Short Condor Spread - (SPY ETF)

12th February, 2015

SPY is an exchange traded fund (also known as SPDR), which replicates the S&P 500 index. State Street are the fund's administrators who manage the fund by holding 100 stocks in proportions that aim to replicate the performance of the S&P 500 index.

There are options traded on the back of the fund and they are very liquid.

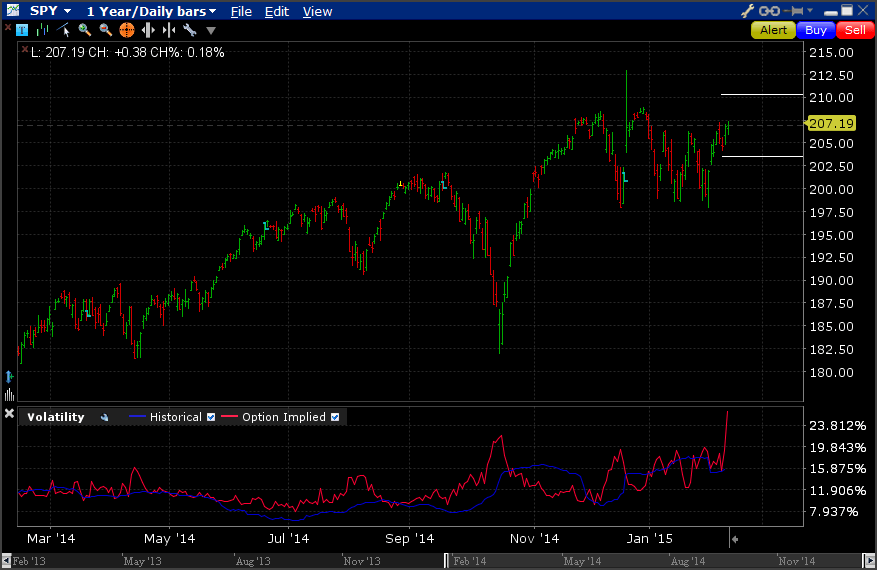

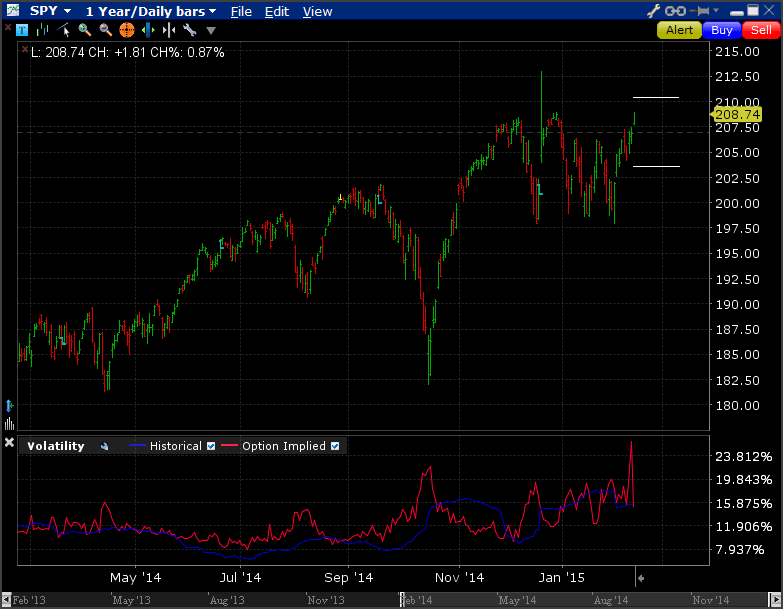

I noticed a nice spike in implied volatility across the options post the close of business on the 11th February and looked at some strategies to benefit from this.

Given the recent sideways action of the index, I'm going with a range bound strategy for this;

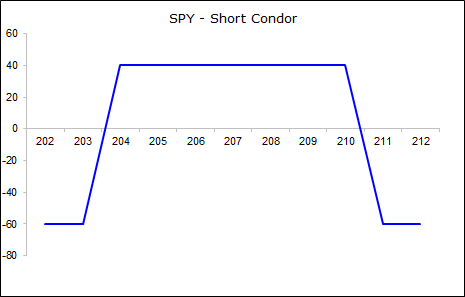

The levels in the chart here correspond to the breakeven points of a Short Iron Condor;

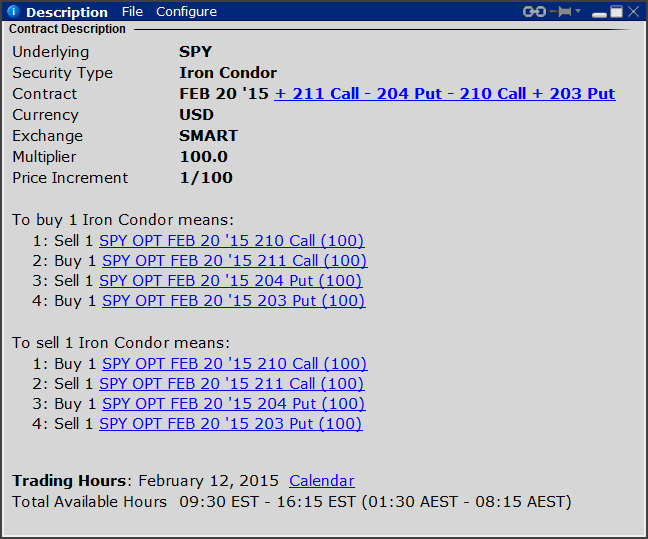

This combination is;

- Short the $210 call

- Long the $211 call

- Short the $204 put

- Long the $203 put

All for a net credit of $40 per contract.

