1 Win, 3 Losses, -$385

October 21st, 2016 Option Expiration

I closed out 4 positions on Friday; only 1 winner from the long Iron Butterfly. Total P&L was down -$385.

| Trade | Open | Days | P&L |

|---|---|---|---|

| GFI Long Call | 13-Sep-16 | 38 | -170 |

| EGO Long Call | 14-Sep-16 | 37 | -200 |

| CCL Long Put | 19-Sep-16 | 32 | -120 |

| BAC Long Butterfly | 27-Sep-16 | 24 | 105 |

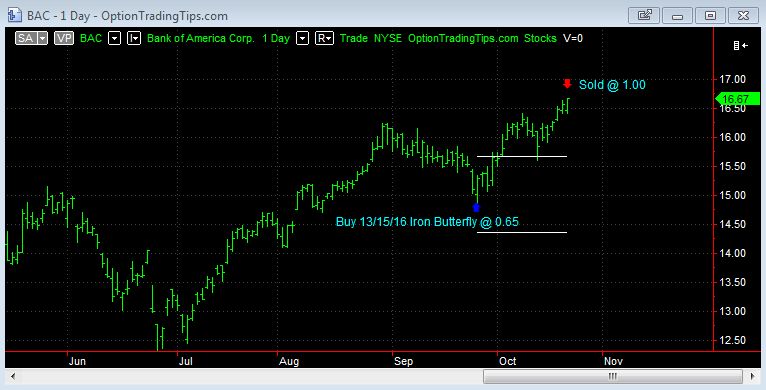

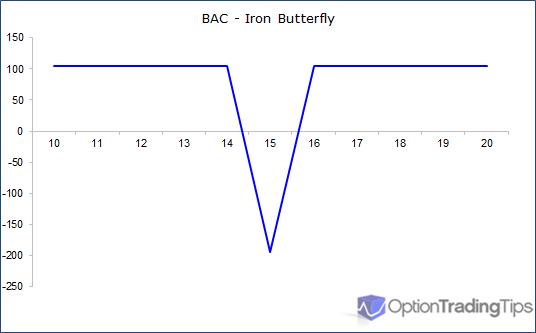

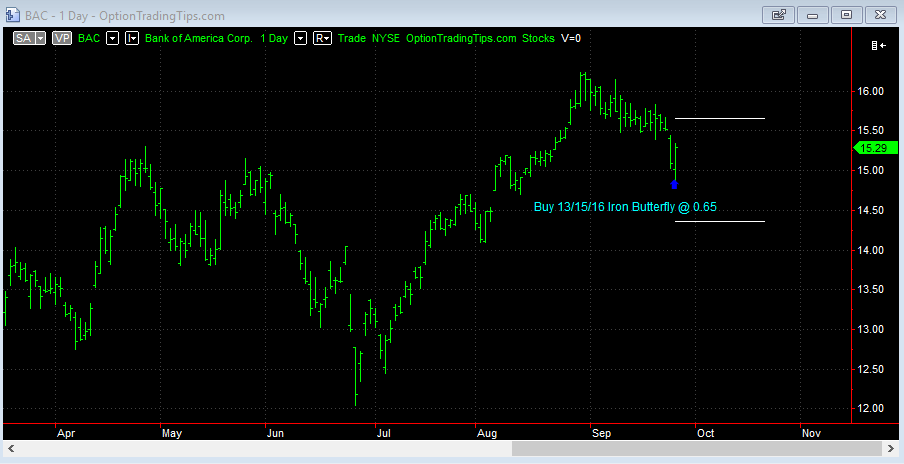

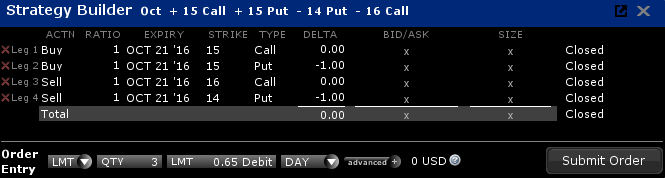

$BAC Long Iron Butterfly

| Stock | BAC |

|---|---|

| Position | Long Iron Butterfly |

| Trade Length | 24 Days |

| Capital | $195.00 |

| P&L | $105.00 |

Trade Start: 27th September

Description.

