Put Bear Spread (EOD)

Start: February 29th, 2016

I've been trying out a new online scanner as a new way of identifying price patterns that I can consider for option setups.

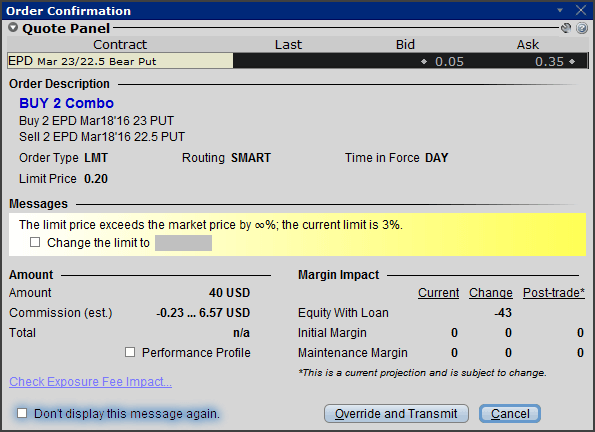

EPD stock came up with a bearish setup. I checked any upcoming earning releases and nothing due until April 28th. Here is the chart as of Friday's close:

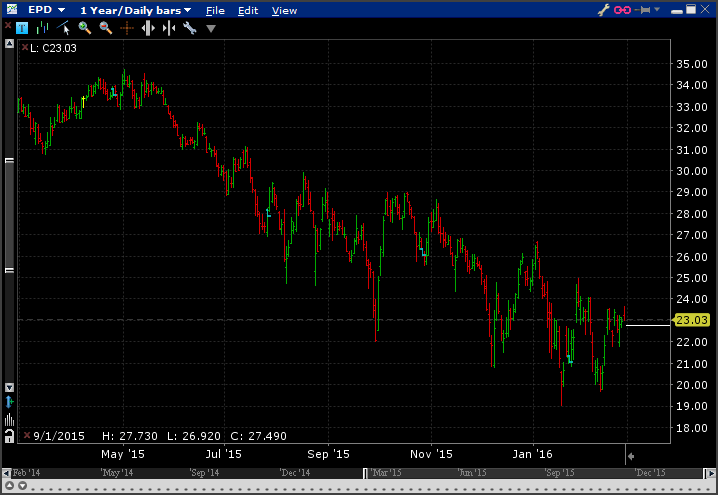

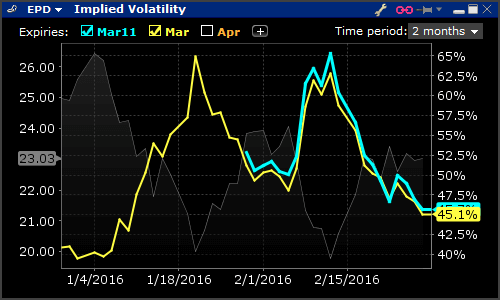

Implied volatility for both March expiries has dropped 20 percentage points from recent highs:

It is best to buy options when volatility is low and sell when volatility is high. From the above graph, it looks as though vol could have hit a low and may revert to higher levels.

Now I have two factors in my decision:

- Bearish on market price

- Bullish on volatility

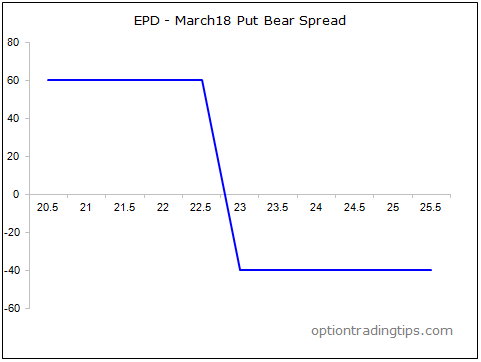

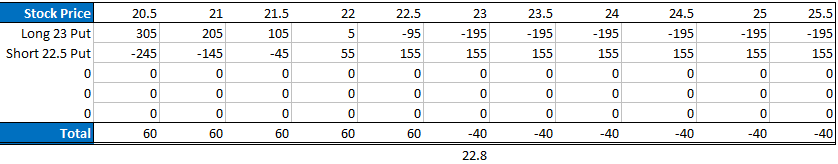

So, I need to select an option strategy that attempts to capitalize on both of these. I looked at Put Backspreads and also Iron Butterflys but I didn't really like their payoff profies. I decided on a Long Put Spread, or Put Bear Spread;

Max loss is $43 ($40 for the spread plus $2.70 in brokerage) and max gain is $60.

Small, yes, but I am still toying with small size until I build up my account before trading larger sizes.

After the market close, the spread is down -$5 so far but there is still 3 weeks to go until expiration.

Updates: March 9th

EPD up slightly by 0.13%. Implied volatility has risen slightly so the spread has made some ground to now be flat. There is one week to go...at this point, being a long spread, time decay will really hurt my position so I need the market to move fast and/or implied volatility to rise as well.

Position Closed, March 18th

EPD Closed above the long put strike level of $23 to finish the week trading at $25.50. I lose the premium paid for the spread, which was $40. The total breakdown is as follows:

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| EPD Mar18 Put Bear Spread (comms $2.70) | ||||

| EPD Mar18 22.50 Put | -2 | 0.65 | 0 | 130 |

| EPD Mar18 23 Put | 2 | 0.85 | 0 | -170 |

| Total | 0.4 | 0 | -40 | |

| Grand Total | -40 |

There are zero comments

Add a Comment