$NTAP - Call Spread

NetApp Inc (NTAP) appeared on my option volume scans on the 30th September showing interesting volumes on the $47 November calls during Friday's market. The calls traded 9900 times while there are currently only 800 contracts in open interest. Checking the earnings calendar I see that NTAP have an announcement due on the 13th November, which is 2 days prior to the option's expiration. Perhaps this is a move by a trader who knows something ahead of the earnings announcement?

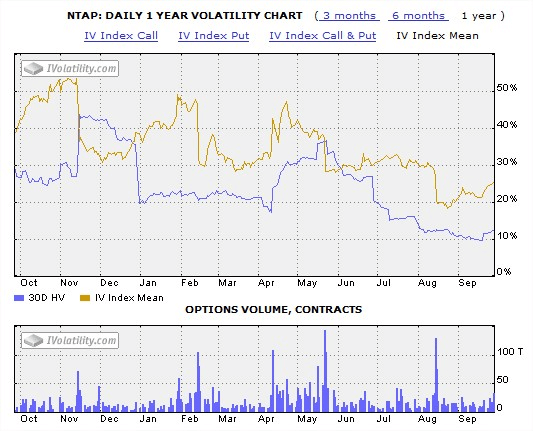

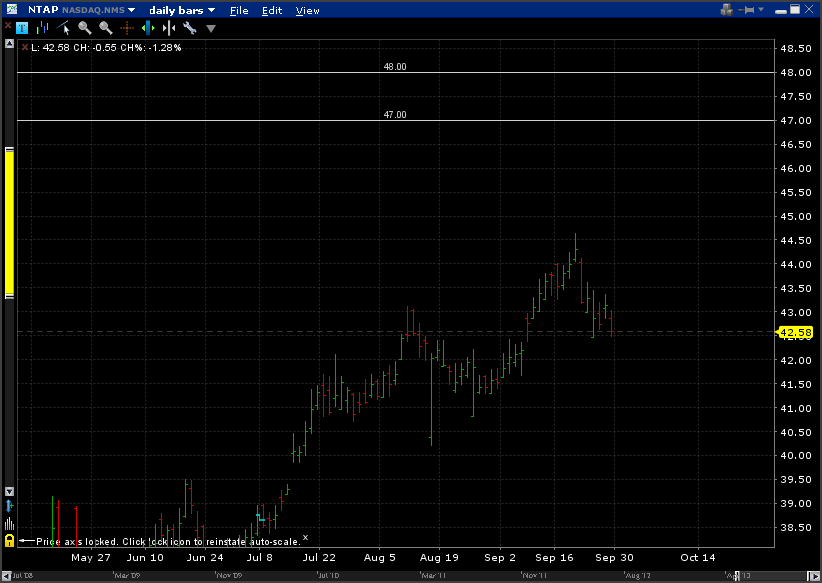

Looking at the chart, NTAP shows a steady trend over the past 12 months. There's been a little pull back of late but the overall trend is fairly positve. Implied volatility is reasonably low but looking like its on the rise:

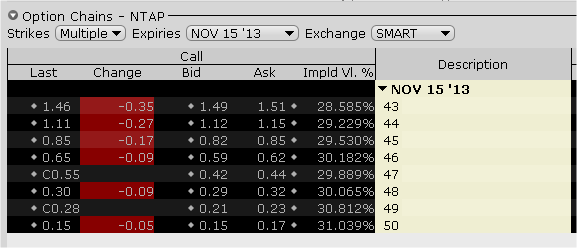

If the call buying indicates some insider movement, maybe it's worth riding it too? The only problem I saw when looking at the chart is that the $47 strike is so far away - over 10% of current levels. So instead of just buying calls I decided to buy the call spread; buying the $47 strike while selling the $48 strike:

Buying this spread at the market prices seen on the screen at the close shows the call spread to be offered at 0.15 per contract.

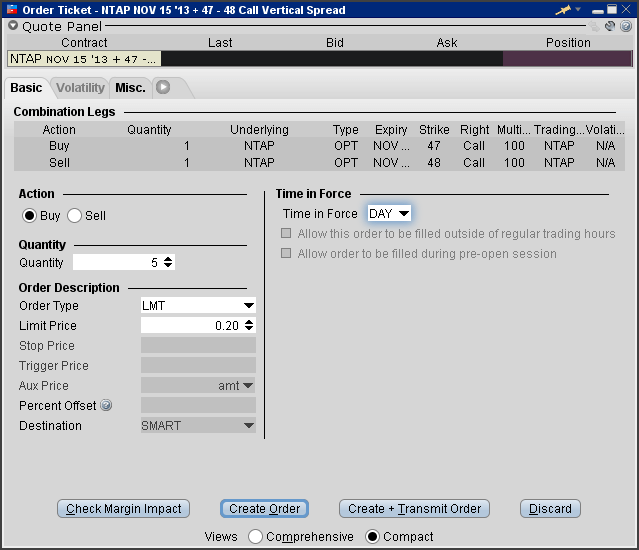

Because the market is closed right now I placed my order to be sent as soon as it opens. To provide some buffer I placed the order to buy the spread at 0.20 limit - so if it opens lower I should be filled at a better price otherwise I will pay up to 0.20 per spread.

This means my total spend is $20 per contract, which represents my maximum loss should the stock go against me or not quite make the $47 level by November 15th.

My maximum profit, however, is $80 per contract, which is the difference between the two strikes ($1) less the premium paid ($0.20) times the multiplier of 100.

Here's a screen grab of the order screen prior to sending it to my broker:

I'm buying 5 contracts total so my spend will be $100. If I am filled my max loss will be $100 while my max profit will be $400.

I'll keep you posted every few days as the trade progresses.

1st October

I was filled on my spread order at 0.20, however, the options closed at levels indicating the call spread is now at 0.13. In total I'm down $35 for my 5 contracts so far.

There are zero comments

Add a Comment