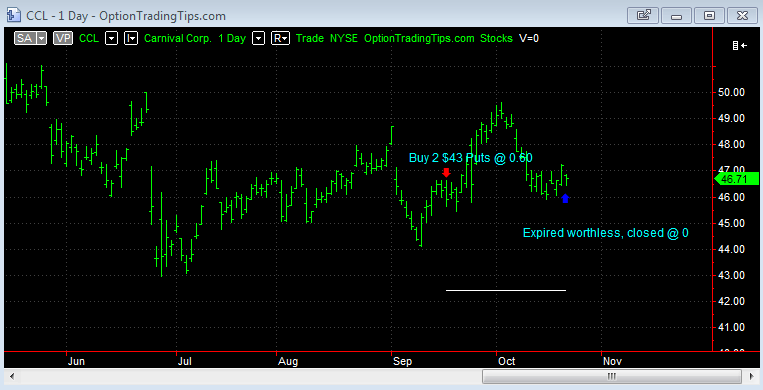

$CCL Long 2 $43 Puts

| Stock | CCL |

|---|---|

| Position | Long Puts |

| Trade Length | 32 Days |

| Capital | $120.00 |

| P&L | -$120.00 |

Trade Start: 19th September

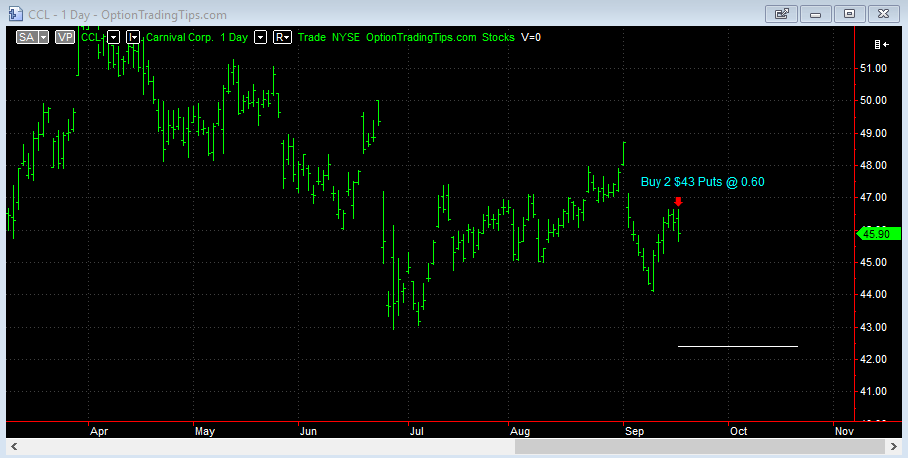

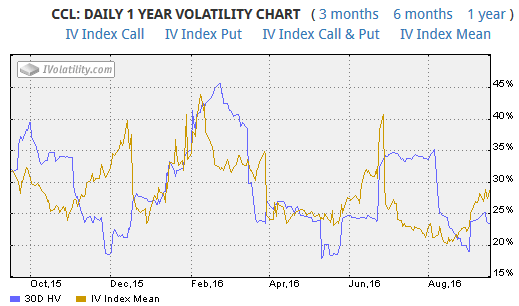

CCL have earnings out before market on the 20th. Friday's trading showed heavy interest in the $43 put options with 17k trading over 1k in open interest. Only 22k puts traded across the October series with 18k in open interest across all October strike prices.

The put volume to call volume on Friday was 17:1 even though the open interest for calls and puts was even at 18k-ish.

I didn't manage to grab a screen grab of the option data in time; when I went back a few hours later to do all the screen grabs the volume data had been zeroed out to get ready for the trading day.