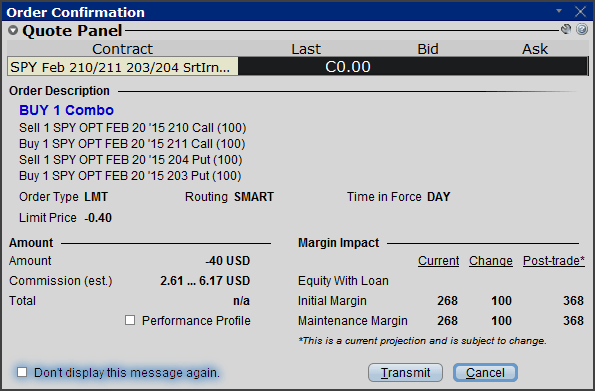

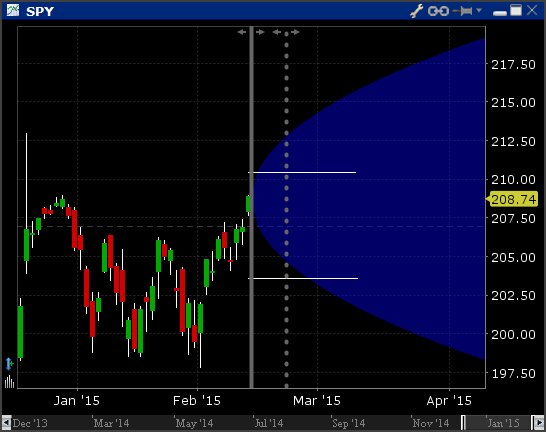

Here are screens of the order details;

I was filled on my spread order and the fill prices are;

- Short $210 call @ 0.64

- Long $211 call @ 0.35

- Short $204 put @ 0.48

- Long $203 put @ 0.37

Net credit of $40.

After Market Close, Feb 12th

Market finished very strong - up 0.96% for the day! Not too good for this strategy, hoping for a pullback tomorrow. Here is the updated chart and payoff profile;

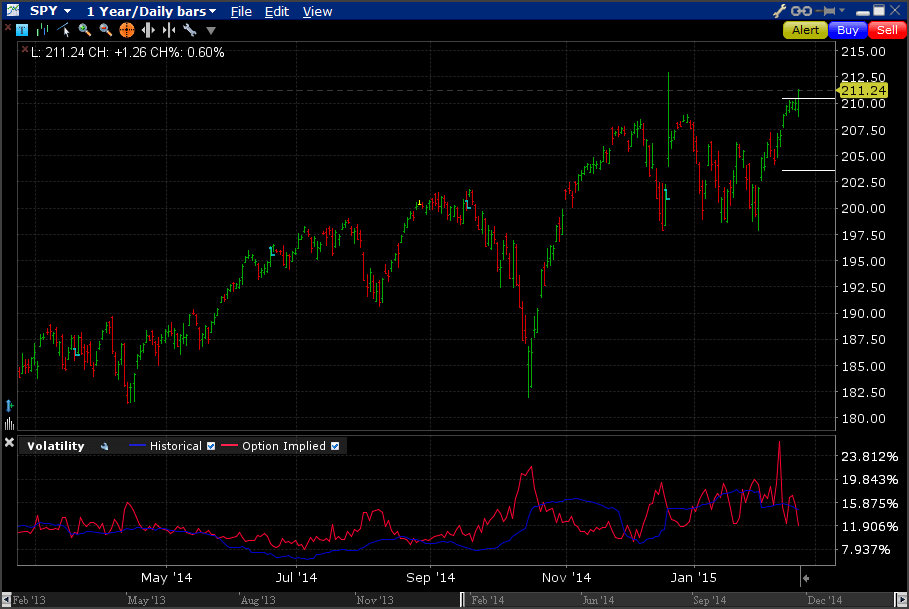

Trade Closed, 20th February, 2015

See above chart - in the last half of trading on the last day of trading for the options, SPY rallied past the short $210 call strike level and then closed above the long $211 call strike level!

This is the worst result and I've now reached the max loss level. Here's what happened to the position in the end;

I was assigned on the short $210 call, which meant I went short the stock at a sell price of $210. However, I exercised (automatically) the $211 call, which means buying the stock at $211. So the stock leg nets out with a loss of $100.

On the put side, they both expired worthless.

The net credit on the initial trade was $40 (received). Now, I subtract the loss on the stock assignment/exercise of $100 leaves a loss of $60. Subtracting brokerage of $6.40 leaves a net loss of $66.40.

There are zero comments

Add a Comment