Short Call Spread (TGT)

Start: February 23rd

Target (TGT) are releasing earnings tomorrow morning before market open.

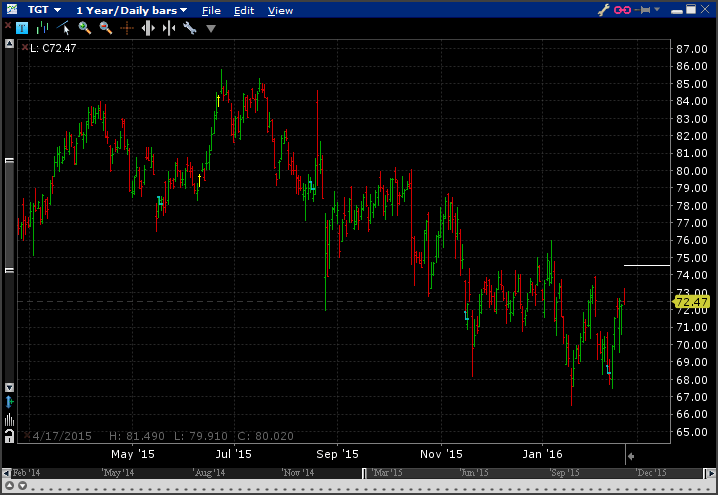

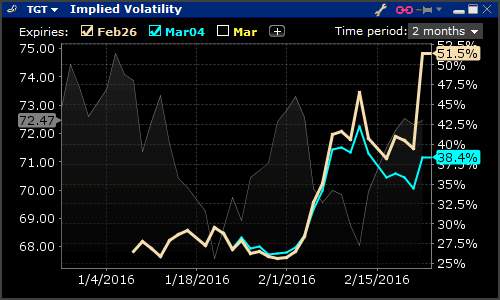

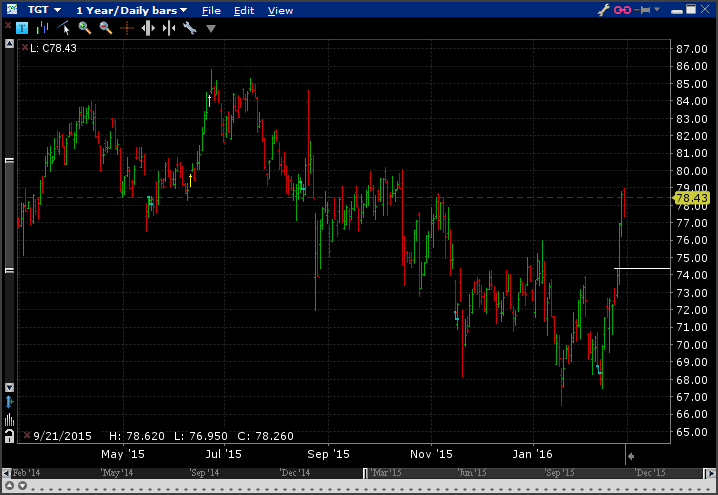

The stock has been in a downtrend for the past 9 months and volatility is relatively high for the Feb 26 expiration; trading at 54%.

I expect the trend to continue and with implied volatility being high I will enter a trade that attempts a play on both; a short call spread. I am betting that volatility will decrease as well as the market price to decline.

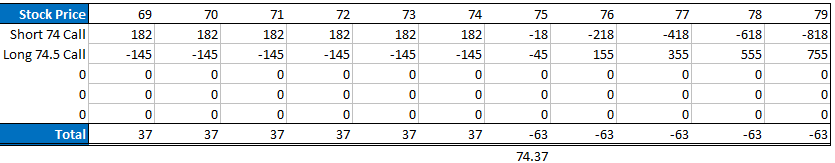

I sold the $74/$74.50 call spread for $18 credit per contract, and again, a massive 2 lots!

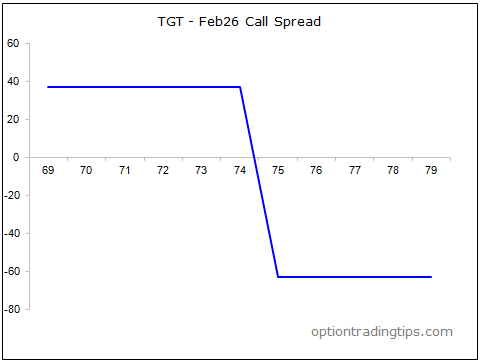

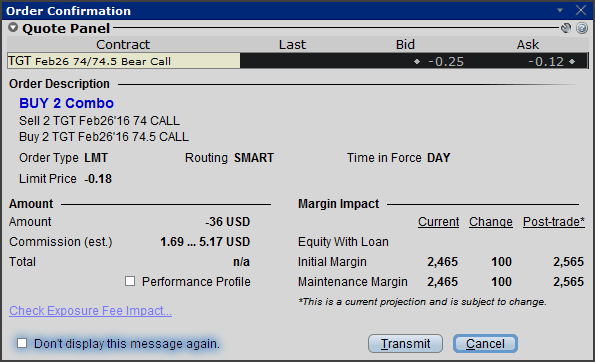

Here is the payoff profile:

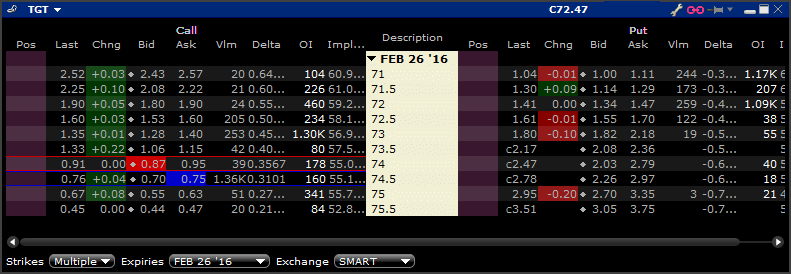

Here are the option closing prices for Monday's session that I based the order price from and my order confirmation screen:

Updates to follow...

Update February 26th

TGT released strong earnings and the stock shot up well and never made it back below the upper break even point:

The trade was a loss, losing $66.60. Here are the closing values of the trades:

| TGT Short Call Spread | ||||

| TGT Feb26 $74.50 Call | 2 | 0.886 | 3.93 | 608.8 |

| TGT Feb26 $74.00 Call | -2 | 1.053 | 4.43 | -675.4 |

| Total | -0.334 | -1 | -66.6 |

There are zero comments

Add a Comment