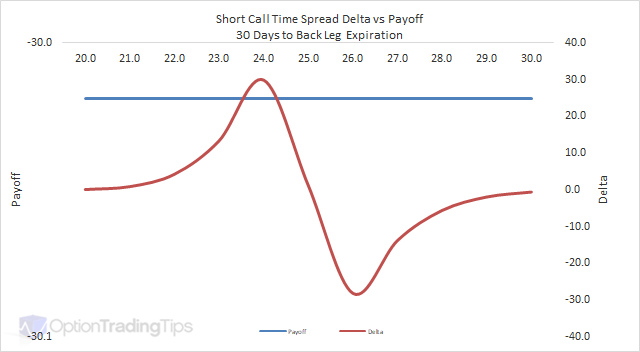

Delta

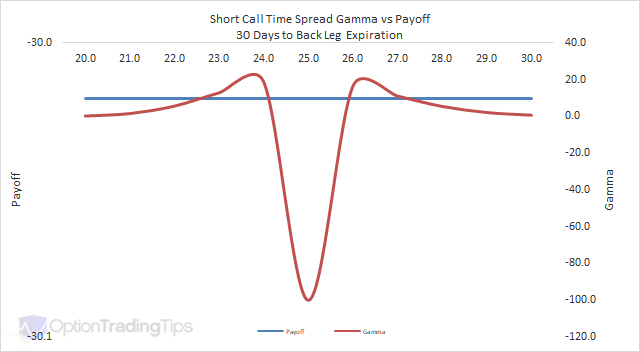

Gamma

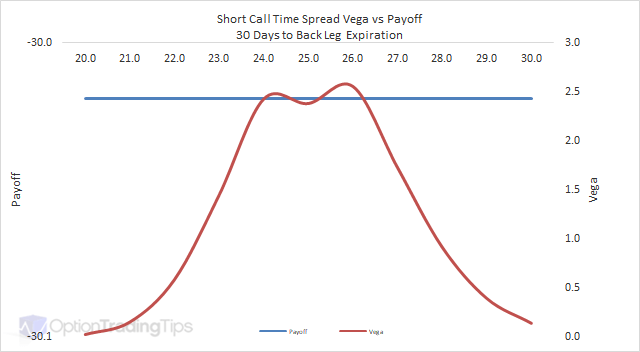

Vega

Theta

PeterJuly 26th, 2015 at 10:40pm

Yes, the back month purchase is not a perfect hedge for the front month short, but provide good protection if the market rallies against you. If, as you say, you're option is ITM and therefore assigned a short stock position, your delta for the front month is -100 whereas your back month option could be, for example, +75.

I've amended the wording so it is a little clearer.

asekJuly 25th, 2015 at 2:33pm

Hi, I'm new to options, can you please explain how buying a call that expires later can hedge against the risk of the short? If the short call options expires in the money, don't we have to purchase the underlying stock then instead of waiting until our long call option expires? Please explain, thanks.

PeterFebruary 16th, 2012 at 4:31pm

Hi Dhrumil, yep, you can create anything you like.

If you did a lower bull spread and a higher bear spread the payoff will resemble a long condor.

dhrumil patelFebruary 16th, 2012 at 6:22am

Hi Peter can I make combination of bull spread and bear spread at one time?

Doug MJuly 25th, 2011 at 7:03pm

The confusion would be cleared up if you showed both curves, at purchase and at near month expiration, as you did for simpler strategies. It would show that before first expiration most prices are a net loss. As expiration approaches, the yield curve rises.

I think in practice this strategy is neither bullish nor bearish, but is used to target a price and low volatility, with limited risk. It yields symmetrically around the strike even when the short call expires ITM.

Thanks for making this great resource!

SarikaMay 30th, 2011 at 10:08am

Request u to plz give an example for this strategies because I still dont understand how this will be profitable on bearish market?

PeterAugust 10th, 2009 at 12:34am

Well, I would say in the short term you would be bearish as you're short the near month call option. You want this option to expire worthless, but if the market does rally you have some protection being long the back month call.

Options are more sensitive to underlying changes when the strike is close to the underlying price and the option is close to expiry, so a market rally in the short term would likely hurt your position (depending on the magnitude of the price increase).

I see what you're saying though...looking at the graph, it would appear that the position is more bullish than bearish. But you have to keep in mind that this payoff is taken only at the expiration of the first option...the longer dated option still has some time value left.

SteveAugust 8th, 2009 at 6:25pm

I think it is bullish on the market not bearish...isn't it?

Add a Comment