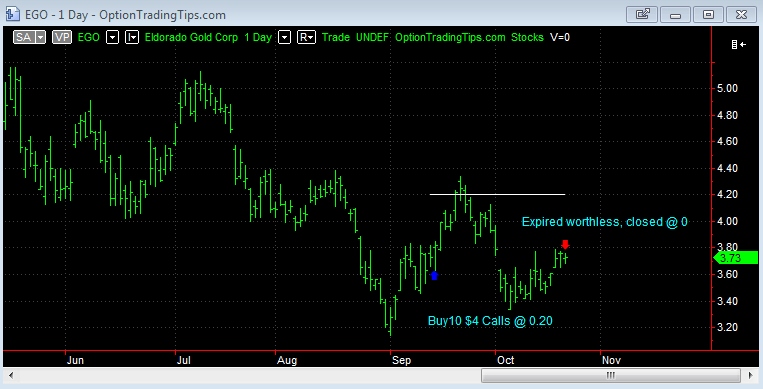

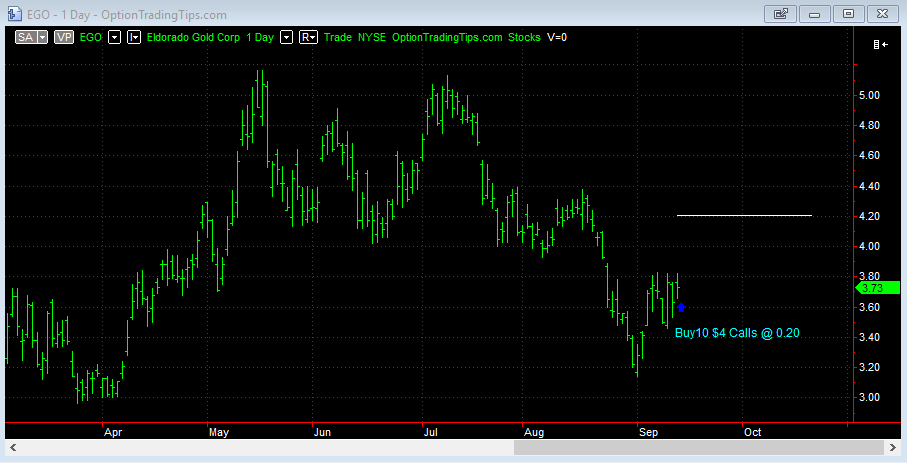

$EGO Long 10 $4 Calls

| Stock | EGO |

|---|---|

| Position | Long Calls |

| Trade Length | 37 Days |

| Capital | $200.00 |

| P&L | -$200.00 |

Trade Start: 14th September

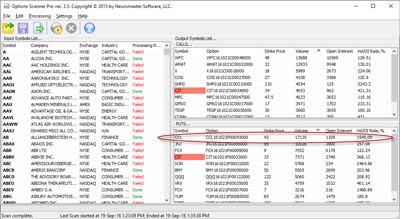

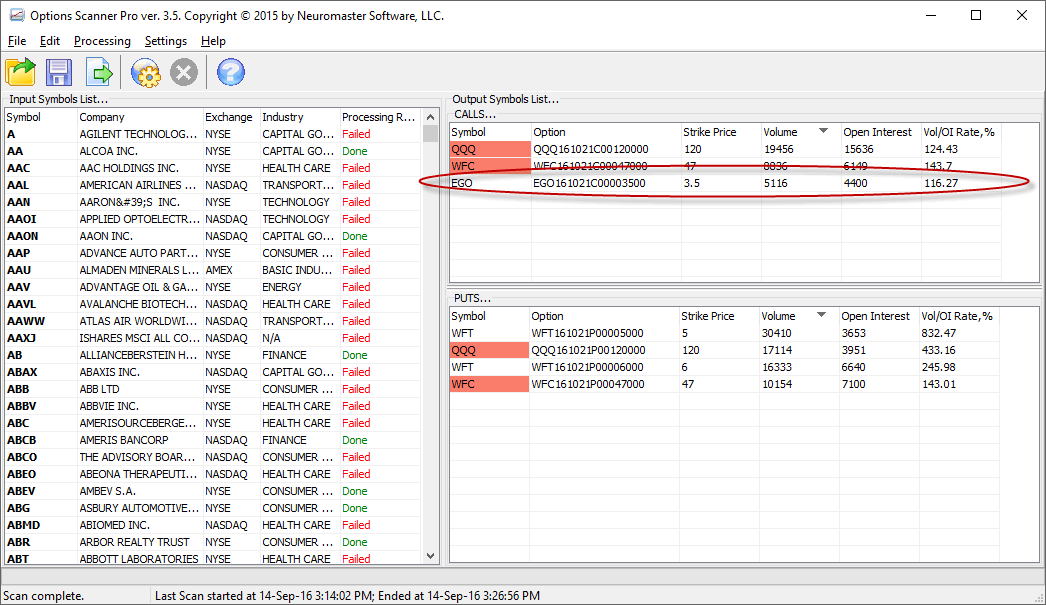

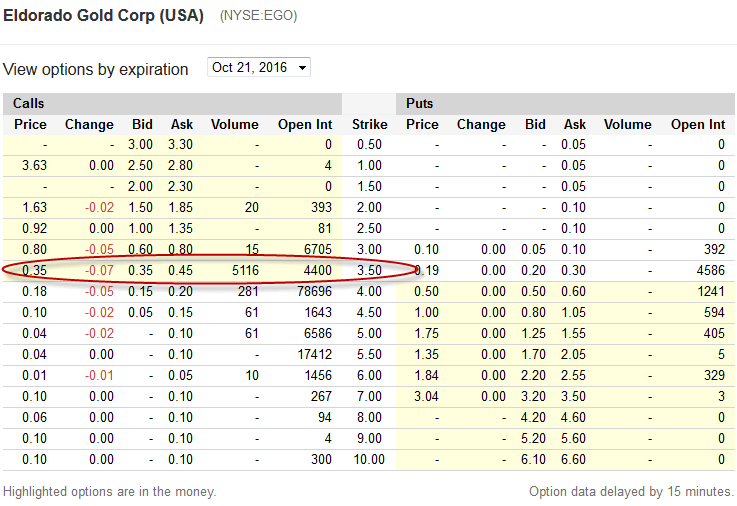

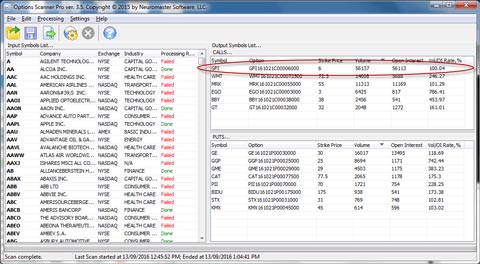

EGO showed up on the scanner with the $3.50 strike trading 5k over 4.4k. When I looked at the October option series I notice that there is significant interest across a few other strikes too...noteably the $4 call, which has 79k in open interest!.

