Double Calendar Spread - (CRUS)

26th January, 2015

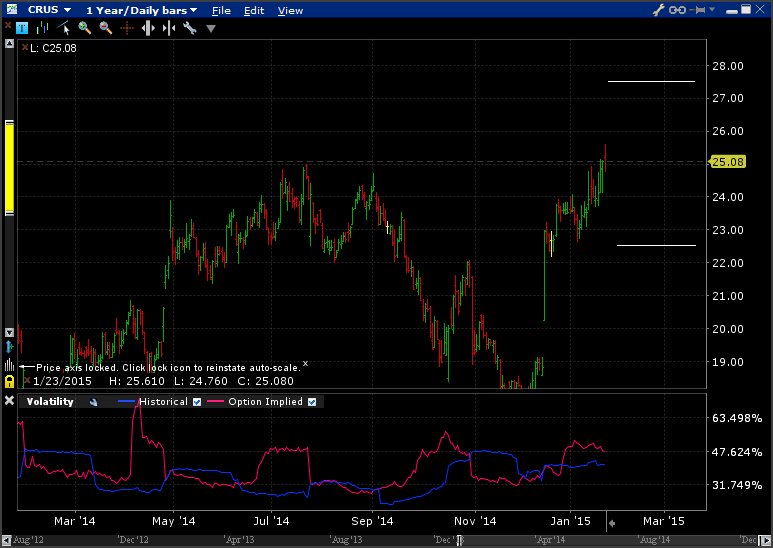

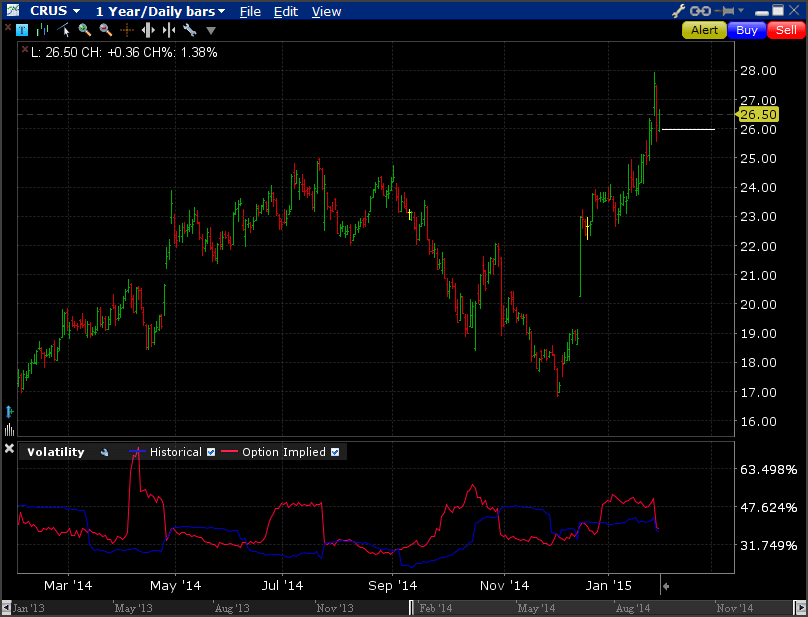

CRUS has earnings out on the 28th Jan so their puts have been showing some interest over the past few days - they've been on the Short Put list the last couple of days. I was looking at putting on a Short Condor - or something other neutral credit spread. But then I remembered reading about Double Calendar Spreads and thought I'd give that a closer look.

