Short Synthetic

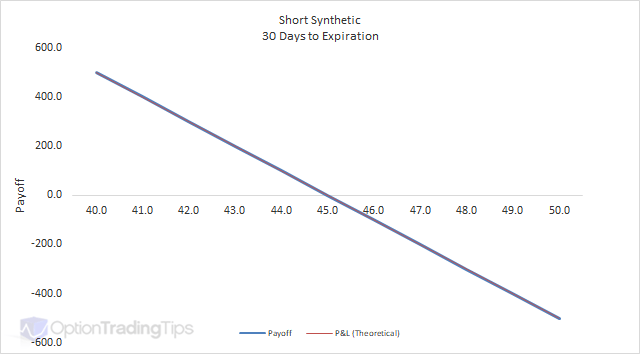

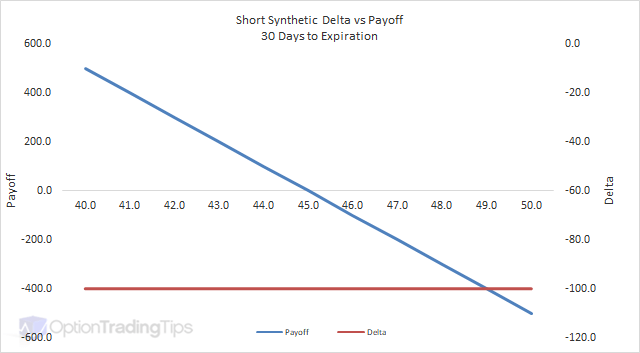

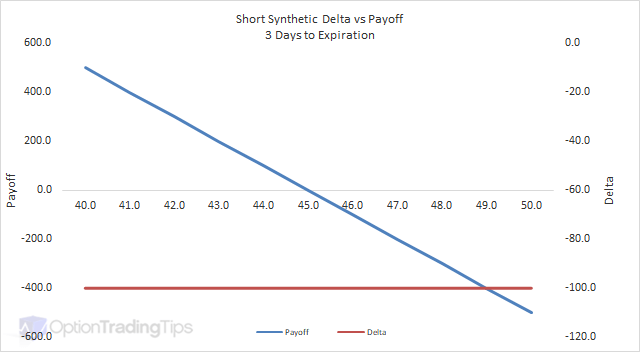

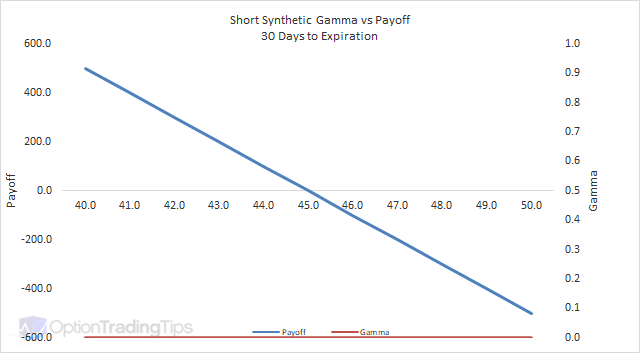

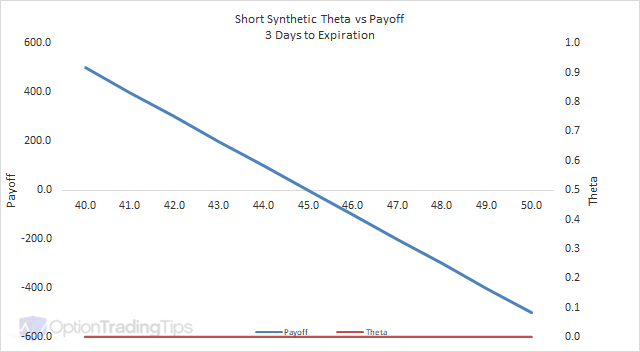

A Short Synthetic is a short call and long put option with both having the same strike prices and expiration dates.

The term synthetic is in reference to the position having the exact same profile as being short the underlying stock/futures contract outright.

The Max Loss is unlimited as the market rises.

The Max Gain is uncapped as the market falls but limited to the strike price minus the stock price as the stock cannot trade lower than zero.

LarryJanuary 2nd, 2009 at 6:48am

If you add a long futures position to a Short Synthetic then the position will be delta neutral. If you buy the futures for less than the cost of the synthetic you have an arbitrage according to put call parity (C-P = S - X).

kannanDecember 25th, 2008 at 12:44pm

suppose i add one long position with futures and expect market direction as up is this complete hedging for my long fututes position is it right one?

Mike SchneiderSeptember 3rd, 2008 at 2:24pm

There are 3 risks in this position beyond the move in the underlying stock: dividend risk, interest rate risk, and pin risk. If this position is put on with a prime broker, in addition you have margin risk.

Add a Comment