With 5 weeks to go and the $4 call offered at 0.20 I thought it seemed a reasonable bet to make. So I placed an order for 10 contracts at 0.20 before the market open.

The pre-market showed EGO already gaining on the prior days 5% drop so I wasn't sure I'd be filled straight away. And I wasn't. 1 lot traded just after the stock opened and the remaining 9 two hours after that.

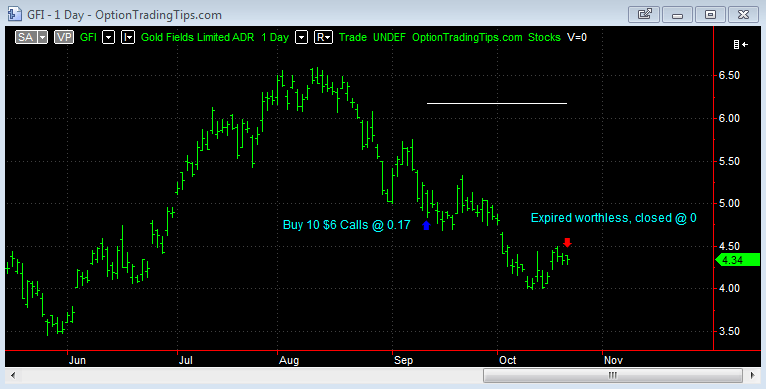

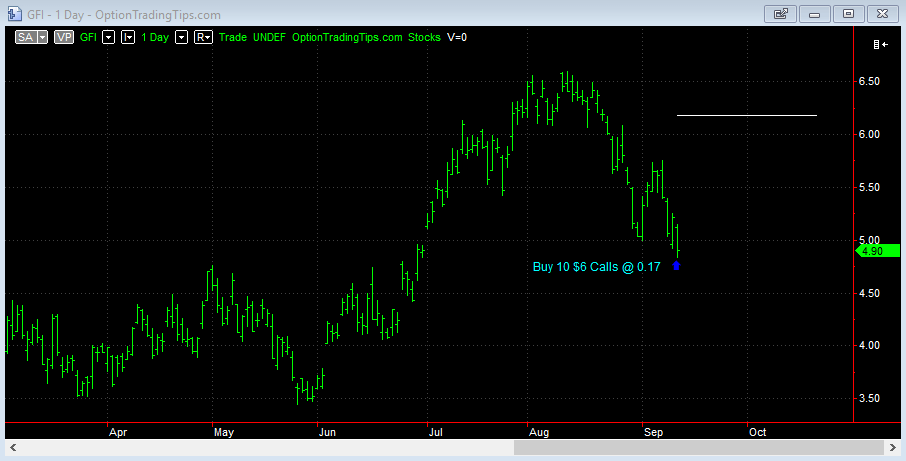

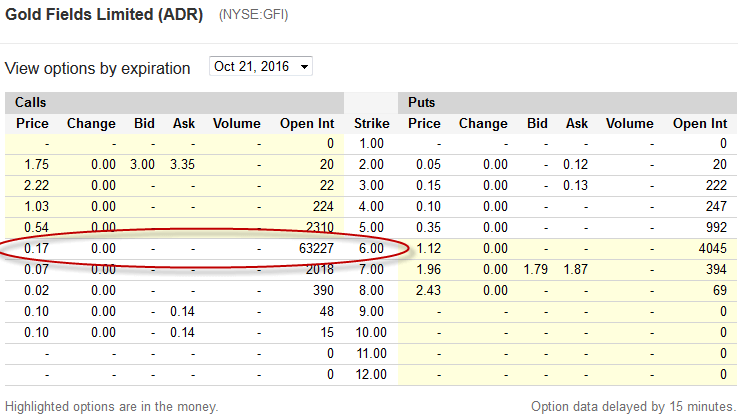

$GFI Long 10 $6 Call Options

| Stock | GFI |

|---|---|

| Position | Long Calls |

| Trade Length | 38 Days |

| Capital | $170.00 |

| P&L | -$170.00 |

Trade Start: 13th September

I bought 10 $6 October calls on GFI. I used the prio days closing price as my order price and was filled on the open. I really should have paid more attention to what was happening in the markets prior to the open as the market sold off heavily from the open. It's likely I could have purchased these calls much lower than 0.17. They closed at 0.10 so I'm already down $70.

There are zero comments

Add a Comment