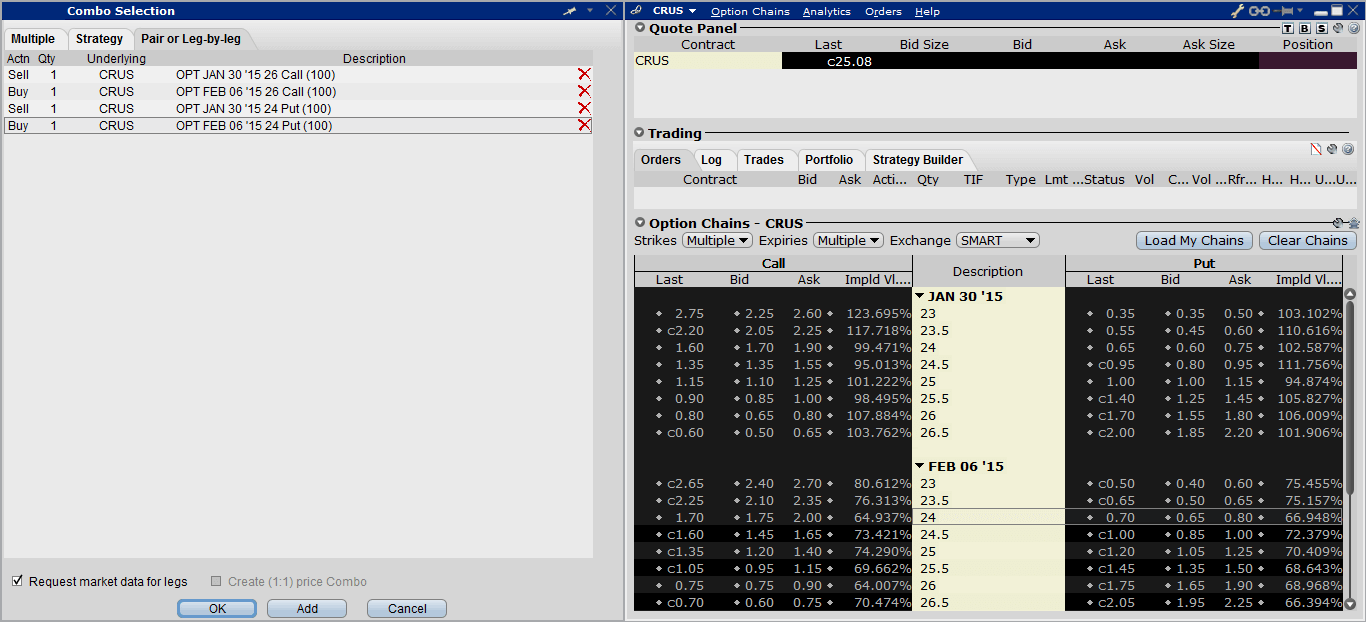

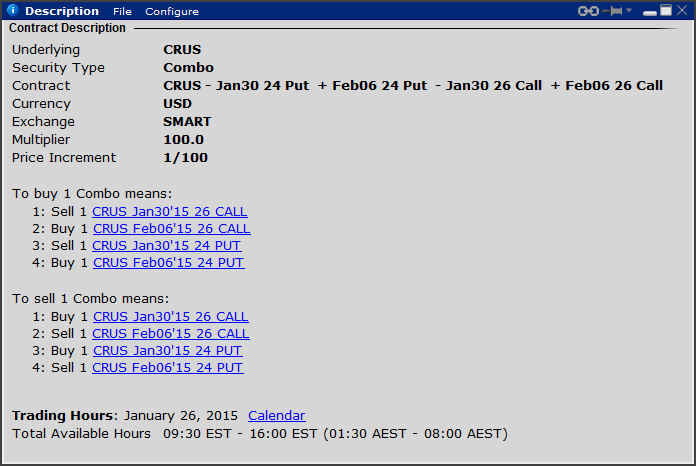

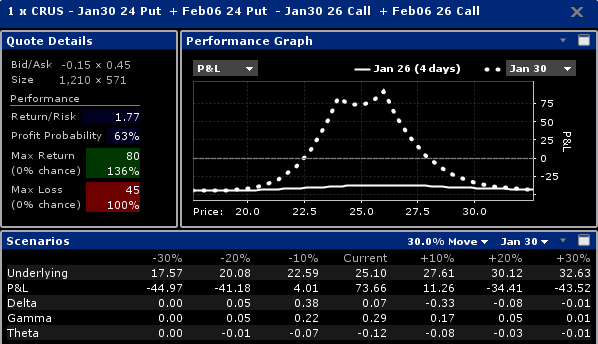

Double Calendars are when you buy an out-of-the-money call calendar spread (sell front month, buy back month) while buying an out-of-the-money put calendar spread. Sounded weird at first, but check out the breakeven points when I applied Friday's closing prices to the chart;

That's about 15% either side!

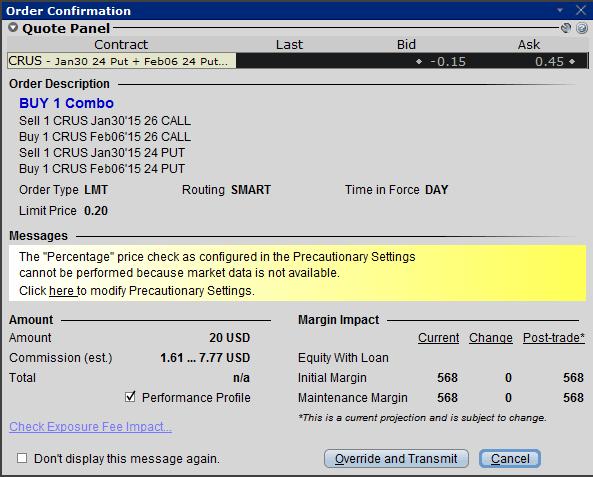

However, it does depend that I get filled on the spread at 0.15 debit. The mid point for all the legs was 0.10, so upping it up a little to 0.15 might get it done.

Update: Market Close, Jan 26th

When I woke up this morning to check my orders, I see that the double calendar wasn't filled. The leg prices in the outright market show the spread offered at 0.55. So, I edged my order up a couple of times and was filled at 0.35!

Yep, paid up big from 0.15. But I was keen to see how this turns out.

Update: Position Close, Jan 30th

CRUS saw a strong rally in the days before closing, trading above the short strike level of $26.

Being short the call option at $26 means that I am at risk of being exercised and could result be being short the stock at a sold price of $26. I watched the market during the last hour of trading to see if I would need to buy back the call prior to the close. I wasn't sure where it would end up, so I ended up buying the call back at 0.67.

I also needed exit the Feb part of the position, which was the $24/$26 Strangle. So I ended up selling that for $1.05.

The $24 Jan put option was way out of the money so that just expired worthless.

The net result of the trade was a small loss of $1.

| CRUS Double Calendar | ||||

| CRUS Feb06 $26 Call | 1 | 1.31 | 0.98 | -33 |

| CRUS Feb06 $24 Put | 1 | 0.61 | 0.07 | -54 |

| CRUS Jan30 $26 Call | -1 | 1.24 | 0.67 | 57 |

| CRUS Jan30 $24 Put | -1 | 0.29 | 0 | 29 |

| Total | -1 |

There are zero comments

Add a Comment