Put Bull Spread

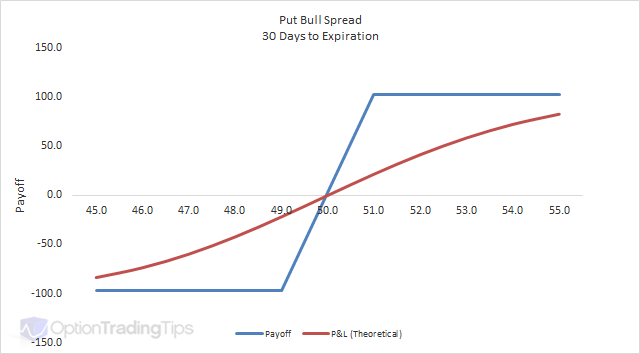

Put Bull Spreads can also be called Short Put Spreads and are made up of long put option and a short put option in the same expiration month but where the short put has a higher strike price than the long. The term "short" would be used in reference to the premium received, which is a net credit, NOT because of the underlying directional bias.

The Max Loss is limited to the difference between the two strike prices minus the net premium received for the position.

The Max Gain is Limited to the net credit received for the spread. I.e. the premium receieved for the short option less the premium paid for the long option.

PeterApril 15th, 2013 at 7:19pm

Hi GB,

Your 85 put expires worthless so your gain on that side is the premium i.e. price of the option sold x 10 x 100 (multiplier).

As the 87.5 put is in the money and you are short means you will be called upon by the put option buyer to buy the stock at the strike price. So you have now purchased the shares at a price of 87.5 (strike) while the stock is trading at 86.14. Each option carries a multiplier of 100 shares per option contract and you have 10 contracts so your loss on this component is 1,360.

gbApril 12th, 2013 at 5:23pm

what happens if the short put expired in the money but the long put did not in a bull put spread. scenario sold 87.5 put, bought 85 put, stock closed at 86.14. margin requirement was 2500 for 10 contracts less credit received. do I lose all the 2500 (less credit) if I did not buy the sold put on expiration? any input will be appreciated.

edwardlog2June 2nd, 2012 at 8:40am

Hi,,

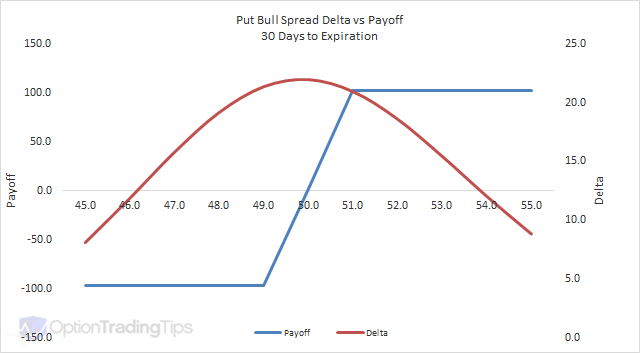

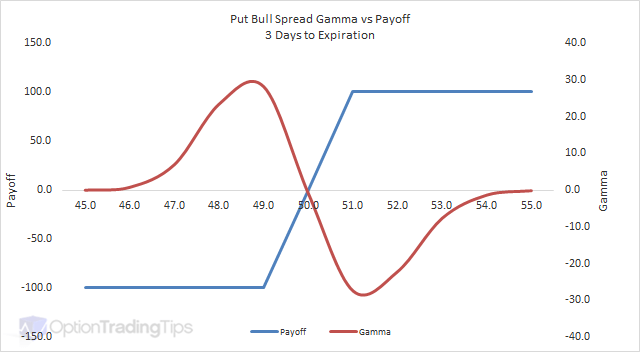

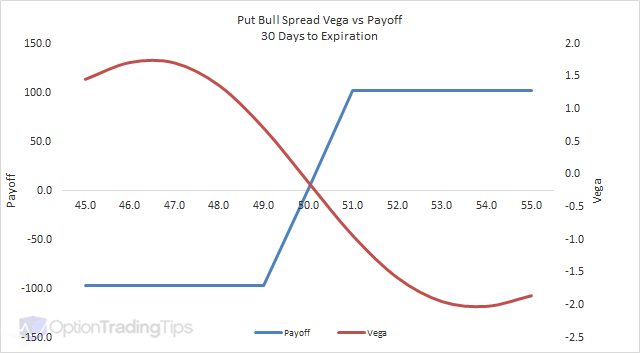

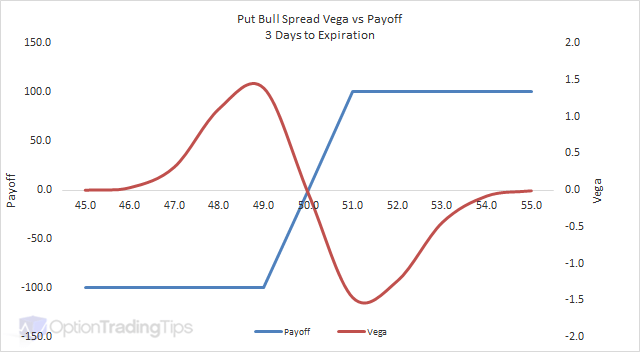

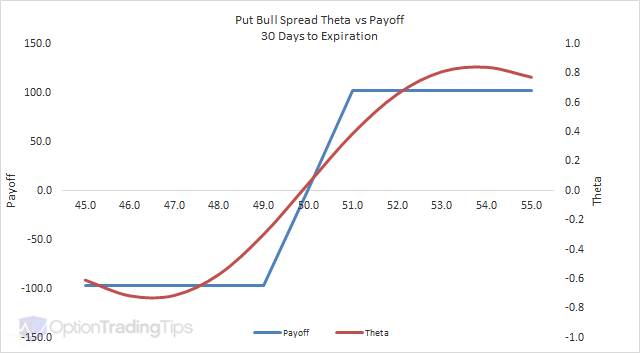

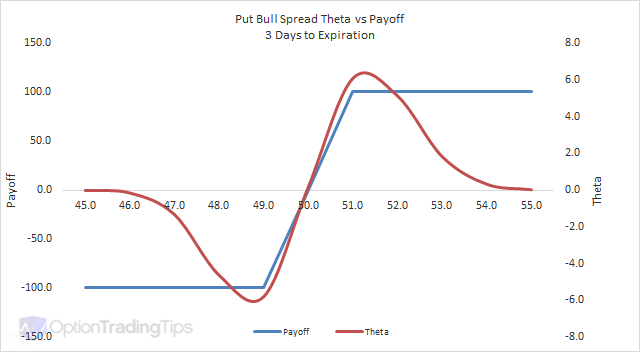

Good discussion. I went through the graph. It is same as the call bull spread. But it held different when we talk about the price market. Bear call spread as work on both buying and selling trading system. You suggest well and you need to keep it up..

Thanks

Add a Comment